How Is America Really Doing? 75 Facts Revealed

Economics / US Economy Dec 31, 2012 - 06:45 AM GMTBy: GoldSilverWorlds

An amazing list of real facts was published by The Economic Collapse Blog, entitled 75 Economic Numbers From 2012 That Are Almost Too Crazy To Believe. An excellent article that presents 75 facts & figures, based on research or surveys, indicating the real state of the US. Reviewing those facts and comparing them with the messages in the mainstream media and the government, we see such a huge disconnect.

An amazing list of real facts was published by The Economic Collapse Blog, entitled 75 Economic Numbers From 2012 That Are Almost Too Crazy To Believe. An excellent article that presents 75 facts & figures, based on research or surveys, indicating the real state of the US. Reviewing those facts and comparing them with the messages in the mainstream media and the government, we see such a huge disconnect.

We selected what we consider “fundamental facts” based on the following themes:

Social drama (increasing poverty)

•In December 2008, 31.6 million Americans were on food stamps. Today, a new all-time record of 47.7 million Americans are on food stamps. That number has increased by more than 50 percent over the past four years, and yet the mainstream media still has the gall to insist that “things are getting better”.

•Back in the 1970s, about one out of every 50 Americans was on food stamps. Today, about one out of every 6.5 Americans is on food stamps.

•Right now, approximately 48 percent of all Americans are either considered to be “low income” or are living in poverty.

•According to one survey, 77 percent of all Americans are now living paycheck to paycheck at least part of the time.

•Today, the wealthiest 1 percent of all Americans own more wealth than the bottom 95 percent combined.

•One recent survey discovered that 40 percent of all Americans have $500 or less in savings.

(Un)employment deteroriating

•The percentage of working age Americans with a job has been under 59 percent for 39 months in a row.

•If you can believe it, approximately one out of every four American workers makes 10 dollars an hour or less.

•Barack Obama has been president for less than four years, and during that time the number of Americans “not in the labor force” has increased by nearly 8.5 million. Something seems really “off” about that number, because during the entire decade of the 1980s the number of Americans “not in the labor force” only rose by about 2.5 million.

Economy deteroriating

•The U.S. share of global GDP has fallen from 31.8 percent in 2001 to 21.6 percent in 2011.

•The United States has fallen in the global economic competitiveness rankings compiled by the World Economic Forum for four years in a row.

•Corporate profits as a percentage of GDP are at an all-time high. Meanwhile, wages as a percentage of GDP are near an all-time low.

•There are four major U.S. banks that each have more than 40 trillion dollars of exposure to derivatives.

Inflation

•Electricity bills in the United States have risen faster than the overall rate of inflation for five years in a row.

What is the government doing about it?

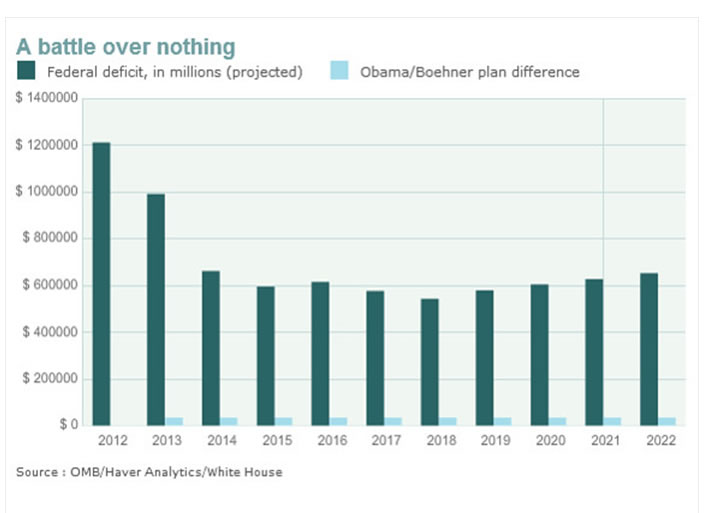

Obviously, for the government everything is running fine, as the talks of the day are about the fiscal cliff. Indeed, this is what the talks are about (chart courtesy Marketwatch.com). Their signal is clear. Looking at the time and effort they spend on the fiscal cliff debate they clearly consider it more important than all of the above issues.

But here are the real facts:

•Amazingly, the U.S. national debt is now up to 16.3 trillion dollars. When Barack Obama first took office the national debt was just 10.6 trillion dollars.

•During the first four years of the Obama administration, the U.S. government accumulated about as much debt as it did from the time that George Washington took office to the time that George W. Bush took office.

•Today, the U.S. national debt is more than 5000 times larger than it was when the Federal Reserve was originally created back in 1913.

•Thanks to our foolish politicians (including Obama), Medicare is facing unfunded liabilities of more than 38 trillion dollars over the next 75 years. That comes to approximately $328,404 for each and every household in the United States.

•If Bill Gates gave every single penny of his fortune to the U.S. government, it would only cover the U.S. budget deficit for about 15 days.

•During fiscal year 2012, 62 percent of the federal budget was spent on entitlements.

Let’s hope the real issues will be addressed voluntarily in 2013 and the years after. It will very sad if they need to be addressed because of force majeur.

Source - http://goldsilverworlds.com/gold-silver-general/75-facts-revealed-how-is-america-really-doing/

© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.