U.S. Economy Real GDP Composition Modified, Though Q1 Headline Remains Unchanged

Economics / US Economy Jun 29, 2012 - 04:07 AM GMTBy: Asha_Bangalore

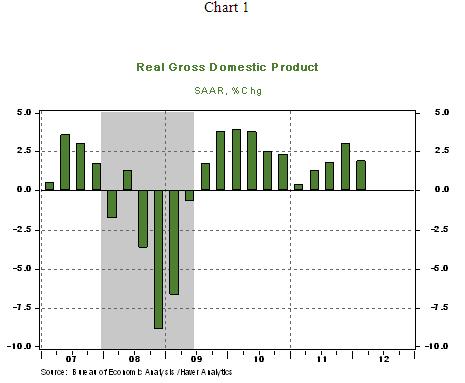

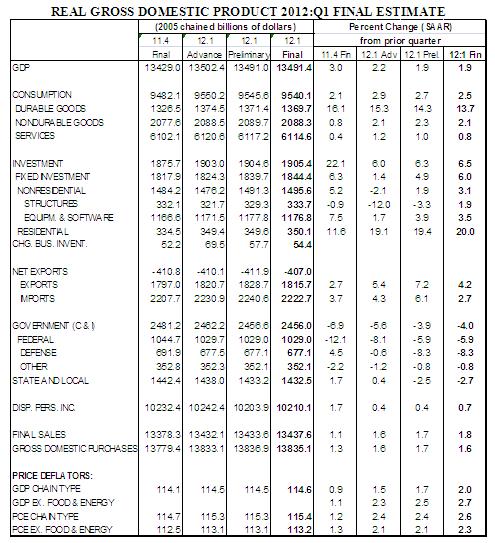

Real GDP of the US economy grew at an annual rate of 1.9% in the first quarter, unchanged from the preliminary estimate. Although the headline was not changed, contributions of several components were modified. Consumer spending (+2.5% vs. +2.7% previous estimate), equipment and software (+3.5% vs. +3.9% previous estimate), exports (+4.2% vs. +7.2% prior estimate), inventories, and imports (+2.7% vs. +6.1% prior estimate) were revised down. Residential investment expenditures (+20% vs. +19.4% prior estimate) and structures (+1.9% vs. -3.3% prior estimate) were raised. In addition to the upward revisions, a smaller trade gap also helped to offset the downward revisions and leave the headline unchanged. There were upwards of each of the inflation measures.

Real GDP of the US economy grew at an annual rate of 1.9% in the first quarter, unchanged from the preliminary estimate. Although the headline was not changed, contributions of several components were modified. Consumer spending (+2.5% vs. +2.7% previous estimate), equipment and software (+3.5% vs. +3.9% previous estimate), exports (+4.2% vs. +7.2% prior estimate), inventories, and imports (+2.7% vs. +6.1% prior estimate) were revised down. Residential investment expenditures (+20% vs. +19.4% prior estimate) and structures (+1.9% vs. -3.3% prior estimate) were raised. In addition to the upward revisions, a smaller trade gap also helped to offset the downward revisions and leave the headline unchanged. There were upwards of each of the inflation measures.

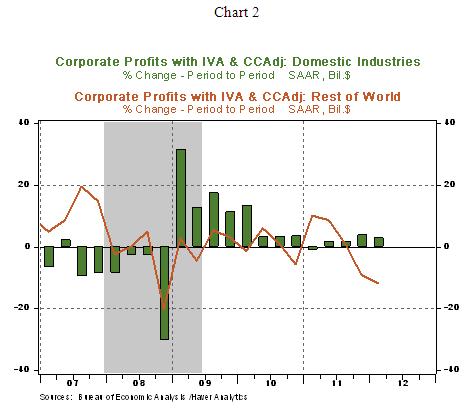

Corporate profits declined 0.3% in the first quarter of 2012, the first decline since the fourth quarter of 2008. Domestic operations have yielded an increase in profits, while net profits from the rest of the world fell 11.8% in the first quarter, after a 9.2% drop in the fourth quarter.

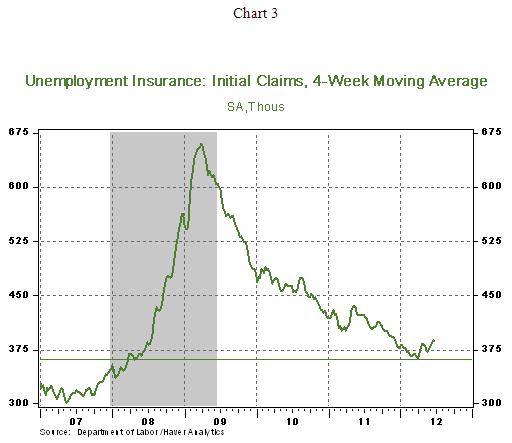

A slow-to-moderate pace of economic activity is likely in the second quarter, given the nature of incoming economic data. A sustained robust pace of business momentum is necessary to bring down the unemployment rate rapidly in the near term, which has not occurred in recent months. The course of monetary policy in the months ahead is tied to the performance of the labor market. In other related news, initial jobless claims fell 6,000 to 386,000 during the week ended June 23. The four-week moving average stands at 386,750, after registering a low of 363,000 in the last week of March (see Chart 3). The elevated level of the four-week moving average of initial jobless claims is another aspect of the labor market that paints a picture of concern. Continuing claims, which initial jobless claims, dropped 15,000 to 3.296 million.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.