The Hidden Cost of Peak Oil

Commodities / Crude Oil Jul 26, 2012 - 07:23 AM GMTBy: Money_Morning

Don Miller writes:

Most of what you've heard about "peak oil" is wrong.

Don Miller writes:

Most of what you've heard about "peak oil" is wrong.

In fact, there's a hidden cost to peak oil that's very real. And it's coming to a pump near you any day now.

I know you've read the same headlines that I have...how we are going to "frack" our way to energy independence by exploiting shale oil and other unconventional sources.

But here's the thing.

Nobody's talking about the high cost of getting the new oil out of the ground. But very soon, high extraction costs will kick crude oil prices into high gear.

As the video below explains, understanding the hidden costs of peak oil will be crucial not only to your energy investing strategy but also to our entire way of life. It's literally a crisis in the making.

What is Peak Oil: A Misunderstood Concept

First, let's take a look at what peak oil really refers to, because it means a lot more than most people realize.

People think peak oil is all about the world running out of oil. But that's not true.

Actually, the theory is based on the fact that all oil fields have a production curve -- a peak and a decline.

Simply put, peak oil refers to the point when oil production peaks and begins to go downhill.

Every single oil field on the planet goes through this cycle. There's only so much oil that we can get out of each field.

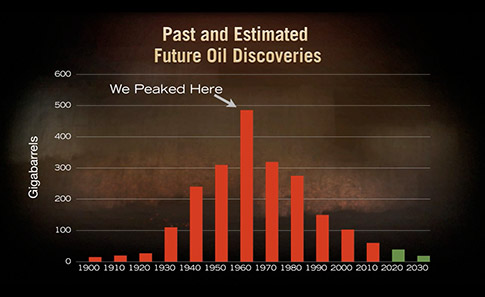

Just consider how U.S. oil discoveries peaked in the 1960s, and U.S. oil production peaked in 1970 at almost 10 million barrels a day.

Since then U.S. consumption has jumped to roughly 20 million barrels a day. To meet this demand we've been importing oil from foreign sources, and will continue to do so as domestic demand increases.

Peak Oil: Supplies Can't Keep Up We're not the only country addicted to oil.

Worldwide demand for liquid fuels will increase from 85.7 million barrels per day in 2008 to 112.2 million barrels per day by 2035, according to a report from the International Energy Association.

But even with every oil well on the planet pumping 24/7, supply simply can't keep up with demand. Every major producing oil field on earth is in decline, including the giant North Sea and Mexico fields.

In fact, the world's oil industry would have to find the equivalent of more than 5% a year in newly discovered oil reserves just to maintain current production.

What's coming up is a classic mismatch between supply and demand, which will hit the fan by 2015, if not sooner.

"[That's] when capacity starts to be overwhelmed by depletion and lack of new capacity additions," Chris Skrebowski, of the firm Peak Oil Consulting, told The Wall Street Journal.

Shale Oil Can't Solve the Peak Oil Problem

Now, you've heard how the Bakken and all those other shale plays have over 10 billion barrels of oil each.

But think about this.

A third of those reserves are probably not recoverable at all. What is left, about six billion barrels, equates to about a two-month supply.

So "fracking" oil from shale deposits will slow the rate of decline in global oil production a little, but will never offset the loss of production from the world's giant oil fields.

This is where we see the hidden costs of peak oil.

You see, to produce a barrel of oil from shale, you have to invest more energy per barrel than you do for conventional oil.

Back in the 1930s, the United States was producing 100 barrels of oil for every one barrel it invested. Today, oil fields range from 20:1 to 10:1. The U.S. average is 11:1.

"It's pretty clear that there is not much chance of finding any significant quantity of new cheap oil," Lord Ron Oxburgh, a former chairman of Royal Dutch Shell plc (ADR NYSE: RDS.A), wrote in a report entitled "Industry Taskforce on Peak Oil and Energy Security."

No wonder the Energy Information Administration projects world crude oil prices will climb to $125 by 2035.

How to Invest as Peak Oil Costs Increase

The hidden cost of peak oil is already hitting home.

As major integrated oil companies scramble to reverse declining production, they are spending billions more on exploration - and getting less in return.

For instance, Shell's return on average capital employed in 2011 fell to 15.9%. A few years ago, when oil prices were much lower, return on average capital was above 20%, according to MSN Money.

In fact, the drop in return on average capital employed is an industry-wide problem.

Chevron Corp.'s (NYSE: CVX) return on capital employed dropped by 20% from 2008 to 2011. Exxon Mobil Corp.'s (NYSE: XOM) return on capital employed dropped to 22% in 2011 from more than 27% in 2006-2010.

In short, the oil majors are losing the battle to efficiently bring more oil to the surface.

This presents a clear strategy for investing in peak oil: Buy picks and shovels by investing in firms that sell the stuff to the oil majors - the oil services companies.

That means companies like Halliburton Co. (NYSE: HAL), Baker Hughes Inc. (NYSE: BHI) or the Market Vectors Oil Services ETF (PINK: OIHYL).

And that's just the start of what you should do to get ready for the effect of peak oil. The bottom line is peak oil is real and Americans need to be prepared for it.

Source :http://moneymorning.com/2012/07/25/the-hidden-cost-of-peak-oil/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.