Gold through the roof! Here's what's next for Gold Oil and the Stock Market

Commodities / Forecasts & Technical Analysis Feb 23, 2007 - 02:20 AM GMTLarry here, with an urgent update on key markets, starting with gold.

The yellow metal went through the roof yesterday ... chalking up a stunning $23 gain on the day, blasting through its July peak ... and launching a price explosion that could easily send it to new, all-time highs very quickly.

Ditto for oil, which surged $1.22, and is now poised for a major new bull market.

I Told You This Was Coming And Now It's Here!

Back in June 2006, I gave Money and Markets readers a market roadmap that highlighted my thoughts on gold, oil and the Dow. And in that issue, I gave you what have turned out to be accurate signposts to follow.

Gold: At the time, gold was trading around $590, and I wrote, “Your downside risk in gold is now lower than it's been in many months,” and I encouraged readers to buy with both hands.

Sure enough, the lowest subsequent level that gold reached was $571. Then it rallied strongly, closing above my $618.70 level on July 5. Gold is now trading at $685, a gain of about 20% since I put out that roadmap issue.

Oil: I wrote in June: “In the unlikely event that oil closes below $64.05, then I would expect oil to fall as low as $50 a barrel, and we may be in store for more of a correction in oil and gas shares.”

The unlikely did happen, as oil promptly fell below $64.05, and it went as low as $57 in November of last year.

Dow: “If the Dow closes above 11,410, it will be a solid signal that the economy is still humming ... that investors are buying stocks as an inflation hedge ... but the Fed is falling further behind the inflation curve, still committed to easy money.”

The Dow did close above 11,410 on September 1, and it is now pushing above 12,750 for a gain of about 11.7%. The economy has done better than most expected, and as I keep telling you, the Fed is certainly behind the curve in fighting inflation.

Now, here's ...

My Updated Roadmap and Important Market Guideposts

If there were ever a time to stay in touch, this is it. Over the next several weeks, important signals will be hit and new trends will emerge. If you don't want to lose out, you'll want to stay on top of these markets. Some of the best profit opportunities of the year are ahead of us.

What to Expect From Gold and Gold Shares

After yesterday's dramatic surge, a little pullback is always possible. But if that happens, seriously consider buying on the price weakness, because the opportunity will likely be very short-lived.

Reason: Gold's breakout above $675 tells me that much higher prices are coming swiftly. My new upside targets:

First, $732 an ounce. That's last year's high in gold, and I expect it to give way very easily.

Next, is $860 an ounce. That would be a new record high, but it's absolutely achievable.

From there, the following two important numbers will be $981 and $1,056 per ounce. And I fully expect to see each of these targets hit this year. Here's why ...

Investors all over the world are waking up to a simple fact — that central bankers are systematically devaluing currencies (with the U.S. dollar leading the way down) ... inflating their economies ... and pumping up money supplies like crazy.

This, on top of all the other problems in the world, is creating huge demand for gold. Meanwhile, there are truly limited supplies of the metal, and mining activity is declining.

You can see why I'm suggesting accumulating gold and gold shares on any weakness. The downside risk is minimal, in my opinion, while the upside is huge.

If you want a diversified stake, you can buy a good gold mutual fund such as the Tocqueville Gold Fund (TGLDX), the DWS Gold and Precious Metals Fund (SCGDX), or U.S. Global's Gold Shares Fund (USERX).

Or, for my specific recommendations, see the latest issue of my Real Wealth Report . If you're not yet a subscriber, you can join now and download the issue immediately!

What to Expect from Oil and Energy Shares

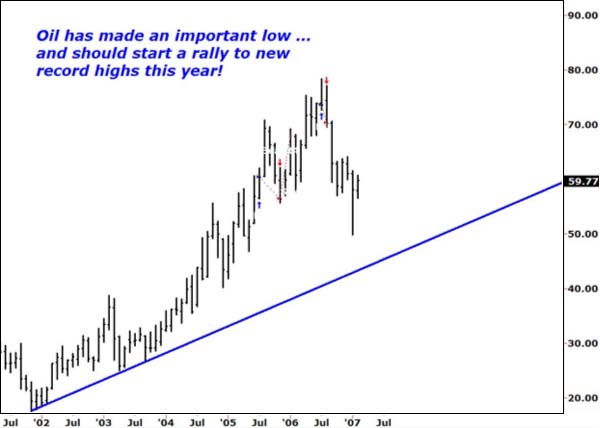

Look at my chart of oil, and you'll see that, while the recent correction has been sharp, in no way, shape, or form has the longer-term uptrend been broken!

Here are the points to watch in crude oil prices: $65.10 on the upside and $55.76 on the downside.

If oil closes above $65.10 — and I fully expect that it will — the next stop will be new record highs. In fact, I'd look for prices to go well above $80 a barrel, probably nearer to $100 a barrel. And oil and gas stocks would move up along with crude prices.

Conversely, in the unlikely event that oil closes below $55.76, then I would expect it to fall back to $50 a barrel, and oil and gas shares would probably drop further.

Let me be clear: Anything is possible, but I do not expect the latter scenario. Here's why ...

China's economy is hot enough to keep oil and gas prices firm for quite a long time. Just consider the country's latest economic stats:

- 2006 GDP just revised to up 10.7% growth!

- Fixed asset investment up 24%!

- Total retail sales up 13.7%!

- Urban per-capita income up 10.4%!

And China's January crude oil imports hit a monthly record 13.7 million tonnes, or about 100 million barrels!

I've said this many times before and I'll say it again — do not underestimate China's impact on the global economy. For oil, China's growing influence is going to mean higher prices.

Seriously consider adding to your holdings of oil service companies. They've come down nicely in recent weeks, and as you can see from my chart of the Oil Service HOLDRs Trust (OIH), which holds major oil & gas companies, these stocks are still well within the slope of the long-term uptrend.

By the way, the 139.67 level is an important one. Once the OIH closes above that number on a weekly basis, oil stocks will likely skyrocket to new highs. For my latest recommendations, see my Real Wealth Report .

What to Expect from The Stock Market

A lot of attention has been paid to the Dow Jones Industrial Average lately. Here are two important numbers you need to watch for: 13,000 on the upside and 12,242 on the downside.

The 13,000 level represents stiff psychological resistance, a point at which investors might pause and think before sending the index higher. In fact, this has been the case with most major whole numbers in the Dow.

If the Dow can get through 13,000, it could rally a bit more, perhaps to 13,500.

But I'll tell you right now: The Dow is defying gravity and several of my indicators continue to tell me that most U.S. stocks are way overbought. Put another way, the stock market is fraught with risk.

Indeed, if the Dow closes below 12,242 at any point, it will be your signal that the recent economic strength is rolling over, that investors think corporate earnings have peaked, and that the weakness in the housing sector is really hitting home. In short, the stock market could get hit very hard.

Despite the seeming strength in the Dow (and other U.S. indexes like the S&P 500), I maintain my position that this is not the time to be heavily invested in U.S. stock markets.

This is especially true because the U.S. dollar is still very much weak at the knees, and prone to further plunges. As I explain in “ How the Dow Is Already Getting Killed ”, even if the stock market is rallying, you could still be losing money.

But never forget: There are always parts of the market that buck the overall trend. So you could easily see select sectors surging even as most other stocks plunge.

The prime examples: The gold mining shares and carefully chosen energy and other natural resource stocks I've just told you about this morning.

Best wishes,

Larry Edelson

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.