When It Comes to Forecasting, Consumers are Smarter Than 'Conomists

Economics / US Economy Oct 13, 2012 - 12:26 PM GMTBy: Lee_Adler

The Thompson Reuters University of Michigan Consumer Sentiment Index was released this morning, and like just about every other September release, it hugely beat economists consensus expectations. I had written several pieces in September alluding to the fact that withholding tax collections had surged early in the month and continued to do well thereafter, foreshadowing what would be stronger than expected economic releases for September.

The Thompson Reuters University of Michigan Consumer Sentiment Index was released this morning, and like just about every other September release, it hugely beat economists consensus expectations. I had written several pieces in September alluding to the fact that withholding tax collections had surged early in the month and continued to do well thereafter, foreshadowing what would be stronger than expected economic releases for September.

But rather than watching good quality real time data, economists are constantly getting whipsawed in their wild guesses because they religiously adhere to following the bad data that results from seasonal adjustments. Rather than looking at concurrent real time data, they extrapolate last month’s seasonally adjusted data into the future. If the economy upticks, as it did in September, they are bamboozled, but they talk fast and make lots of plausible sounding excuses. So the media keeps interviewing them and investors go on paying attention to all the nonsense and gibberish that results.

“Consumers,” a euphemism for “everybody,” do not have that problem. They just follow the Dow and the value of their house, and take note of whether family and friends have jobs or are losing them, and when those things are looking up, their outlook brightens. So while the economists guessed totally wrong about just about everything in September “consumers” unlike economists, actually had their boots, and eyes and ears, on the ground, and actually experienced real life as it is on a day to day basis. They took note of the fact that stocks had broken out and responded to the fact that more of them and their neighbors had jobs, were making a little more money, and had houses whose values may have gone up a little. All of those things may or may not last long, but consumers got it. Economists didn’t. It has always been this way.

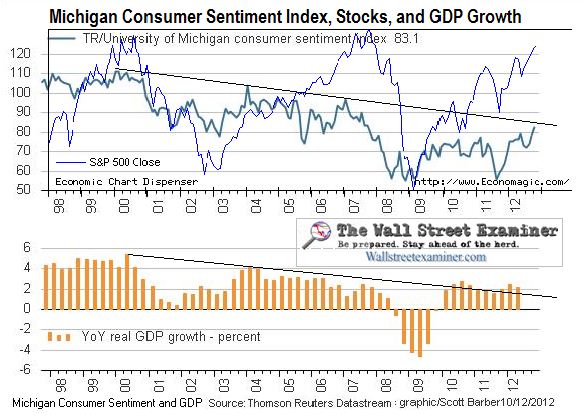

That being said, there’s the one month reading representing a barometer of the reality on the ground, and there’s the trend, representing the reality of from where we have come and where we are headed. There again, consumers seem to have a better handle on things then do economists. Because while consumer sentiment has broken out from a trough in 2011 through the highs of 2010, 2011, and earlier this year, that trend is about to run headlong into a long term downtrend that began in 2000. If things have really improved in the larger, long term sense, consumers have yet to tell us that. Depending on how they react over the next few months, they will.

I have taken the Reuters chart composed by Scott Barber and drawn a couple of trendlines and overlaid a chart of the S&P 500 to illustrate.

Michigan Sentiment and Stock Prices

Before we get to the implications in terms of stock prices, you will note that “consumers” are very good judges of the economy, far better than economists. Scott Barber’s graph of consumer sentiment and GDP growth shows that the consumer sentiment trend tends to foreshadow well the subsequent measure of GDP growth. So the implication in this case is that all the economists proclaiming that the economy is currently growing at 1.5-2% are probably wrong yet again. The breakout in consumer sentiment implies that GDP growth is likely to exceed the 2010 and 2011 highs of around 2.5%. The lead time may be a couple of quarters however, so we may not see the verdict on this immediately.

While sentiment broke out within the context of a year long uptrend in September, in the short run, it was following stock prices as it usually does. When sentiment didn’t follow stock prices up over the past dozen years, it was time to be afraid, be very afraid. But in this case, the public mood is confirming the new highs in stock prices for this bull market, in the short run.

The problem is that increasingly positive consumer sentiment is about to run headlong into the 12 year downtrend line. The first time the line was established by the late 2003 sentiment peak, it led to only a 6 month correction in stock prices. But the second time was in early 2007, after which sentiment began to diverge from still rising stock prices. That was the precursor to the 2007-09 bear market. It had already been preceded by a negative divergence from the 2003 peak. In this case, we haven’t quite reached the trend line yet, and there’s no preceding negative divergence. But that may not be a requirement for an intermediate market decline.

Over the next few months it will be interesting to see how consumer sentiment performs relative to this trend line. Consumers are likely to prove yet again to be better predictors of both the economy and the stock market than are economists.

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, along with regular updates of the US housing market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Try it risk free for 30 days. Don’t miss another day. Get the research and analysis you need to understand these critical forces. Be prepared. Stay ahead of the herd. Click this link and begin your risk free trial NOW!

Lee AdlerEditor and Publisher at The Wall Street Examiner Company Inc.

© 2012 Copyright Lee Adler - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.