U.S. Economic Recovery? Sign's of What's Ahead

Economics / US Economy Oct 08, 2012 - 01:38 AM GMTBy: EWI

Several signs suggest economic contraction instead of expansion.

Several signs suggest economic contraction instead of expansion.

The first was recent front-page news: 8.1% August jobless rate. The number would have been higher, but it excludes people who gave up the job search.

The second is summed up by this Sept. 4 Bloomberg headline:

Food-Stamp Use Climbs to Record

Nearly one in seven Americans use food stamps. Before the downturn it was one in 10.

You can find the third sign at the other end of the income scale.

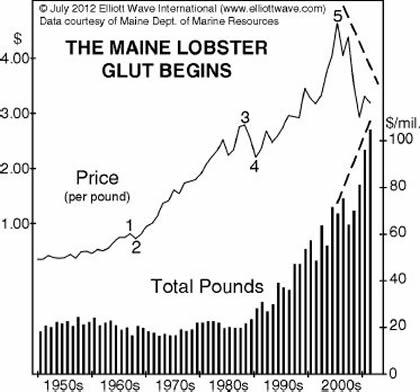

The chart shows that after a multi-decade bull market that tracked the major stock indexes, lobster prices (per pound) peaked in 2005, one year ahead of the global downturn. The timing of the lobster price top is so close to the downturn in home prices that the Maine Department of Marine Resources noted, "Interestingly, a 'lobster bubble' coincided with the national 'housing bubble' in 2006. ... The six-year divergence between per-pound prices and total pounds (shown by the trendlines on the chart) suggests that lobster mania will not be back for a long time. Luxury is a classic byproduct of a bubble.

The Elliott Wave Financial Forecast, August 2012

Speaking of the parallel trend of lobster and home prices, a Sept. 18 Wall Street Journal excerpt reveals the fourth sign of a deflationary trend:

Mortgage lending declined to its lowest level in 16 years in 2011 amid weak demand for mortgages and tighter lending standards.

A Sept. 19 Reuters article says the latest housing data is mixed:

U.S. housing starts rose less than expected in August as groundbreaking on multifamily home projects fell, but the trend continued to point to a turnaround in the housing market.

Yet we've seen "hopeful signs" of a housing recovery before. The larger trend for real estate points in the opposite direction.

The fifth sign is summed up in this Sept. 18 CBS headline:

Median Income Worse Now Than It Was During Great Recession

The article says:

The median income for American households in 2009 - the official end of the Great Recession - was $52,195 (in 2011 dollars), while the median income dipped to $50,054 last year, falling 4.1 percent over two years. ... The recovery is the "most negative for household income during any post-recession period in the past four decades."

The "Great Recession" never ended. A more accurate way of describing the state of the economy is the onset of "depression."

Have you prepared your portfolio for what's ahead? See below for an offer to view 8 chapters of Robert Prechter's New York Times bestseller, Conquer the Crash.

8 Chapters of Conquer the Crash This free, 42-page report can help you prepare for your financial future. You'll get valuable lessons on what to do with your pension plan, what to do if you run a business, how to handle calling in loans and paying off debt and so much more. Get Your FREE 8-Lesson "Conquer the Crash Collection" Now >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Economic Gloom or Recovery? 5 Signs That One is Ahead. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Best Regards,

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.