The Economic Depression Is Deepening

Economics / Great Depression II Apr 23, 2013 - 01:47 PM GMTBy: Bill_Bonner

Gold seemed to be stabilizing at the end of last week. Commodities remained weak. Steel has fallen 31% this year. Brent crude is off 17% since early February. And copper is down 15%.

Gold seemed to be stabilizing at the end of last week. Commodities remained weak. Steel has fallen 31% this year. Brent crude is off 17% since early February. And copper is down 15%.

Copper is the metal you need to make almost anything – houses, cars, electronics. When it goes down, it generally means the world economy is getting soft.

At the start of last week, the conventional analysis of the gold sell-off was that the central banks' efforts to revive global growth were working. The feds had the situation under control. So who needed gold?

By the end of the week, it appeared that gold – and commodities – had sold off for the opposite reason: because central banks' money printing wasn't working and the world was slipping further into a period of slow growth and barely contained depression. From Business Insider:

Recent U.S. economic data has been disappointing, especially in the realm of housing, which is what the US bull case is all about.

In Germany, dubbed the strong arm of Europe, economic sentiment just fell.

Where's the Growth?

And growth has begun to slow in China – still considered a global growth engine – as it continues to crack down on corruption, a property bubble and a bloated shadow banking business. China's plan to shift its economic model away from exports to domestic demand-led growth has also contributed to the lower growth rate.

In the US, building permits are down... and foreclosures are up. There is no renaissance happening in manufacturing. Only half of the new jobs expected showed up in March. Retail sales are down, and consumer confidence is off.

And in Britain, the unemployment rate is rising. Retail sales are falling. And figures coming out this week will probably tell us that the country is in a triple-dip recession.

Here's Ambrose Evans-Pritchard in The Telegraph:

It is becoming ever clearer that the roaring boom in global equities since last summer has priced in an economic recovery that does not in fact exist. The International Monetary Fund has had to nurse down its global growth forecasts yet again. We are still stuck in an old-fashioned trade depression, with pervasive overcapacity in manufacturing plant and a record global savings rate of 25% of GDP...

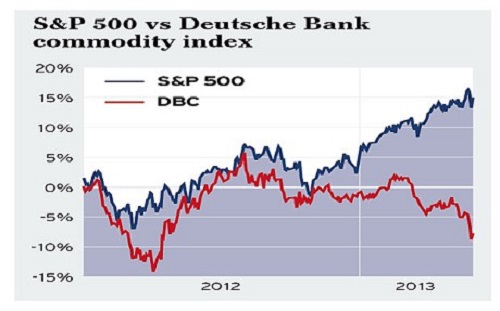

As you can see from the chart below, the divergence between stock markets and the Deutsche Bank index of raw materials is astonishing to behold, so like the pattern in early 1929...

The US economy is growing below the Fed's own "stall speed" indicator. Half a million people fell out of the workforce in March. Retail sales fell in March. So did manufacturing...

"There is a threat of deflation almost everywhere. A lot of central banks will have to follow the Bank of Japan, whatever they say now," said Lars Christensen from Danske Bank.

The era of money printing is young yet. Gold will have its day again.

Bill Bonner

Bill Bonner is a New York Times bestselling author and founder of Agora, one of the largest independent financial publishers in the world. If you would like to read more of Bill’s essays, sign-up for his free daily e-letter at Bill Bonner’s Diary of a Rogue Economist.

© 2013 Copyright The Daily Reckoning, Bill Bonner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Bill Bonner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.