Palladium Hitting New Highs While Gold and Silver Test Lows

Commodities / Palladium Sep 06, 2014 - 01:19 PM GMTBy: Jeb_Handwerger

Summary

Summary

- Gold, Silver and the junior miners are undervalued hitting three year lows.

- US dollar, stocks, bonds and equities hitting major highs trading at high valuations as a supposed safe haven.

- Beware of Black Swan events which come out of nowhere. This could cause capital to flow out of equities into hard assets.

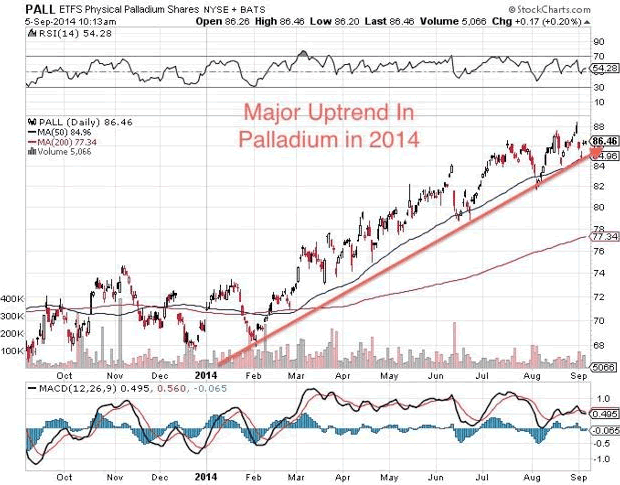

- Palladium is in a major uptrend in 2014, outperforming all the precious metals.

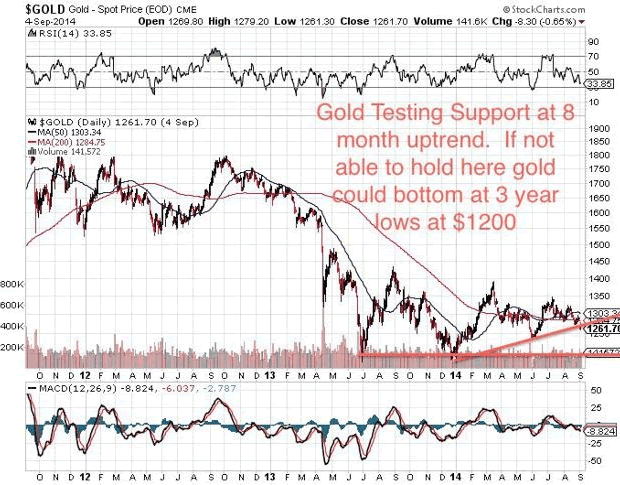

There is no doubt gold is undervalued and stocks, the US dollar and bonds are way overbought. Globally, investors are flocking to the supposed safety and stability of the US despite rising deficits which are continuing to soar amidst the threat of instability in Asia, Europe and the Middle East. Beware of black swan events and look to protect your assets with positions in gold, silver and the junior miners at near three-year lows.

Despite the global quantitative easing which sent stocks, bonds and real estate soaring, gold (GLD), silver (NYSEARCA:SLV) and the junior miners (NYSEARCA:GDXJ) are now trading below both the three-year and five-year moving averages. That's very rare. The last time we saw the gold price move below the long-term moving averages was more than 15 years ago in the 1999-2001 bear market. This set the stage for the historic bull market from 2001 to 2007. The Philadelphia Gold and Silver Index rallied more than five times from a low in the mid 40s to over 200.

If you can get gold at a discount to its long-term moving averages, then it's a great buying opportunity. The greatest leverage may be in the junior gold miners. The larger miners (NYSEARCA:GDX) are usually closely correlated to gold, but the smaller miners could generate outsized gains to bullion in the next bull market. For instance, in the 2008-2009 correction we saw the Philadelphia Gold and Silver Index decline from 200 to below 80-more than a 50% decline-even though gold only corrected from $1,000 per ounce ($1,000/oz) to $700/oz.

Now we're seeing higher lows in the $1,200/oz range and the Philadelphia Gold and Silver Index is trading around $100. If gold moves up even $50 or $100/oz, the miners and the index could have much larger percentage gains, so the leverage opportunity is really in the miners. The miners outperformed gold by a wide margin from 2000-2008.

If you're unable to beat the Market Vectors Gold Miners ETF and the Market Vectors Junior Gold Miners ETF, then buy them directly. I try to do my homework and find the smaller junior companies that outperform the large producers and their junior peers. If you find companies that are leading both in fundamentals and technical data, you have a good chance of beating the indexes.

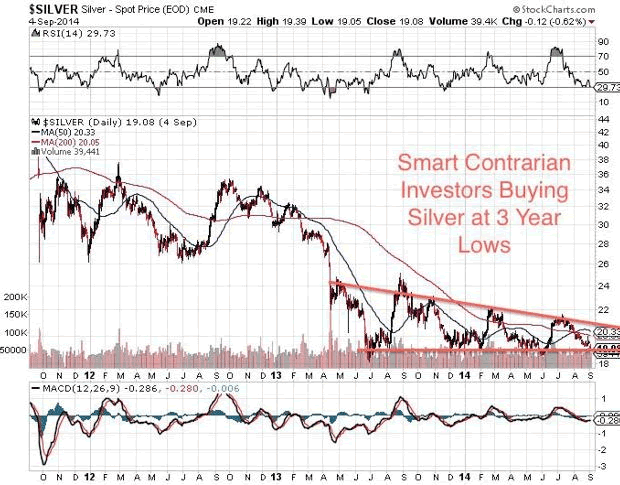

The long-term charts for silver and the Philadelphia Gold and Silver Index are closely correlated and leading indicators to gold; silver and the miners (NYSEARCA:SIL) will usually top a few months ahead. They were also the strongest gainers after the 2008 crash. Silver has pulled back to lows and the major breakout point from back in 2011 when quantitative easing was announced and silver ran close to $50/oz. Now that it has pulled back to that breakout point again, silver should reverse higher provide leverage and outside gains to gold.

Positions in platinum group metals should be increased. In 2012, I became bullish on platinum (NYSEARCA:PTM) and palladium (NYSEARCA:PALL) because both were trading at a discount to gold. Palladium is now breaking out and in a major uptrend on concerns about supply from South Africa and Russia, while industrial and investment demands are increasing.

There are very few platinum group metal major assets. Investors should check out the juniors with advanced platinum group metals resources in North America.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Disclosure: Author owns no stocks mentioned.

© 2014 Copyright Jeb Handwerger - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.