Bonds Persist in Their Warning About the U.S. Economy

Interest-Rates / US Bonds Aug 15, 2014 - 11:27 PM GMTBy: Sy_Harding

Bonds do not like economic strength, but love economic weakness.

Bonds do not like economic strength, but love economic weakness.

It makes sense. In a strong economy there is upward pressure on interest rates, and therefore on bond yields. When bond yields go up, their prices go down.

In a weakening economy, there is downward pressure on interest rates as the Fed cuts rates to re-stimulate economic growth. When interest rates and bond yields go down, bond prices go up.

The Fed cut interest rates to record lows, near zero, in efforts to pull the economy out of the ‘Great Recession’, and along with other dramatic efforts, it worked.

However, the Fed has been of the opinion since December that the economy is now in a zone of sustained recovery. It is tapering back its bond-buying QE stimulus at an impressive pace, and already debating when it will begin raising interest rates to prevent the economy from overheating.

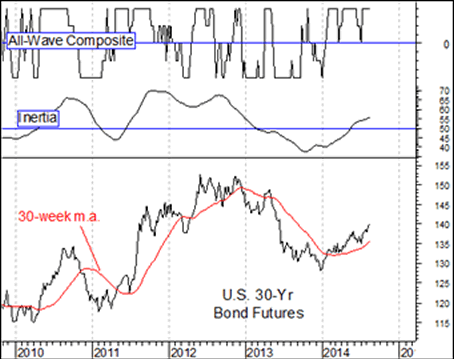

The bond market disagreed from the get go.

Although the consensus opinion was that bond prices would collapse as soon as the Fed began tapering back its monthly bond-purchases, bonds launched into a rally at year-end, the instant the Fed began to so do.

Bonds seemed to be onto something when it was subsequently reported that GDP growth had plunged into negative territory in the first quarter.

However, they continued to rally even after GDP growth recovered from its first quarter stumble. They continue to rally now even though the Federal Reserve assures us the first quarter was just a weather related glitch, and economic growth continues.

Unless the bond market’s ability to anticipate trouble has gone away, the bond market is still seeing the situation quite differently than the Fed.

It’s interesting that in a similar manner, bonds began rallying early in 2011, and we soon learned then that GDP growth had turned negative in the first quarter of 2011 (the last time it did so).

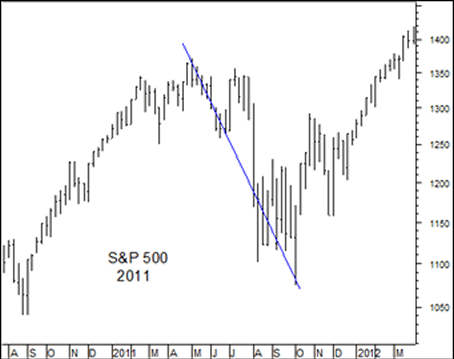

In 2011, bonds also continued to rally after GDP recovered in the second quarter, like now apparently still worried about the economy. The bond rally then spiked up sharply in 2011 when the stock market began to plunge on its own concerns about the economy. It was not until October that the bond rally paused, when the Fed, panicked by the stock market’s 19% decline, rushed in with promises of QE3 stimulus.

As in 2011, the bond market’s rally this year has continued even though the economy (GDP) recovered from its first quarter decline. By doing so, is it warning that the Fed is wrong this time too, that the economic recovery is not as sustainable as it seems and will need the Fed to bring QE stimulus back again?

If so, will the Fed repeat its 2011 lagging response by ignoring what the bond market and economic reports may be saying, and continue to taper back QE until the stock market scares it by plunging again?

The stock market is more overvalued than in 2011. And it has also gone for a similar unusual long time as in 2011 without even a normal 10% to 15% correction.

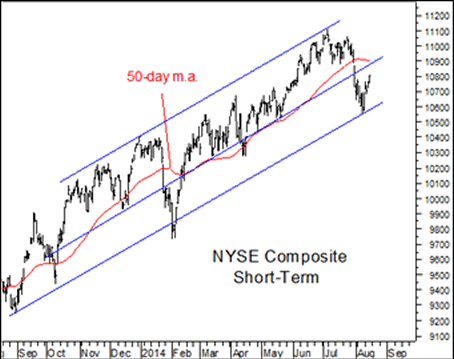

Its current pullback is only around 3% and it’s already trying to bounce off that.

But the continuing warning from bonds regarding the economy, and the deterioration of our technical indicators, do have our attention. So we shall see.

In the interest of full disclosure my subscribers and I still have a position in the iShares 20-year bond etf, symbol TLT, and initial downside positions on the stock market in inverse ETFs, ProShares Short Dow, symbol DOG, and ProShares Short Russell 2000, symbol RWM. We are watching our technical indicators for confirmation of a potential stock market top before adding to those initial positions.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.