U.S. Treasury Bond Market Implosion Has Officially Begun

Interest-Rates / US Bonds Jun 21, 2013 - 02:02 PM GMTBy: Graham_Summers

The QE Infinite parade officially ended yesterday when Bernanke hinted at tapering QE later this year or in mid-2014.

I first warned Private Wealth Advisory subscribers about this in mid-May writing,

If Bernanke is going to step down (as hinted by his decision to skip out on the Jackson Hole meeting) he’s not going to want to leave with the Fed going at QE 3 and QE 4 full throttle.

Instead his best bet would be to take his foot off the gas a little bit, giving his replacement a little room to maneuver if things get ugly.

Source: Private Wealth Advisory

This is precisely what Bernanke is trying to do. However, there is another far larger issue at work here.

The primary driver of stocks for the last four years has been the hope of more Fed stimulus. This hope has put a floor under ALL asset prices as market participants KNEW the Fed was involved in the markets. As a result EVERYTHING (stocks, bond commodities, even currencies) has been artificially propped.

By calling for the end to QE 3 and QE 4, the Fed has begun to remove these market props. Which means that the markets are now going to start adjusting to where assets prices REALLY SHOULD BE.

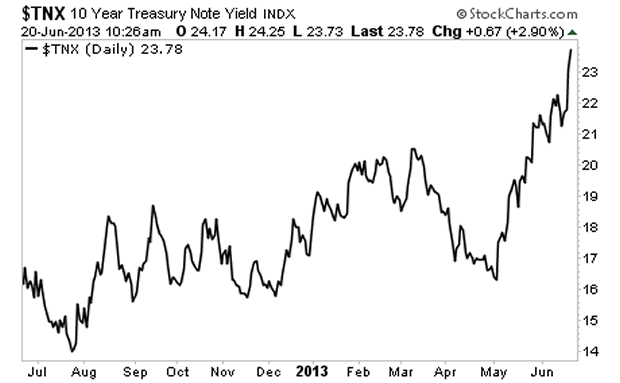

Take a look at the spike in the 10-year Treasury yield:

This is just the start. I warned Private Wealth Advisory subscribers in our most recent issue that higher rates were coming noting a collapse in bonds in Europe and the emerging market space.

This could easily become truly catastrophic. The world is in a massive debt bubble and the Central banks are now officially losing control. The stage is now set for a collapse that could make 2008 look like a joke.

If you are not preparing in advance for this, the time to get started is NOW.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

To join us…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.