China-Vietnam Conflict in The South China Sea

Politics /

China US Conflict

Jun 05, 2014 - 10:20 AM GMT

By: EconMatters

China is on a roll upsetting neighbors from all directions in its aggressive stance towards territorial claims.

East China Sea

In the East China Sea, tension and hostility from the row with Japan over a group of uninhabited islands, (known as Diaoyu in China, Senkaku in Japan, Diaoyutai in Taiwan) has dialed up

- Last November, China created a new air-defense identification zone to include Diaoyu, and would require any aircraft in the zone to comply with rules set by Beijing.

- In May 2014, Tokyo reportedly is planning to set up 3 military outposts near the islands to boost Japan’s defense of ‘its outlying islands’.

- A close call to blows about two weeks ago when China scrambled four fighter jets to deter Japanese aircrafts in the disputed water where China just carried out joint maritime exercises with Russia.

South China Sea

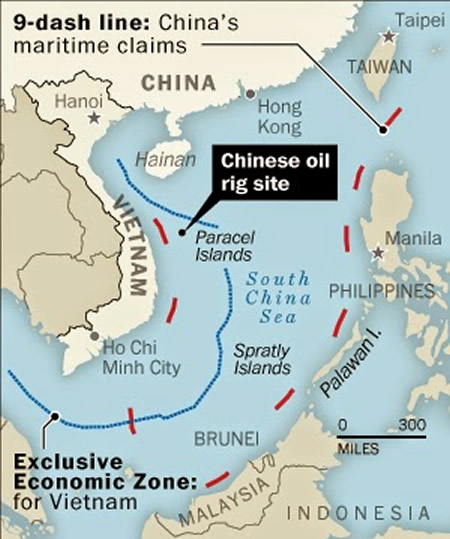

Tension has been rising in the South China Sea since May 1 after China’s state oil company CNOOC mobilized a deepwater semi-sub rig HD-981 drilling near the Paracel Islands (known to China and Taiwan as the Xisha Islands), close to the Vietnam coastline and also claimed by Vietnam. In response, Vietnam dispatched some 40-vessel coast guard fleet to the rig location, but only to be outgunned and outnumbered by China’s fleet of some 60 vessels (including Navy warships, and fishing boats) and fighter jets escorting the $1-billion rig. According to Vietnam, China has since upped the fleet around the rig to 90 vessels

That big oil rig has sparked anti-China protests and riots in Vietnam. China had to send ships to evacuate Chinese workers after some Chinese nationals were killed, and 400+ Chinese factories were burnt down during the riot.

Reportedly, China Oilfield Services Ltd., a unit of CNOOC operating the deep-water rig, already mobilized the rig last week about 20 nautical miles to the east, but drilling exploration was expected to continue until mid-August. Hanoi said the rig still remains in Vietnam's exclusive economic zone as defined by the United Nations. While the rig is still sitting right in Hanoi’s face, the latest drama came this Tuesday after

the two navies almost came to blows beyond water cannons.

Separately, China is also having disputes with the Philippines which claims part of the Spratly Islands in the region. Malaysia, Brunei and Taiwan all claiming parts of the South China Sea are also rejecting China’s claim.

China ‘9-dash Line’ for Decades

Citing 2,000 years of history where the Paracel (and Spratly island chains) were regarded as integral parts of the Chinese nation, China has for decades claimed a U-shaped ‘9-dash line’ of the South China Sea (see graph below). This is nothing new and has long been disputed and protested by the neighboring countries including Vietnam, Philippines, Malaysia, and Brunei. (Taiwan, which considers itself the only legitimate

democratic government of China, has a similar claim to Beijing’s.)

Potential Rich Oil and Gas Deposits

Everything got much more intense after it was discovered that the South China Sea (as well as the East China Sea) could have rich oil and gas deposits. This is part of the reason for the U.S. involvement and energy-hungry China flexing its new and improved maritime and economic muscle to assert and defend its claims and sovereign rights as perceived by Beijing.

U.S. Butting In

The U.S. even though officially indicated not taking a position on these territorial disputes, but as Obama re-pivots to Asia to counter-balance China’s increasing influence in the region, countries like Vietnam, Philippines and Japan are looking to the U.S. to essentially back them up when push comes to shove going against China.

To put it another way, when you look at the map comparing the size of Vietnam or even Japan, for example, to China, before even taking into account the respective GDP size, trade volume and relations, what do you think has bolstered the ‘confidence’ of Vietnam and Japan to confront China in such assertive manner, including allowing the anti-China riot to take place? Remember, Vietnam is a communist country similar to China in that public demonstration does not ever occur without official sanctions. The same behind-the-scene U.S. support is also evident in the case of the

China-Japan island row in the East China Sea.

China, Vietnam, Philippines in International Mediation

Vietnam is now preparing to sue China in an international court, while the Philippines say it will take China to a UN tribunal. Nevertheless, experts believe the attempts by Philippines and Vietnam to pursue China via international mediation would be futile as China would not be obliged to abide by the ruling.

U.S. Re-pivoting China To Russia

With the U.S. eager to demonstrate goodwill gesture and support to the region, the re-pivoting to Asia campaign by the U.S. is actually re-pivoting China towards Russia. China and Russia just completed a joint naval exercise last month where both Putin and Xi Jinping attended the opening ceremony. According to Taiwan media, as part of the exercise, China and Russia exchanged closely-guarded military and communication system intelligence which signals an unprecedented level of cooperation between the two. Furthermore, in exchange for signing the $400Bn and 30-year gas deal, China will be gaining some much needed invaluable top military technology know-how’s from Russia.

China Calling Obama’s Bluff

Territorial disputes (land or sea) among Asian countries are as old as history itself. Countries usually worked things out eventually or keep status quo. The situation in the East and South China Sea would not have escalated to the current state without U.S. trying to play all sides.

China is basically calling Obama’s bluff that the U.S. will not be able to walk the talk. Frankly, it’d be very imprudent of U.S. to really go against China by taking side in these regional squabbles and risks

China and Russia re-acquainting into BFFs again.

CNOOC Chairman Wang Yilin once said,

"Large-scale deep-water rigs are our mobile national territory and a strategic weapon".

So China is unlikely to show weakness losing face in front of the international community, while it is too late in the game for Vietnam or even the U.S. to back out of the situation, even if they want to. Since Vietnam spent $714 million last year on Russian military kit, it’d also be interesting to see Russia’s reaction to the new ties between Vietnam and U.S.

By EconMatters

http://www.econmatters.com/

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

China is on a roll upsetting neighbors from all directions in its aggressive stance towards territorial claims.

China is on a roll upsetting neighbors from all directions in its aggressive stance towards territorial claims.