America's Double Trouble and The Reckoning, U.S. Debt Higher than Greece

Economics / US Debt Nov 09, 2012 - 01:01 PM GMTBy: Andy_Sutton

Now that the untold billions have been spent trying to convince America that our leaders actually know what they’re doing, they’re going to get put to an early test, and a critical one at that. Looming large are two big issues: the debt ceiling (again), and the ‘fiscal cliff’ automatic budget cuts. While they may seem like two separate issues, it all really ties together rather nicely into one big package that can be loosely labeled as yet another attempt to spend more than is brought in and at the same time justify it. The good news is that the players are the same so the egos are the same and we can use that as barometer based on how they ‘handled’ the situation in 2010. The bad news is the egos are the same and they did a pitiful job in 2010, opting to simply kick the can down the road as opposed to actually embarking on any meaningful reform pathway.

Now that the untold billions have been spent trying to convince America that our leaders actually know what they’re doing, they’re going to get put to an early test, and a critical one at that. Looming large are two big issues: the debt ceiling (again), and the ‘fiscal cliff’ automatic budget cuts. While they may seem like two separate issues, it all really ties together rather nicely into one big package that can be loosely labeled as yet another attempt to spend more than is brought in and at the same time justify it. The good news is that the players are the same so the egos are the same and we can use that as barometer based on how they ‘handled’ the situation in 2010. The bad news is the egos are the same and they did a pitiful job in 2010, opting to simply kick the can down the road as opposed to actually embarking on any meaningful reform pathway.

The ‘American Superiority’ Myth

We’ve all heard countless times from mainstream economists, policymakers, and their ilk that America is somehow immune from consequences. They always pin their argument on the dollar standard. ‘Our’ central bank issues the reserve currency of the globe and that alone immunizes us from any repercussions. The 25% unemployment of Spain and Greece? The 50% unemployment among the young people in Spain? Forget about it! Never going to happen here because our paper is better than everyone else’s. Right? Sounds good, but only if you take them at their word and ignore the realities that lie just under the surface.

While it may be true that the reserve status can buy us some extra time, it is by no means a guarantee against hardship. In fact, it is quite the opposite in that it guarantees that our beating will be worse than everyone else’s because we’ll be the last to fall. Greece’s problems started when debt/GDP crossed the 103% area. The rest of the PIIGS and all of Europe for that matter ran into problems in that same area, a few points here and there.

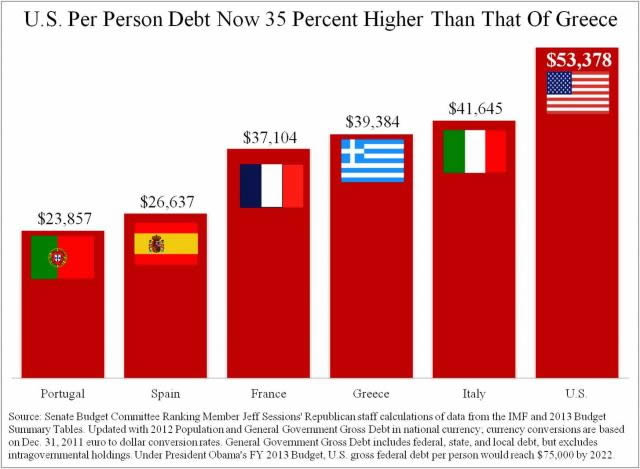

What would you say if I were to tell you that America’s per capita share of the national debt currently outstanding was 35% higher than that of Greece’s per capita share? You might do a double take. Now, what if I were to tell you that America’s per capita share of the fiscal gap (net present value of future unfunded liabilities) was more than 18 times that of Greece? These little useful tidbits of information are precisely the kind of thing the syndicate that runs the global financial system would prefer you remain ignorant about. Because you might start to wonder how exactly are we to sustain our current path? The answer is we’re not. However, the syndicate would prefer that you continue to load up on iPhones, big screen televisions, and all the modern day trappings of a neo-Roman society. There are even cracks in that façade, however. Sony Corporation was recently downgraded by Moody’s to one step above junk due to its seventh consecutive quarterly loss and falling demand for its televisions, phones, and cameras.

Now I’m not going to put my reputation on the line and give a timeline for this great unraveling and period of reckoning. There are too many quality analysts who have already discredited themselves in the eyes of the general public as the boy who cried wolf by putting absolute dates on these events. And that is a shame because the rest of their message is, for the most part, spot on. All I’m willing to say is that this might very well go on a while longer than most people would think. It could also end next week. Look at Europe. It was going. Then it stopped.

While it is true that the USFed is backed into a corner, there are still some tricks they can pull. The same goes for the USGovt. Accounting is a lovely business, especially when you can change the rules to suit your whims (see FASB Rule 157 as a great example).

The Consumer’s Millstone

Another problem facing America that is perhaps unique in the world is the level of personal indebtedness. I know I sound like a broken record, but I’ll say it again. When you borrow money, you are essentially voting for your own economic enslavement – in more ways than one. First, your borrowing allows the banking system to create inflation, which lowers the purchasing power of your currency. So you end up having to borrow even more because your current borrowings don’t buy as much. And it quickly becomes a cycle.

Secondly, the job market is downright pitiful. The ‘good’ jobs keep disappearing. For example, Lockheed Martin laid of 3,000 workers this week. And the jobs the economy is ‘creating’ are junk, paying below-subsistence wages. It is pretty sad when you can have a job and still qualify for all types of government assistance because the job doesn’t pay a living wage. This is another consequence of the USFed’s inflationary Keynesian rattletrap policies. Wages haven’t kept up with prices. Borrowing has filled the gap. Enter a good dose of materialism and voila – instant serfdom to the banking system. In this type of environment, who in their right mind would want to further encumber themselves with debt?

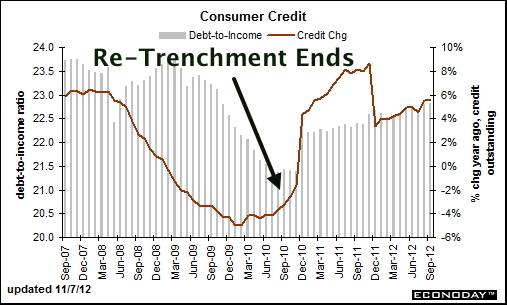

Yet the latest report from the USFed shows that consumer credit outstanding hit a record high. Yes, an ALL-TIME RECORD HIGH. Ironically, the culprits were automobile and student loans. I’ve already written previously about the student loan crisis that is brewing. Aside from the bubble in USGovt debt, the student loans mess qualifies as the #2 bubble as far as I’m concerned. Of course the ignorant media spun this utterly awful report as a good thing, following in their good Keynesian bias that debt to spend is good and doesn’t matter. Debt equals prosperity in fact. Very 1984ish. More on this later.

What the Reckoning Will Look Like

Austerity will be coming to America. Of course it will not be called austerity, because that is now another of the ‘bad words’ for which there is no place in American journalism outside describing Europe woes. We seem to be settling on the idea of using ‘fiscal cliff’ to describe our own set of woes.

Austerity will not be any prettier in America than it has been in Greece because we’re of the same mindset by and large. The freeloaders in this country are not going to take well to the idea that they can no longer eat off the sweat of someone else’s brow. They’re no different than the freeloaders in Greece and the rest of Europe who are now rioting in the streets along with pretty much everyone else.

America has already defaulted on its debt and the rest of the world for the past several years has been playing along, leading people to the idiotic notion that the Chinese don’t realize that they’re being paid back in dollars of steadily decreasing value. Does anyone actually believe this nonsense? The Chinese (and the rest of the world) might be a lot of things, but ignorant isn’t one of them, especially their policymakers. This default is one of the main reasons that China, Russia, and the OPECs have been cutting deals quietly to exclude the USDollar from their trade. And we’re not talking about two-bit countries either. China and Russia have massive economies and massive economic power. They are making some very poor choices by the way, but they are still miles ahead of America. They are cutting us out.

Everyone on earth has been quietly and slowly stepping away from USDebt, particularly that of a longer-term nature. The USFed and other central banks have been sopping up that debt to keep the game going. The syndicate then dispatches its minions to monkey with the precious metals markets to keep the illusion that the dollar is still worth something. They bash gold in their banker-owned television networks, and then load up behind the scenes. Has anyone noticed that the Cash4Gold places won’t sell you gold? They only buy. They’re more than happy to give you paper for the family jewels.

However, there will soon come a major paradigm shift. Central banks will stop printing fiat money to buy bonds. They will continue printing like crazy, but instead of buying debt, they’ll be buying gold. The big (and smart) money is moving towards metals. Soros, Paulson, Putin in Russia, and China have all been buying gold. Soros doubled his holdings in one day, albeit it through the gold ETF. Think he doesn’t have physical gold? Think again. The syndicate knows gold is money and is preparing for a massive power shift. He that has the gold makes the rules.

The end of the USBond bubble will spell a certain end to the entitlement structure and America’s welfare society. Much in the way the Greeks and Spaniards have been suffering so shall Americans who have not properly prepared. By prepared, I mean shunning new debt, paying down (preferably paying off) existing debt, and building up savings, a good portion of which are stored in precious metals. Too many people consider metals an investment. Gold and silver are cash. Pure and simple. Just another way of holding cash that happens to be a lot better at holding value than paper currency.

I and countless others have been beseeching people to accumulate metals since the beginning of this publication over six years and took untold flak for calling gold the opportunity of a lifetime back in 2008 before the crisis. This is not pat on the back time. Gold is still a marvelous opportunity, even though it has pretty much doubled from when that 2008 article was written. For those who can no longer afford gold, silver is an excellent (though more volatile) alternative. Bear in mind the syndicate actively manipulates the silver markets, so be prepared to exercise some serious patience.

Other austerity measures in the US will consist of steady increases in the retirement age to ‘save’ Social Security, increases in premiums and cuts in benefits to keep Medicare from blowing up. Be prepared to pay a lot more from healthcare, despite the massive reform that is forthcoming. That reform doesn’t even come close to dealing with the real problems, but instead mandates that approximately 35 million Americans who don’t have health insurance buy it from the insurance industry. Rather convenient, but should be no surprise considering the insurance industry crafted the reform bill.

Much of this austerity will fall under the labeling of ‘shared sacrifice’ and those who are against the theft of their Social Security contributions for example, will be deemed to be ‘unpatriotic’. That is already happening and, regardless of your worldview, the facts are out there.

The K-winter, Generational Theory, and Death of Keynesianism

There are clear cycles in society and they come under a vast array of names. The Kondratieff winter and the Strauss-Howe Generational Theory are two of the more popular monikers given to the period in the progression of societies where decadence leads to complacency, which ultimately results in bondage. We’re clearly either at the very end of the decadence/complacency stage or the beginning of the bondage stage, depending on how cynical you happen to be.

What cannot be denied is that the world is going through a massive paradigm shift. The dollar standard era, the age of consumerism, and the parabolic accumulation of debt are all slated for termination. As is Keynesianism. The great experiment that began with “A Treatise on Money” in 1931 that encouraged people to spend rather than save (among other things) is beginning its disastrous end as central banks and governments around the world engage in unlimited monetary stimulus as a means by which to ‘fight’ economic malaise. The patented answer and justification for additional stimulus was, is, and will continue to be ‘well, the last one just wasn’t big enough’. We’ve seen that with the USFed’s failed policies over the past half dozen years. When the mere lowering of interest rates failed to achieve the desired ends, interest rates were lowered to zero. When that didn’t work, they pledged to maintain ZIRP until 2015. That hasn’t worked and we’ve seen two QE failures and a TWIST program that has done absolutely nothing. So now we’re into QEunlimited.

The mainstream parrots the party line that unlimited QE is the way to prosperity. I reject that hypothesis out of hand because every last one of them already knows what the end result will be. The banksters will end up owning the title to your house, your car, and will enrich themselves infinitely with the spoils of your labor. It is quite obvious that the Keynesian experiment results in prosperity, but it is not that of the people as was asserted back in the 1930’s, but rather it is that of the financial oligarchy. At the end of this cycle, Keynesianism will meet its well-deserved demise, but the American standard of living that has been enjoyed since the Depression will die along with it. In truth, that living standard has been compromised for quite some time now with its maintenance becoming more and more dependent on the accumulation of debt, but even that will no longer be enough.

In conclusion, our society has reached a point where we are so far disconnected from our last great lessons in economics and hardship that we are now doomed to experience the next round. All the ingredients are in the mixing bowl and the blender has been slowly picking up speed for the last half dozen years.

My parting question to you is which side are you on? Are you on the side that is willing to face these problems head on and impose some austerity on yourself so as not to be caught off guard or are you on the side that wishes to remain blissfully ignorant? If you’re in the former group, you are to be commended. If, however, you find yourself in the latter group, I’ll leave you with a prescient quote from Sam Adams:

“If ye love wealth greater than liberty, the tranquility of servitude greater than the animating contest for freedom, go home from us in peace. We seek not your counsel, nor your arms. Crouch down and lick the hand that feeds you. May your chains set lightly upon you; and may posterity forget that ye were our countrymen.”

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.