Falling Oil Prices and Gold Market

Commodities / Commodities Trading Jan 06, 2015 - 03:05 PM GMTBy: Arkadiusz_Sieron

In the last Market Overview we pointed out some signals indicating that recession may be on the U.S. horizon. There is no doubt that a possible outbreak of the crisis would have important implications for the whole global economy, including of course the gold market. Therefore, it is extremely important to analyze gold performance through business cycle.

In the last Market Overview we pointed out some signals indicating that recession may be on the U.S. horizon. There is no doubt that a possible outbreak of the crisis would have important implications for the whole global economy, including of course the gold market. Therefore, it is extremely important to analyze gold performance through business cycle.

Although gold is generally considered as a safe haven, which behaves in an anti-cyclical way, some analysts argue that yellow metal is rather pro-cyclical gaining during commodity booms fueled by easy money. And others say that the business cycle has limited predictive power for gold price fluctuations. What is the truth? In this edition of Market Overview we try to clarify views about the behavior of gold prices in business cycles and during emerging markets crisis.

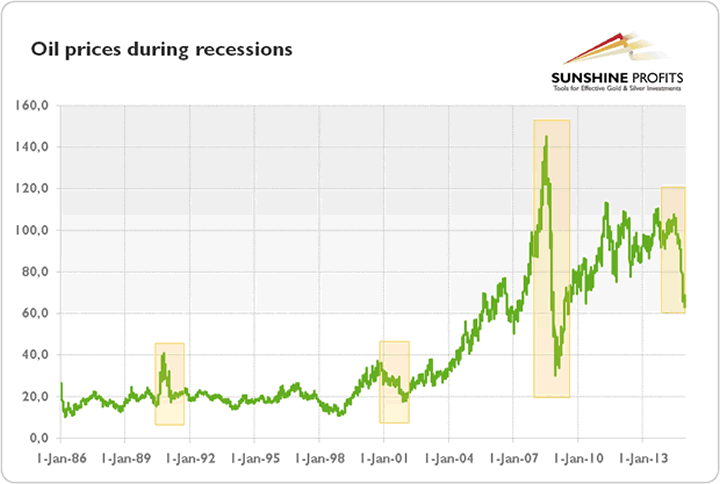

But first let's analyze what the recent falling oil prices mean for the U.S. economy and gold market. In the last Market Overview we claimed that we had witnessed the burst of the oil boom. Given the great interest of investors in this subject, it is worth developing our point of view a little. Let's examine the first chart showing the price of oil over the few last decades. It shows something very interesting.

Graph 1: WTI crude oil prices from 1986 to 2014

In general, oil prices rise in a boom and fall during the bust (it cannot be seen in this graph, but we can add that the price of oil was very stable until 1971, when the gold standard was finally abandoned; therefore the dramatic instability in this market is a feature of the current fiat paper dollar monetary system). Why does the price of oil decline during recessions (indicated by the rectangles, except the last one)? Undoubtedly, there are many determinants of oil prices, like the performance of the U.S. dollar or supply conditions (U.S. field production of crude oil is up more than 50 percent since late 2010), however there is a very interesting link between central banks' meddling with the economy and price of oil. In short, expansionary monetary policy induces entrepreneurs to start new businesses and projects, which stimulates demand for all raw materials, including oil. Given the relative inelastic supply, higher demand translates to higher prices. Since rising oil prices indicate expanding economic activity and increased demand, lower oil prices can be a signal that entrepreneurs are contracting their operations and thus demanding less oil.

In other words, ultra-low interest rates and quantitative easing programs led to the rise in private investments, often very-energy dependent, stimulating demand for oil. Additionally, some investors were buying oil as a hard asset and a hedge against expansionary monetary policy and possible inflation, so oil prices were pushed sky high. Therefore, the decelerating pace of U.S. money supply expansion reduced investment funds available to entrepreneurs for purchasing resources, including oil, to carry out their plans. Moreover, the end of QE3 and some tightening of U.S. monetary policy, at least compared to Japan and Europe, caused the strengthening of the greenback. The U.S. dollar moves generally inversely with oil, so its recent rally was one of the reasons why the price of crude oil plunged. A concurrent drop in prices of many different commodities (e.g., cotton, gold, soybeans and sugar) shows that the fall in crude oil prices is not merely due to Saudi Arabian strategic decisions or development in U.S. production and that Fed's monetary policy really counts.

Ok, we already know the reasons behind the drop in oil prices, but what are the possible consequences for the economy and gold market? We would like to point out here a few, the most important, things. Undoubtedly, lower oil prices are good news for consumers and many entrepreneurs, especially for energy-intensive manufacturers. On the other side, the collapse in oil prices threatens certain high-cost producers, in particular the shale oil industry. There are many premises that the development of this oil extraction sector was another bubble, driven by high oil prices and cheap credit, available again thanks to expansive Fed's monetary policy with ultra-low interest rates. That easy money was then used to finance the shale producers' drilling activities.

And why this is so important? First, according to a Bank of America Merrill Lynch Research report roughly 15% of the high yield bond market resides in the energy sector (and another 23% in the banking sector which is also exposed in the energy sector). This means that low oil prices for a sustained period can trigger significant debt default and bankruptcy issues. According to a Deutsche Bank analysis, a drop in WTI to $60 (currently, i.e., December 16, 2014, WTI crude oil is traded at around $55) is likely to push energy companies with riskier credit profiles to a level that would imply a 30% default rate and trigger a broader high-yield bond market default cycle.

Second, further U.S. GDP growth is at risk. It is of course difficult to precisely assess the overall impact of lower oil prices on economic growth, however it is worth pointing out that the states driving GDP growth in the USA right now are oil states, such as Texas, Colorado, and North Dakota. This may indicate that much of current U.S. economic growth depends on the oil extraction business (even if oil and gas capex represents about only 1% of US GDP), not to mention the stock market. The energy sector is responsible for a third of S&P500 capex.

In the last FOMC's statement, the Committee said that it can be patient in beginning to normalize the stance of monetary policy and the start of hiking interest rates will depend on the strength of U.S. economic data. Taken all these facts under consideration, it is not difficult to imagine that Fed returns to the QE program to boost GDP or the stock market, which would be positive for the gold market.

We focus on the macroeconomics and fundamental side in our monthly Market Overview reports; however we provide also Gold & Silver Trading Alerts for traders interested more in the short-term prospects. We invite you to stay up-to-date and sign up for our mailing list. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.