Independent Scotland Currency, Plan A, B, C or D - British or Scottish Pound?

Currencies / Scotland Sep 02, 2014 - 09:03 AM GMTBy: Nadeem_Walayat

Alex Salmond recently repeated - "It's our pound and we're going to keep it."

Alex Salmond recently repeated - "It's our pound and we're going to keep it."

Much of the independence debate has centered around what currency an independant Scotland would use, where on one side we have the SNP implying that an independent Scotland would have the right to 'share' the British Pound in terms of the ability to print money and debt (government bonds), whilst on the other hand UK politicians state it would be impossible for two countries to share sovereignty over the same currency for the obvious reason that it would effectively allow an independant Scotland to go on debt fuelled spending binge without consequence of hyperinflation or currency collapse as the bill would be being picked by the UK tax payer as guarantor of the currency. Which is particularly galling as an independent Scotland would no longer be paying any taxes to the UK Treasury.

The effect of Scotland going on a sterling debt fuelled deficit spending binge on the back of UK tax payers would be erode the purchasing power of the the British Pound over several years that would manifest itself in the ratcheting higher of inflation as the British Pound spirals lower against all other major currencies.

George Osbourne's (Conservative) "I could not as Chancellor recommend that we could share the pound with an Independent Scotland, it wouldn't work, it would cost jobs, and cost money, and it wouldn't provide economic security for Scotland or the rest of the United Kingdom, I don't think any other Chancellor would come to a different view"

Edd Balls (Labour) "Scotland cannot keep the pound and the Bank of England if it chooses independence. It would be bad for Scotland, it would place an unacceptable burden on the UK tax payer, it would repeat the mistakes of the Euro area, in fact worse, you would be trying to negotiate a monetary union as Scotland is pulling away from the UK."

Danny Alexander (Lib Dems) "It is clear to me that a currency union wouldn't work for Scotland if it was Independent, and wouldn't work with the rest of europe".

Sir Nicholas Mcpherson (UK Treasury) " And so to sum up, I would advise you against entering into a currency union with an Independent Scotland. There is no evidence that adequate proposals or policy changes to enable the formation of a currency union could be devised, agreed and implemented by both governments in the foreseeable future".

The ONLY way a currency union with Britain would work is if Scotland gave up sovereignty over many aspects of governance such as in the setting interest rates and taxes, keeping to government spending limits and on debt issuance, in fact place itself in a position that is under far greater direct control from West Minister than Scotland is today under Devolution but all without political union! i.e. no representation in West Minister.

The bottom line is that the likes of Alex Salmond can continue to scream as loud as he want about having the right to share the pound, for the facts are that pushing this agenda to its ultimate limit conclusion would result in a UK referendum on whether a foreign nation should be allowed to share the British Pound and associated institutions such as the Bank of England to which the UK people would overwhelmingly vote NO!

So what Currency options are available to an Independant Scotland ?

A. Sterlinglisation - Continue to use the British Pound Without PermissionAs ever politicians lies tend to be cloaked in half truths such as the fact that an Independant Scotland (I.S.) WOULD be able to continue to use the British Pound in day to day transactions, much as an I.S. would be able to use ANY currency, i.e. U.S. Dollars, Euros or even the Zimbabwean Dollar if it so wished to, but critically this would be without any say in monetary policy. i.e. an I.S. would NOT be able to print debt or money denominated in sterling but would be able to borrow British Pounds in exchange for collateral (scottish assets).

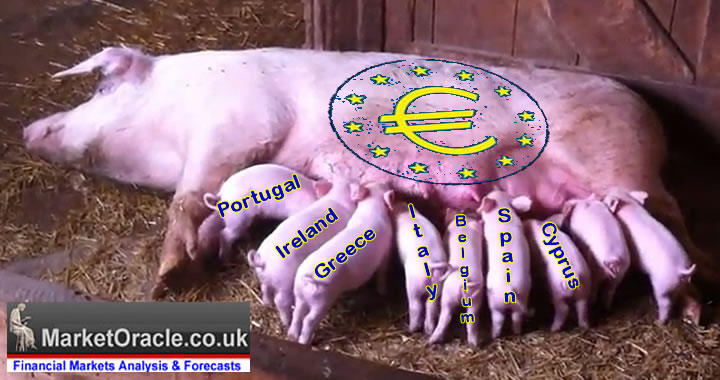

However as we still see to this very day with the Euro-zone that such arrangements just do not work for without the ability to print money there needs to be a mechanism for INTERNAL TRANSFER payments to offset differences in productivity as effectively Scotland would be subject to UK monetary policy WITHOUT transfer payments. Whilst this takes place to the tune of £10 billion a year today as the price England pays to keep Scotland within the UK, however following independence such transfer payments would END, and Scotland would soon enter into an economic death spiral as the exchange rate would not reflect the needs of the Scottish economy. This would take place without the likes of the ECB central bank stepping in to keep bailing Scotland out by buying Scottish debt without which within a matter of months Scotland would go bankrupt just as many euro-zone countries have such as the PIIGS before the ECB and Germany stepped in to bankroll them in perpetuity by buying their debt.

Another consequences of Sterlinglisation is the fact that whilst Scotland used the British Pound, the Bank of England would not be standing behind its banking sector as the lender of last resort which means Scotland's large financial sector would be deemed to be far more riskier to do business with and thus greatly diminish in size within a relatively short period of time to more closely match the actual size of the Scottish economy. Similarly many large companies for the sake of financial credibility would seek to relocate their headquarters to within the UK and under its regulation.

Therefore Sterlinglisation would not work as the Bank of England's focus would be on what actions are in the best interests of the UK without any regard to the impact on Scotland i.e. a strong UK economy may require higher interest rates to cool an economic boom which would be crippling for a weaker Scottish economy that may already be in recession.

B. Join the Euro?

Given the disaster that the euro-zone has been for most of its member nations that remain immersed in an economic depression, such a decision is going to go down like a led balloon with the Scottish electorate.

The problem here again is one of TIME, as it could take Scotland as long as 10 years to meet the requirements of first EU membership and then euro-zone membership.

Off course this begs the question as to what is Scottish Independence for if it just goes from being an over weight partner in a 4 state union to a tiny member state in a 28 nation union.

C. Scottish Pound?

Scotland could also as the nationalists suggest just print its own currency, perhaps to be called the Scottish Pound but that would take many years to achieve which would be followed by much volatility in the price of the NEW currency that I expect would be just as volatile as the oil price tends to be as Scotland's oil reserves are what will deem to ultimately back the currency that would play havoc with with the Scottish economy and price stability when the Inflation rate could annually oscillate between 0% and +30% per year! With probability favouring a higher inflation rate given the in-bred tendency for socialist deficit government spending that can only be covered by printing money and debt.

Unfortunately Scotland printing its own currency is going to learn a very painful lesson which is that to all intents and purposes it will be backed by nothing and therefore deemed as being near worthless, so Scotland would be lucky if its annual inflation rate stayed below 30% as I suspect it would eventually experience its own Weimar moment.

Also Scotland having its own currency would still only be a longer term objective that means for at least a couple of years Scotland would still be without a currency which is more than enough time to wreck the Scottish economy.

And once Scotland has its very own currency then what happens to trade with its largest trading partner the UK? Trading with the UK would become no different than trading with the euro-zone with every transaction or business deal no matter the size incurring a currency conversion fee of as much as £1billion per year that will inflate prices. So yes this will benefit the banks but it will become a permanent drain on the Scottish economy that will act to prohibit cross border trade.

Plan D

A mixture of Plan A and Plan C, namely printing a Scottish currency that is officially pegged to Sterling. Which unfortunately as previous currency pegs such as the ERM have revealed will NOT work as speculators would soon act on the differences between the two economies to allow for a huge profit opportunities that would soon bleed an newly independent Scotland's reserves dry and break the currency peg probably within just a matter of weeks of its implementation.

In fact the only way a peg could work for any significant length of time would be if it were backed by the Bank of England! As only the Bank of England would be able to BUY Scottish Pounds for British Pounds without the consequences of exhausting its reserves as it can just print as much British pounds as it needs to maintain a Peg with the new Scottish Pound, though it will never do this because again it would mean that the UK would be picking up the tab for Scottish socialist deficit spending.

Still if an Independant Scotland were to go down this route then effectively to maintain the peg most of Scotland's major monetary policy decisions such as setting interests would be dictated by what the Bank of England was doing.

The bottom line is that an Independant Scotland would be without a currency, with the only via option available to unofficially use the British Pound (Sterlinglisation), all without any backing of the Bank of England behind which stands the UK tax payer. The result would be that Scotland's financial industry would within a matter of months migrate South of the border as the most important requirement for banking and finance is confidence that requires the backing of the state, something that small Scotland without even its own currency would not be able to do given the relatively large size of its financial sector.

So unfortunately, an Independant Scotland would soon find itself on the path towards bankruptcy Iceland style as its banking sector disappears, and all we will see is UK foreign correspondents reporting from Holyrood showing Alex Salmond in a state of denial making delusional statements about Scotland's oil reserves that in large part will remain under the ocean for many decades.

However, in all probability the people of Scotland will vote to remain a part of the UK as most Scots realise the extent to which they are subsidised by England for being within the UK as voting YES would be tantamount to committing financial and economic suicide.

Source and comments: http://www.marketoracle.co.uk/Article47155.html

By Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.