Could Tesco Go Bust? How to Save Tesco from Debt Bankruptcy Risk

Companies / Corporate News Oct 27, 2014 - 01:55 PM GMTBy: Nadeem_Walayat

Unbeknown to most of Tesco's remaining customers as they continue their weekly shops at its well stocked mega-stores across Britain is that Tesco is not just at the edge of a cliff but has actually fallen off it and is in a state of free fall. So whilst customers may soon start to look forward to splurging on their Christmas shopping which undoubtedly will buy the likes of Tesco time during a period when the stock price could hit bottom and bounce. However, as experienced investors well understand that which is termed a 'dead cat bounce', as literally even a cat thrown off a cliff will eventually hit bottom and bounce and so that will likely be the experience for Tesco investors over the coming months as they mistakenly assume a rallying stock price is a sign of recovery.

Unbeknown to most of Tesco's remaining customers as they continue their weekly shops at its well stocked mega-stores across Britain is that Tesco is not just at the edge of a cliff but has actually fallen off it and is in a state of free fall. So whilst customers may soon start to look forward to splurging on their Christmas shopping which undoubtedly will buy the likes of Tesco time during a period when the stock price could hit bottom and bounce. However, as experienced investors well understand that which is termed a 'dead cat bounce', as literally even a cat thrown off a cliff will eventually hit bottom and bounce and so that will likely be the experience for Tesco investors over the coming months as they mistakenly assume a rallying stock price is a sign of recovery.

Shoppers Hate Being Ripped Off

The psychology that drives bull and bear markets in for instance housing and stocks is the same driver for consumers, for at one time literally EVERYONE wanted to shop at Tesco's, then comes a time when NO one wants to shop at Tesco's, and even those who continue to do so no longer find it an enjoyable experience as they wonder how much financially better off they would be if they were shopping at the likes of Aldi or Lidl instead. So there is financial pain associated with shopping at Tesco, just is there is pain associated with holding a depreciating asset during a bear market, as shopping at Tesco's today is perceived in terms of rather than saving the shopper money, instead of how much is the customer over paying by, 20%? 30%?, and that is where Tesco's problem lies today and why its stores can be literally empty.

Why Tesco Could Go Bust

The expected Tesco dead cat bounce for tesco's stock price may not even make into end of the year as horrendous shopping numbers start to come through by the end of December signaling Tesco's free fall towards inevitable losses had resumed that risks shaking the very fabric of Britain's supermarket culture that could result in what to many is the unthinkable that a giant such as Tesco could literally disappear over night! If you think it's impossible then maybe that's what many thought of phones4u with its 550 stores before it went bust in September, with Comet and Woolworth's before it, though some such as TJ Hughes manage to return after bankruptcy.

The reason why Tesco actually could go bust is the same reason that any entity right from an individuals to small companies to mega corporations such a Tesco or every whole nations can go bust such as the recent examples of Iceland, Greece, Cyprus illustrate which is DEBT.

To illustrate the magnitude of the crisis that Tesco faces is that a year ago when I first started to literally warn of Tesco's probable demise Tesco was worth approx £30 billion against debt and liabilities of approx £12 billion, against today Tesco is barely worth £13 billion with debt and liabilities of approx £15 billion (debt+pensions hole). The other critical factor in Tesco's debt crisis is what has happened to Tesco's profits, a couple of years ago Tesco was reporting profits of £4 billion, which was ample enough to service its debt mountain and waste on junk such as private jets for CEO's, but today that profit has been wiped out to just £112mln, and remains in a steep decline which implies LOSSES are around the corner, and when companies make losses DEBTS tend to EXPLODE higher, for it means the company needs to borrow money just to stay alive as it is unable to cover day to day activities such as paying suppliers and workers and of course debt interest of £500mln a year. What this does is to result in a quantum shift in debt vs assets in a relatively short period of time which tends to result in bankruptcy as no one is going to lend more money to a company with a ballooning debt mountain that it will increasingly be unable to service (interest payments) let alone actually repay.

And as I have warned several times over recent months, the crunch point for Tesco is likely to come early in the new year when Tesco could implode in spectacular style, literally close its doors over night, not even giving customers a chance to benefit from of a closing down sale.

What Tesco Urgently Needs to do

What Tesco needs to do is to remember they are a MARKET for goods and realise that they have fallen for the SAME mistake that ALL mega-corporations tend to make which is one of OVER SUPPLY at TOO HIGH PRICES in the face of demand that has evaporated as a consequence of being under cut by competitors with far lower cost overheads towards which Tesco's supposedly loyal customers have fled.

If I were running Tesco's this is what I would do -

Unfortunately Tesco has left it a little late to do what I would really have done which is to deeply cut prices and put the discounters out of business then buy their stores at rock bottom prices. So instead this is what I would do given today's sorry state -

Firstly, I would reorganise all of the stores along the lines of the discount retailers i.e. fewer staff, shorter opening times, and far less frills such as the club card nonsense.

Secondly, I would ONLY stock those goods that are actually in demand AND carried a hefty profit margin that were able to cover costs, so the quantity of goods offered would be greatly reduced by as much as 80% in favour of what is actually in demand at a profit.

Thirdly, I would soon seek to mothball ALL stores that were not able to operate at a profit.

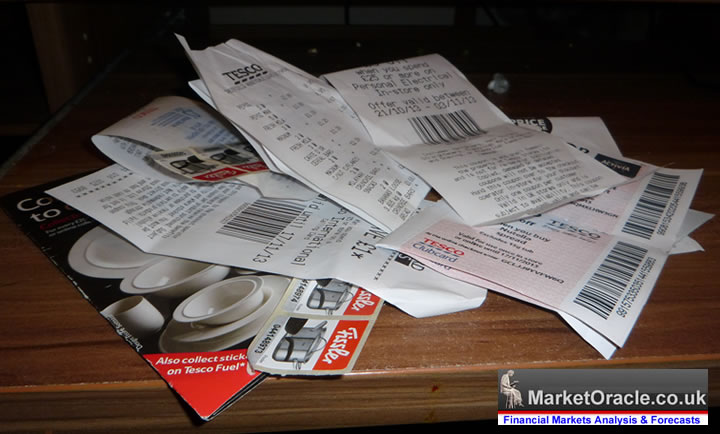

Fourthly, I would either do away with the club cards points system or greatly stream line it, no more wasting countless millions sending out near worthless voucher books that waste time at checkouts and most of which eventually get binned by customers. They only work in the fantasy land of head office, the staff and customers don't like the voucher books ! Better would be an automatic 2% or 3% off the next shop as an encouragement to return.

Fifthly, I would sell off assets abroad such as asia which could be utilised to pay down Tesco's debt mountain before it starts to explode exponentially.

Sixthly, I would go to the shareholders with a plan to reduce the debt mountain, but this can only work IF the earlier measures had been able to bring a halt to Tesco's profits slide.

Unfortunately, I doubt that Tesco's bloated over educated under real world experienced management are competent enough to do what needs to be done who rather than take action may just hope things turn around whilst they play with their spreadsheets producing fancy graphs based on bogus figures, therefore it may already be too late to save Tesco from going bust. Though most probably Tesco is probably now ripe for a hostile takeover as breakup could yield a return of at least £5 billion over total debt and liabilities.

At the end of the day, the likes of Tesco killed off much of Britians high streets and given the law of supply and demand Tesco itself being killed off by the discount retailers today, many of whom will in turn be killed off when customers start to realise the amount of chemical crap that goes into their food products!

The bottom line is it is not too late to save Tesco if urgent action is taken as indicated above. But the Tesco that emerges will not be the same, much leaner and meaner.

More on Tesco's death spiral -

24 Oct 2014 - Tesco Meltdown Debt Default Risk Could Trigger a Financial Crisis in Early 2015

18 Oct 2014 - Tesco Supermarket Crisis Worse To Come as Customers Vanish!

22 Sep 2014 - Tesco Super Market Giant Fast Disappearing Down a Financial Black Hole

31 Aug 2014 - Tesco Supermarket Death Spiral Latest Profits Warning and Dividend Slashed

24 Jul 2014 - Tesco Supermarket Death Spiral Accelerates as Customers HATE the Mega Brand

18 Apr 2014 - Tesco Profits Panic! Back to Back £5 Off £40 Shop Voucher Promotions

24 Oct 2013 - Tesco Bubble Bursts - Profits Crash As Big Spending Customers Quit Shopping on Poor Service

By Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.