New Dow Jones Record? Stock Market Actually in Freefall Since the Year 2000

Stock-Markets / Stocks Bear Market Nov 18, 2013 - 10:04 AM GMTBy: Richard_Moyer

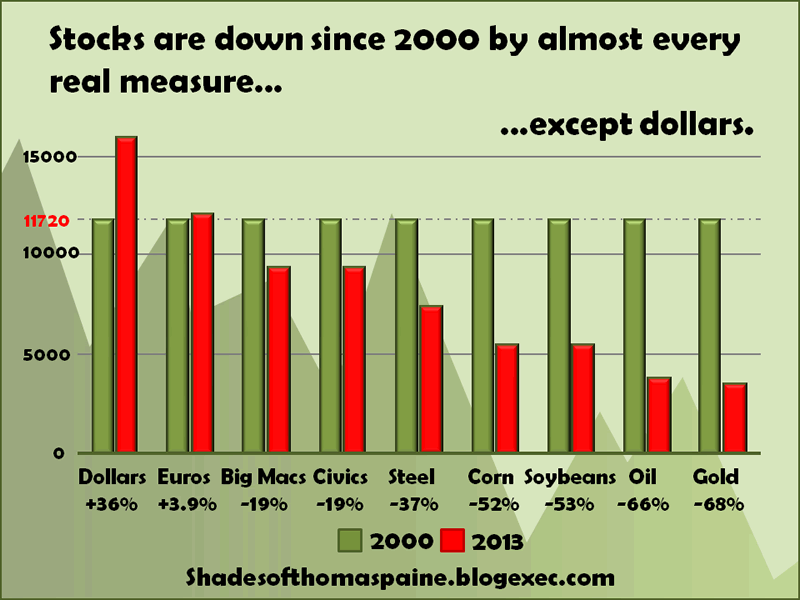

Lately, the Dow Jones Industrial Average and most every other market index have been on a tear, setting new records every week. There should be hairy asterisks aside these "records" that belie the larger truth: these aren't records at all. They aren't even close to the January 2000 record of 11,720 in terms of real stuff.

The high jump world record is a shade over 8 feet, set by a slender Cuban fellow, Javier Sotomayor. What makes his record useful, and comparable to other attempts is that the inch stays the same. It has a definition that doesn't change year to year. The dollar, however, constantly loses value. Calling the present DJIA measure of 15,962 a "record" is equivalent to me redefining the inch down by half and then claiming the high jump record for myself.

So what's reality? The graph below shows how the Dow actually performed by comparing how much of a commodity $11,720 would have bought in 2000, and how much $15,960 would buy in 2013. Pick your poison, 'cause it ain't pretty.

Take the Euro, which is a floppy, fake money substitute just like the dollar. In spite of the European Central Bank's whizzing printing presses, it's still beating the old US greenback. It was just barely over a dollar in January of 2000 when the Dow was breaking 11700, but now it's $1.33. While the Dow appreciated 36% in terms of dollars, it only appreciated 3.9% in terms of Euros.

How about a Honda Civic or a Big Mac, two relatively constant products? One is a cheap hamburger, the other is a cheap four-banger sedan. Back in 2000, you could buy a Civic for $10,350, or less than the Dow. Today, the $17,000 plus MSRP of a basic Civic exceeds the Dow by a thousand or more. Sure the Dow went up by 36% in dollars, but in terms of Civics and Big Macs the Dow is down by 19%.

Commodities make it look even worse. Between steel, corn, soybeans, oil and gold, the Dow is 37% to 68% below its January 2000 peak.

It shouldn't come as a surprise, in the midst of a global recession, that companies by any consistent measure would be less valuable than when things were going well. What's disturbing, though, is that no meaningful conclusions can be made when measuring with dollars. Furthermore, the nation makes its financial decisions through the wildly distorted lens of the US dollar with terrible results. Only amidst the dollar's acid-tripping, money-printing delusions could the wholesale exportation of American industry be regarded as the cure for what didn't ail us. Only in an atmosphere of free money could the frenzied accumulation of debt be viewed as a sensible replacement for productive activity. And, ultimately, it is this bend in space-time that makes the stock market set new records in terms of dollars while plumbing new lows when measured any other way.

Richard Moyer

http://shadesofthomaspaine.blogexec.com

© 2013 Copyright Richard Moyer - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.