Economic Transition And The Supercycle

Economics / US Economy Dec 27, 2012 - 04:28 AM GMTBy: Andrew_McKillop

WHEN IS A CYCLE A SUPERCYCLE?

WHEN IS A CYCLE A SUPERCYCLE?

The very first modern stockmarket crash of 1719-1721, of the French bourse was entirely driven by the Apple and Facebook-of-the-day. These were shares in the Mississippi Company, a company modeled on England's South Sea Company which peaked and crashed in almost exactly the same timeframe. Mississippi Co.'s first share offering IPO was in January 1719 at a unit price of 500 livres (the French currency of the time). The shares "went viral" driving prices to 10 000 livres per share by December 1719, an 11-month gain of 1,900 percent. All kinds of people became "investors" and many became millionaires just from their holdings of Company shares. The French word “millionaire” was coined to describe speculators who got lucky and got wealthy as a result of the Mississippi Bubble.

Profit taking started in Q1 (first quarter) 1720 with first redemptions, in Bernie Madoff style, being paid in metallic gold, but the Madoff-of-1720 and originator of the scam, Scotsman John Law tried discouraging more aggressive selling by limiting redemptions in gold to 100 livres. This far from stemmed the rout. Company share prices, in paper money crashed to 500 livres by late November 1721. Shortly after that, now openly called a scam artist (arnaqueur) by his former admirers including France's Duc d'Orleans, the stand-in head of state for underaged King Louis XV, John Law received death threats and fled the country, firstly to Switzerland. He ended his life as an unsuccessful gambling pro.

This sorry tale, so up to date it can be transposed word-for-word for today's algorith and high freq' trading scams has to be seen in its geopolitical context. This instantly explains why the French Mississippi Co. scam, and the British South Sea Bubble ran together, exploiting the same sources of pseudo logic, apparent rationale and mass public gullibility, to fraud the multitude and enrich a few.

(Source http://ns1763.ca/remem/7yw-timeline-w.html)

GEOPOLITICS, TECHNOLOGY AND NATIONBUILDING

The Mississippi Co. stock crash is claimed by many to a leading economic cycle starter, especially of modern stock exchange cycles, but it was at least as much a political or even cultural event, as an economic event. It was managed, like the blowback from Britain's South Sea Bubble through a now-classic mix of elite panic, repression, disdain and inertia called "muddle through" today.

This "management response" was later on, in France, given the slogan which regime-friendly media talking heads and economists still mumble today: "laisser faire, laisser aller". This slogan was coined by the quack doctor to the court of King Louis, Francois Quesnay, a supposed founder of liberal economics, but more accurately a founding spokesman of the call to let laisser faire run its course - over the brink. Liberal economics, in the 18th century, was exactly what is is today: a mix and mingle of elite fear of being found out, big profits for asset scammers close to the elite, and elite satisfaction at keeping the party going, just one more day.

In other words 'crony capitalism'.

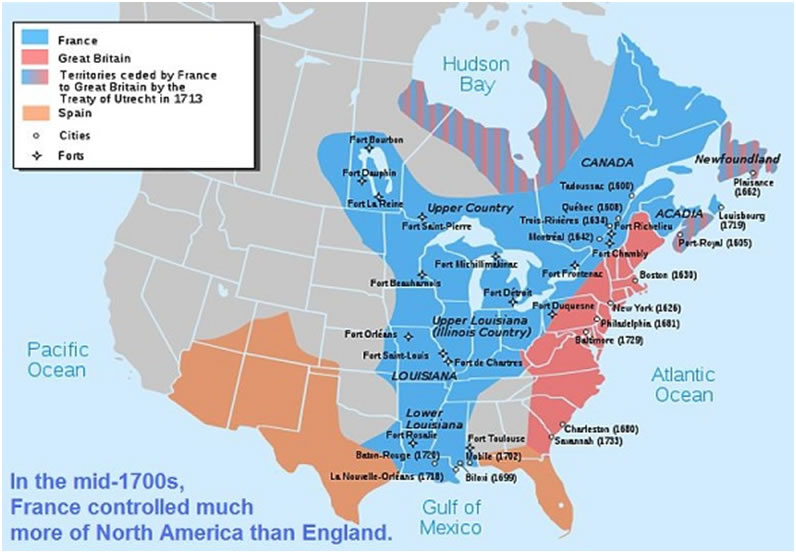

At the same time, in the real world of the late 18th century, the convergence of technological innovation, cheap energy and population growth were setting the scene for Europe's Industrial Revolution. This produced real world wealth far beyond the skimmings extracted from the vast and enticing but Empty Lands of North America - skimmings which were heavily dominated, in the late 18th century, only by beaver skins and small amounts of gold and silver, despite the definition of "Louisiana and Mississippi country" covering a vast slice of the future USA, extending north to and including the Great Lakes! The vastness of the prospect - French or English North America - was used by asset scam charlatans to create the bubble mix of greed and hope that all politicians try to create, but this always collapses one day, when truth shines in. In elite mythology "only the unlucky get caught".

The three-way split of North America between the Spanish, French and English was an epic event, geopolitically, but its role in driving the Industrial Revolution of around 1780-1860, sometimes called the "First Industrial Revolution", was low. This first revolution was internal European, and European colonists in North America were both uninterested and almost unaffected by this faraway revolution.

The thirteen English colonies acted like miniature republics, almost Mayan style! They were disunited and jealous of one another, were not interested in technological change, and were suspicious of the mother country. This in fact was the only uniting factor - none of them liked taking orders from, or paying taxes to London. The southern provinces or 'republics' of Virginia, North Carolina, South Carolina and Georgia saw no threat or danger from the French at faraway Fortress Louisbourg (controlling the St Lawrence river) and their huge demographic superiority over the French - whose very small population was heavily dominated by the military, by hunters and a few miners - was neutralized by apathy, lack of union and a total absence of national identity.

In Europe however, the Industrial Revolution rapidly became a national identity quest and source of national pride. The revolution not only coincided with, but massively intensified the nationbuilding process in Europe. It supplied the means to launch the Scramble for Africa, in a similar way but more intensely than the fight for what was in reality only the economic symbol of influence in North America. Population growth and urbanization soared in Europe, with the world's first city of more than 1 million - London in 1760 - making further industrial development and growth in the 19th century not only possible, but necessary to feed, clothe, house and attempt to employ the masses and prevent them being affected by Marxist, anarchist or millenarian cults. The Industrial Revolution was a real economic cycle event, while the first stock market crash and its sequels was not.

THE VIRTUAL TRANSITION: REVERSE ENGINEERING

Since the 1980s, for a variety of reasons including culture change, loss of national identity and national purpose, rising economic competition from Asia, as well as technology change, resource depletion and continuing massive global population growth producing the equivalent of 1 new USA every 4 years, economic transition has 'virtualized'. This occurred firstly in the Old World or Western hearth regions of previous historical economic change, starting at least 30 years ago. This process is given the synonym 'economic globalization' to summarize 'multi-polarity' of economic decison making but the critical dysfunctionality and ineffectiveness of this mostly ritual decision making system and process jumps out from the fog of talk on 'globalization'.

We can easily call this what it is: reverse engineering of the economy, with the unsurprising result (for sane persons) of economic and social chaos preceded by system-wide disorganization.

Many economic indicators, for example US driving miles and driving habits, electricity demand per capita in many OECD countries, population size in rising numbers of OECD countries show present day numbers little changed since the 1970s and 1980s, tracing an almost perfect bell-curve with a peak 10 to 15 years back in time. Many other leading global economic indicators for the end of 2012 are little changed from, or below those of 2008. The so-called 'global economy' has already and openly experienced 4 lost years, but the rot started long before.

Political and national spinoff or collateral damage from the process of reverse engineering is multiform, shown by an insidious de-socialization or de-culturation of declining nations - which are declining as national real world entities with specific identities, losing economic power and political influence, with few or no compensating gains. More than ever, "laisser faire, laisser aller" is the No Alternative non-policy for both economic and political decisions, more precisely the method of avoiding decisions which are supposedly "imposed by the market" (or by mass street protest for political change). The net result is very simple and unsurprising (to sane persons): the inevitable and overdue result is accelerated economic decline since at latest 2008. The potential for this becoming irreversible is now openly discussed, for evident reasons.

At least as important, this is global economic decline not specially or particularly restricted to any one single country or bloc such as the "hearth of global decline" OECD group. This is despite the attempts made to put positive spin on the process of so called globalization - for example by invoking the "East Asia Bubble" or Emerging Economy 'locomotive' and calling this fragile bubble 'Global Economic Transformation'.

THE GLOBAL ASSET SCAM

Vast amounts of data are available on the debt-and-derivatives scam which has at one and the same time transformed and virtualized the economy. Taking only national or 'sovereign' debt, this one factor is a certain driver in the loss of national identity and purpose. In turn, this underscores the total difference between former economic transitions, and the current. The main difference is easy to summarize: previous transitions were 'teleologic', they were goal-oriented or became goal-oriented quick enough to prevent anarchic collapse and chaos following some major stepwise gamechanger event - such as the development of coal-fired industry and transport in the late 18th century. The present pseudo economic transition, or 'transformation' is not goal-oriented. One critical missing factor is the national identity factor - nations are being destroyed by the present transition, not built - but several others also exist.

This can be evoked another way. Since the 1980s or early 1990s, for a variety of reasons, management and operation of the global economy is a "reverse engineering" quest. The process, sometimes open and unashamed, sometimes by design but often random-based is to strip down economic and social, cultural and psychological event trees and hierarchies in the unsuccessful search for fundamental economic deciders and movers, but without the compensating gain of generating the decisional methods, software or algorithms, or political and social processes able to "map our path through deterministic chaos."

HISTORY IN THE MAKING

The post-2008 rout and process of transition was in no way due to technological change; it was at most accelerated or "enhanced" by recent and previous computer-based communications technology and business or trading software. The basic facilitator or enabler as we note above, was the lure of chaos, of "spontaneous market decisions" coming down from on high - essentially a primitive desire from our neanderthal past. This primitive desire was sufficient to drive the global elite cult we can call 'nobody in the cockpit', but with no flight plan to anywhere that exists in the real world. Empty Lands to invade, conquor and pillage can still exist in elite imaginations, as we know, but not in today's known real world of 5 continents.

Historians will most surely and certainly be talking about "What happened after 2008" in a decent interval of time forward. By as early as 2025 perhaps, the time interval will be long enough for historians to underline that the generational age-group of Neoliberal doctrinal leaders, promoting economic chaos, massive social inequality and the end of the nation state among other 'pet' themes, through the period of about 1985-2010, was replaced and disappeared from the scene almost overnight, in the 2012-2020 period. Whether this was by assassination or not, remains to be known.

Outlyer events will be easy to identify. Other than the terminal crisis for the Growth Economy, of 2008-2010, the Arab Spring revolt of 2011-2015 (or longer) will feature high up the list. These were both events which had almost no relation at all to technological change, despite brave attempts, around 2011-2012 at explaining the Arab revolt as "smartphone enabled".

Above all the collapse of popular support for, and massive rejection of the flimsy and primitive ideas peddled by the Neoliberal Elite in the Western world, the rejection being either by the ballot box or by street revolt, will be given the major historical attention it already merits. Among the most pernicious works of this deviant single-generation clique of political non-deciders, future historians will underline, was the cult of "dysfunctional and pseudo regulation and legislation". As we know, only in the US, around 12 000 bureaucrats work each day to devise and promulgate dysfunctional new regulations - for a chaos-based economy!

The already long-running Eurozone and Union crisis and Japanese crisis, or crises, provisionally dated at about 2009-2014 for Europe, and 1990-2013 for Japan will be seen by future historian as both a key example of dysfunctional and pseudo decision making - deciding to do nothing, but with massive amounts of new 'comfort legislation' - and a key driver of renewed and intensified nationalism, nationbuilding and the quest for identity. All of these goals, the historians will agree, could only intensify the decline of Europe and Japan "in classic or conventional" economic terms.

NO MORE EUROPE, NO MORE JAPAN

Taking Japan and Europe out of the asset creation scam - called "the global economy" - will have major effects. For the USA and China, in particular, the increasingly easy to predict 'Missing presumed dead' status of the European and Japanese economies will seal their own programmed recentering and redeployment as national economic entities. For future historians this process which became powerful and unstoppable through 2010-2020, was one of the most important gamechangers - Economic Transformations - the world has ever known. One outlyer in the countdown period of 2012-2015 was that economic data became ever more manipulated, rigged, chaotic and volatile - causing little surprise to future historians.

Both for the US and for China the founding role and model of Europe for the US, and Japan for China, are critical factors during the post-2010 breakdown phase. Among the most important of these factors, the "received wisdom" in the US and China but in fact created in the US and China, was that Europe and Japan had somehow lost focus, abandoned the game and the race, and failed in their Economic Transformation. As failures, they could "bow out" of the race. This race, as future historians will always remark, in fact did not exist in the sense of having a real and identifiable goal. It was a race to nowhere - a virtual transformation, or voyage to a nowhere state which could not and did not exist.

Europe and Japan, which to US or Chinese economists and politicians seemed to have "burned out" like the Third World of the 1980s and 1990s, had in fact embarked on their re-nationalising quest, or rediscovered identity quest. This started at least a decade before the 2008 crisis. This quest firstly demanded the abandonment of the virtual will o' the wisp called "the global economy". Reflected by a host of data such as energy demand per capita, consumption patterns, attitudes and values, voting habits, the "economic" transformation in Japan and Europe was and is above all social and cultural, and then political, before it became economic.

Hallowed values of Neoliberal Transformation, or so-called transformation such as the cult of inventing gimmicks, and its political lookalike of "permanent major reform", and the social poison of competition and exclusion - rather than cooperation and social integration - naturally disappeared, as the economy went out of focus and constantly declined. The reappearance and rapid growth of national identity and social responsibility, rather than the fake tinsel "greedy global consumer" cult identity forced down the throat of citizens, by political decision, was a key indicator of change, future historians will note.

Global economic, social, cultural and political transformations called Supercycles are almost always a time of conflict and war. This may again be the case, despite the nuclear risk and threat, with the war theatre being national, civil and domestic rather than international. Under any hypothesis the mirage of the "global economy" will be the first collateral damage from this transformation.

By Andrew McKillop

Contact: xtran9@gmail.com

Former chief policy analyst, Division A Policy, DG XVII Energy, European Commission. Andrew McKillop Biographic Highlights

Co-author 'The Doomsday Machine', Palgrave Macmillan USA, 2012

Andrew McKillop has more than 30 years experience in the energy, economic and finance domains. Trained at London UK’s University College, he has had specially long experience of energy policy, project administration and the development and financing of alternate energy. This included his role of in-house Expert on Policy and Programming at the DG XVII-Energy of the European Commission, Director of Information of the OAPEC technology transfer subsidiary, AREC and researcher for UN agencies including the ILO.

© 2012 Copyright Andrew McKillop - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

Andrew McKillop Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.