U.S. National Deficit

Interest-Rates / US Debt Dec 11, 2012 - 06:28 AM GMTBy: Fred_Sheehan

"Under current law, the Treasury is technically allowed to mint as many coins made of platinum as it wants and can assign them whatever value it pleases. Under this scenario, the U.S. Mint would make a pair of trillion-dollar platinum coins. The president orders the coins to be deposited at the Federal Reserve. The Fed moves this money into Treasury's accounts. And just like that, Treasury suddenly has an extra $ trillion to pay off its obligations for the next two years - without needing to issue new debt. The [current $16.4 trillion national debt] ceiling is no longer an issue." - Brad Plumer, Washington Post, December 6, 2012, "Could the 'Platinum Coin Option' Solve the U.S. Debt Crisis?"

Buy NowIn reality, the U.S. Constitution permits Congress alone to "coin money," but technicalities are particularly in vogue for a country stumbling through its dotage. Author Plumer may be auditioning for The Onion, but he did cite the authority of Yale Law School (Professor Jack Balkin) for legal counsel. (As you probably deduced, Balkin teaches Constitutional Law.) As to its practicality, Plumer turned to one Joseph Gagnon from the Peterson Institute for International Economics: "I like it. There's nothing that's obviously economically problematic about it."

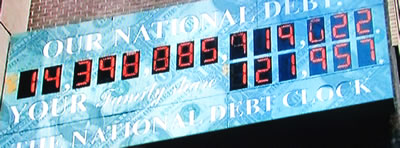

Whatever Gagnon's reasoning, he is a candidate for the Federal Reserve Board, just as Balkin is a shoo-in for the Supreme Court. This proposed plan to wipe out the federal deficit involves more substance than the Fed's open market operations. Platinum is a physical element on the periodic table: it is real. Federal Reserve Chairman Ben S. Bernanke has preternaturally expanded the Fed's balance sheet - that is, he has declared over $2 trillion into electronic existence where nothing exists - since 2008. Simple Ben is a laggard here. If the Treasury can declare a platinum coin worth $1 trillion, why not stamp 100 coins at $10 trillion each, wipe out the national debt, and give every American a few million dollars? Everyone would be rich.

The Washington Post, Yale, and the Peterson Institute are good brand names. In America, it does not matter what is stated but that it is declared by a revered source. Reuters reporter Cate Long recommended, in the wake of Hurricane Sandy, that the billions of dollars needed to repair busted infrastructure was there for the taking: "Tough times is no excuse to give away public assets to private entities. The most obvious source of funding for these projects would be for the Federal Reserve to purchase public infrastructure bonds instead of the $40 billion a month of mortgage-backed securities it has been buying." (See: "Can the Port Authority and MTA Afford Repairs After Sandy?"

Looking beneath the surface, Long has described how state and municipal debts are funded. The Chinese and Japanese are no longer dependable buyers of U.S. Treasury obligations. The Federal Reserve buys the majority of Treasuries. Without the Fed's backstop of the several-trillion-dollar deficit at such an unnatural rate of interest, it would be impossible for corrupt or incompetent municipal borrowers to find a buyer of bonds below 10%. As long as such proposals as Cate Longs' are written and read without acknowledging the obvious contradictions, To Be Foolish Will Be Very Heaven.

There will come a time when the U.S. Treasury will be unable to borrow at under 8%. At that moment, "tough times" will require "public assets [to be sold] to private entities." (Not "given," as Cate Long somehow concluded from a proposal recommending that "private funds can be used.") Corrupt or ossified municipal unions, which, too often, go hand-in-hand with corrupt or incompetent municipal governments, will retain control only so long as the Treasury receives accommodating bids. A failed auction and a 6% Treasury rate will relieve many faded organizations, maybe even Yale Law School, of underserved tenure.

By Frederick Sheehan

See his blog at www.aucontrarian.com

Frederick Sheehan is the author of Panderer to Power: The Untold Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of Recession (McGraw-Hill, November 2009).

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Frederick Sheehan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.