U.S. Dollar Long/Short Position

Currencies / US Dollar Dec 11, 2014 - 03:13 PM GMT In the context of the gold price, many relate the net long/short position in the US.$ as an influence on the gold price. To a small extent this may be true, but not, in our opinion, to an extent that actually affects the gold price.

In the context of the gold price, many relate the net long/short position in the US.$ as an influence on the gold price. To a small extent this may be true, but not, in our opinion, to an extent that actually affects the gold price.

Normal use

A short/long position on COMEX for instance can be used in a multitude of major and minor transactions to hedge the original $ positions so as to remove the risk of an exchange rate change a policy that has nothing to do with the future exchange rate of the dollar against any currency or against the move of gold against the dollar. A much smaller but considerably more active market is that involving speculators and traders who do view the potential for a change in the exchange rate of the dollar against any currency. It is this market that influences day-to-day prices, but not in a way that commentators often think. COMEX is a financial market where as much as 95% of all contracts are closed out before the contract matures.

Turning to the real net long/short positions in the dollar, this number includes all those where delivery will not take place as well as those that do. This muddies the water somewhat and reduce this figure to one defining expectations, not necessarily realities.

Change in expectations?

The section of this market defined as the Commercial positions reflect those positions that are conducted by the more savvy professional investors. As the dollar turned higher in recent weeks, these investors closed more and more short positions that would have cost them dearly as the dollar rose against all currencies. The expectations were that the dollar was set to rise and continue to rise, justifying long positions, not short, in the dollar.

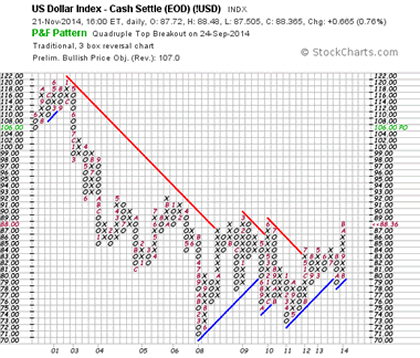

As you can see in the chart here the dollar's future according to the Technical picture is for it to rise by another 20% against all currencies. But it must be said that this figure is a 'target' and often not a future reality. Even the Fed has made it clear it does not want to see a stronger dollar, as this will damage its exports and increase imports, hurting the recovery in the U.S. We believe they are already taking action to hold the dollar back.

As deflationary expectations have risen worldwide, for the last six months, alongside a rising equity market, we have seen a switch from overseas investments to dollar assets by the 'carry trade' [borrowing in dollars to lend in other countries] as they closed their positions. The rising dollar index has shown this. Gold has been made to fall back to its lows as a result until now.

It's an expression of fear, not of hope when this happens, because of the rising expectation of deflation prompting a turning to 'safe' positions in the most liquid and strong currencies. Treasuries and cash are believed to be the safest of places when market falls are expected.

It may be there will be a major sell-off in Treasuries when interest rates start to rise and bond prices respond by falling. Then cash in dollars becomes the only currency haven in most investor's minds.

For gold too?

It is a matter of history that U.S. investors/traders/speculators take long positions in the U.S. dollar and may well either stay out of gold and the euro, or short them both. This ignores gold's fundamentals which show Asia and the Middle East absorbing around 80%± of the world's gold supplies annually and have considerably reduced western market liquidity in gold, a factor that may well leave Asia in control of future pricing. It is a surprise that this physical dominance of the gold market by Asia has not already translated into Asia's control of the gold price. [That time is coming fast as gold liquidity has reduced to critical levels in the developed world - It may be here already]

But until that happens developed world markets will exert this 'strong dollar - weak gold' positioning. As the dollar turned up, there was a global rush into U.S. treasuries and into the U.S. dollar.

Until August, the largest of the largest traders of gold and silver futures continued to report very low net short positions, right near the lowest net short positions they have had in years. The expectations are therefore that the dollar has peaked and will either consolidate around these levels [with the help of the Fed and Germany] or will fall. But from August until now short positions in gold doubled until this last week when they were hastily reduced as the gold price leapt from $1,141 to $1,218 and after a consolidation from $1,200 and the current rise to $1,230.

Following this traditional relationship, it is likely that developed world investors will go long of gold as the dollar retreats. Why has this change happened now?

The dramatic fall in the oil price has also led to a vast quantity of U.S. dollars not being used now and will return back to the U.S. This will have a heavy affect. If the fear persists and deflation becomes the new global reality, then the dollar as a national currency, faced by an expanding Yuan, loses a great deal of its appeal and gold, the non-national currency, takes on a far greater sheen. As it is still close to its low, since 2009, it becomes an even more attractive haven.

It may be that we are seeing this turn right now.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2014 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.