The Commodities Market Is Not Dying, It’s Just Hibernating

Commodities / Commodities Trading Dec 19, 2014 - 08:54 AM GMTBy: Submissions

Nicholas Maithya writes:

The price of Gold plunged massively in 2014, especially during the second half of the year and based on the current market sentiment, there are fears that things could get worse over the next few quarters. Other popular commodities like Silver and Oil also followed the same trajectory, with Oil in particular trading at some of the lowest levels in recent history. The various ETFs associated with these assets have also followed the same trend as investors continue to shift investments to the equities market.

Nicholas Maithya writes:

The price of Gold plunged massively in 2014, especially during the second half of the year and based on the current market sentiment, there are fears that things could get worse over the next few quarters. Other popular commodities like Silver and Oil also followed the same trajectory, with Oil in particular trading at some of the lowest levels in recent history. The various ETFs associated with these assets have also followed the same trend as investors continue to shift investments to the equities market.

The price of gold recently touched new lows of $1,145, a level last reached in April 2010, when the yellow metal trended upwards to reach highs of $1,873, one and a half years later. The price of the precious commodity has recently recovered from the $1,145 level reached on Nov 5, 2014 to trade within a few dollars of the $1,200 benchmark level.

Chart Source: anyoption.com

However, some believe that gold prices could still fall further towards the $1,100 level, within the next few months, while recent World Bank report suggests that the price could moderate at $1,240 over the next twelve months.

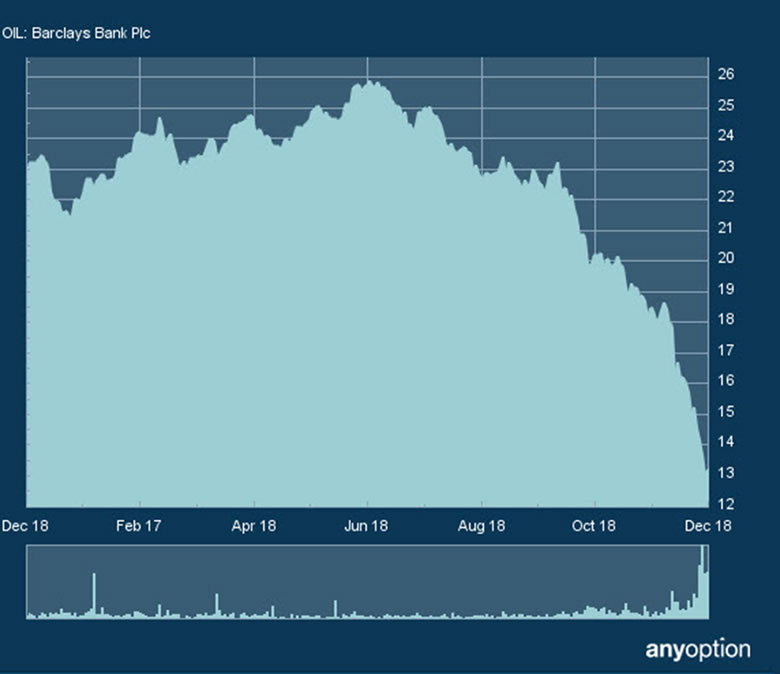

The price of Crude oil hit new multi-year lows of $53.60 per barrel on Dec 16, 2014 (lowest level since May 2009), and analysts are already predicting that the price could fall below the $50 level in the near future. Brent too is not far off these levels, having traded below the $59 level per barrel recently, but is now at the $62 level. Crude on the other hand has recovered to top the $56 level per barrel.

Chart Source: anyoption.com

It is worth noting that Crude did trade upwards of $107 early in 2014, but now reaching that price level again looks like a pipedream. The recent fallout of the OPEC, which more or less acts as a cartel for oil, did not help the situation, either.

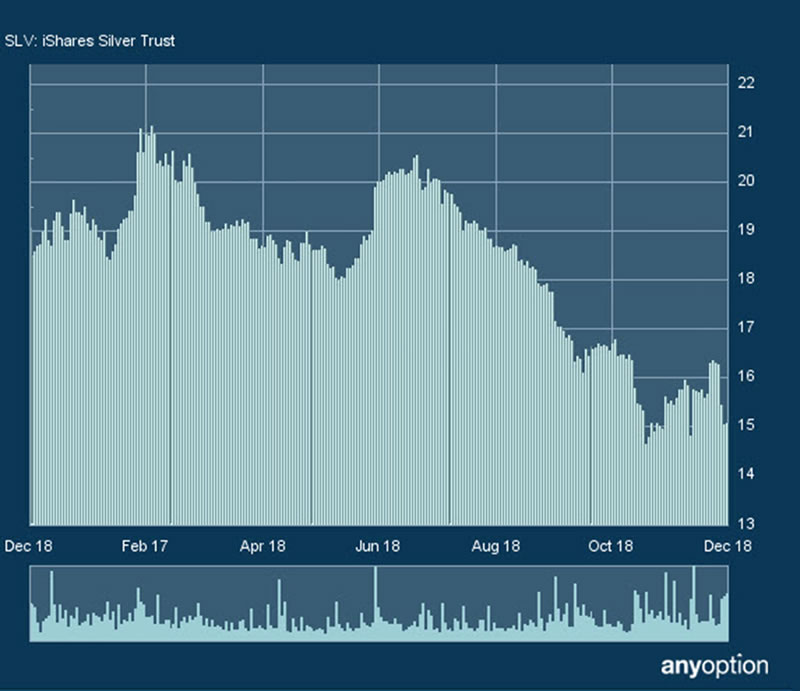

The price of Silver on the other hand has plunged from a high of $1,548.88 per Kg, or $48.58 per ounce reached in April 2011, to a low of $510.91 per Kg or $15.87, as of Dec 17, 2014. This again illustrates the massive plunge in the overall commodity prices, which many believe is due to the weakening demand coupled by a strengthening U.S Dollar and a U.S economy that appears to be on the right track in terms of recovery.

Chart Source: anyoption.com

Is the commodity market dying?

Now, don’t get me wrong. That is not what I am trying to literally imply, but according to some people the commodities market is about to experience one of the worst declines in history. In fairness, I believe that whatever we are seeing now already qualifies to be one of the worst declines. However, the implication that this decline could continue over the next few quarters or even years as some are suggesting, is the notion that I do not resonate with.

To begin, if the current decline in the commodity prices continued over the next 2-3 quarters, then this would send a signal of a possible global financial crises. After all, Mohamed El-Erian, one of the most seasoned investors pointed that the current commodity price declines could be a useful signal to equity investors with regard to market direction.

There are reasons why I believe that next year could set up a contrary picture to what many are predicting and the commodities market could strike back with a bang. The U.S market along with a slowing Chinese economy has played a crucial role in the fall in commodity prices.

The U.S economic recovery has played to the advantage of the U.S dollar the principle currency denomination for trading oil, gold and silver. The net effect of a strong USD against major currencies is a decline in commodity prices, especially oil, gold and silver. The musings of a possible uptick in U.S interest rates has also played a major role in fueling the demand for the green buck.

However, there is a high possibility that there could be a delay in raising U.S base interest rates. This because the Federal Reserve would need to be sure that an increase in interest rates would not harm the current economic recovery.

However, such a decision would cause anxiety in the market thereby, pushing investors towards the commodity markets, which have often proven to be a valuable haven during financial crises. There are already fears that the current U.S economy may not be reflecting the true status of affairs regardless of the impressive Jobs Data and economic growth rates.

Therefore, an uptick in interest rates could also slow consumer spending, as people remain cautious thereby affecting economic growth.

On the other hand, reports suggest that the likes of China and India continue to ramp up demand for various commodities, especially gold bullion, while the recent plunge in oil prices could result in increased demand. Oil does not expire and many will be looking to revamp their pipelines, while others airline companies enter into compelling commodity swaps with a view of cutting energy costs.

Conclusion

The bottom line is that the current picture painted by the global commodity prices could be one of the best opportunities for buying long, assets such as gold, silver and oil. Either way, after a plunge, a rebound is always imminent, and there is no reason why this time it would be different. Therefore, the commodities market is not dead, it is just hibernating and next year could be huge for the bulls.

By Nicholas Maithya

Copyright © 2014 Nicholas Maithya - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.