Crude Oil Prices vs the Power of Personality

Commodities / Crude Oil Jun 07, 2008 - 01:58 AM GMTBy: Mike_Shedlock

Shura member calls for oil production curbs in Saudi Arabia .

Shura member calls for oil production curbs in Saudi Arabia .

Saudi Arabia's Shura council (parliament) will hold a series of meetings over the next two weeks to discuss a controversial proposal by a key member to curb oil production to save reserves for better prices, Saudi media reported. The council will listen to a report by deputy chairman of the Shura water and public utilities committee, Salim bin Rashid Al Marri, who will argue for cutting crude supplies to maintain the Kingdom's underground reserves.

"Marri will seek to persuade council members that the oil production must be linked to the country's actual development needs not the needs of foreign consumers," Alriyadh newspaper said in a report from the capital Riyadh. "He will tell the Council that keeping sufficient oil quantities underground is a good investment for the future as oil prices will then be higher…he will argue that this will be better than producing more oil and generating financial surpluses on the grounds these surpluses are causing inflation."

"The price of oil under ground is actually higher than its current market price because it will become a unique commodity by time and demand will continue to rise because of a steady growth in the world's population," Marri told Alriyadh.

"The level of oil production in Saudi Arabia must be linked to the country's actual development and financial needs not to market prices and the need of foreign consumer. It is not wise to sap this resource just to satisfy the demand of foreign markets. Dateline

Saudi oil revenues touch $1bn per day

Saudi Arabia is making $1 billion (Dh3.67bn) a day in oil revenues on the back of record global fuel prices, according to a top executive at Riyadh-based Jadwa investment company.

"Currently Saudi Arabia is making over a $1bn a day in oil revenues. So $30bn a month, of which about half is being used to support core government spending, and the other half is going to Sama which says it's growing its foreign assets by about $15bn a month," said Bourland. "This is going to continue on and on, and the sovereign wealth story will continue to roll," he added.

Saudi Arabia oil revenues are predicted to hit $16.6 trillion by 2030 with prices at $150 a barrel, according to IEA production assumptions. Oil income for the UAE is expected to reach $4.6trn over the same period and for Kuwait this figure is $4.5trn. In total, by 2030 all three countries will command $25.7trn in revenues with oil priced at $150 a barrel. Sama is Saudi Arabia's sovereign wealth fund responsible for investing government surpluses.

Sheer Force Of Personality

Dateline June 28th 2000 - The 2000 presidential campaign

Bush Would Use Power of Persuasion to Raise Oil Supply

Gov. George W. Bush of Texas said today that if he was president, he would bring down gasoline prices through sheer force of personality , by creating enough political good will with oil-producing nations that they would increase their supply of crude.

"I would work with our friends in OPEC to convince them to open up the spigot, to increase the supply," Mr. Bush, the presumptive Republican candidate for president, told reporters here today. "Use the capital that my administration will earn, with the Kuwaitis or the Saudis, and convince them to open up the spigot."

Asked why the Clinton administration had not been able to use the power of personal persuasion, Mr. Bush said: "The fundamental question is, 'Will I be a successful president when it comes to foreign policy?' "

Sheer Force Of Personality In Practice

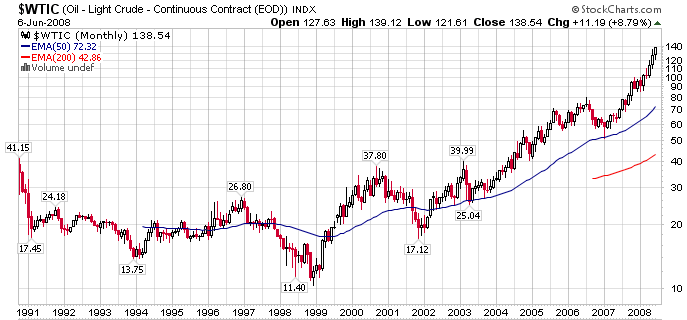

Crude Monthly Chart

Gold Continuous Chart

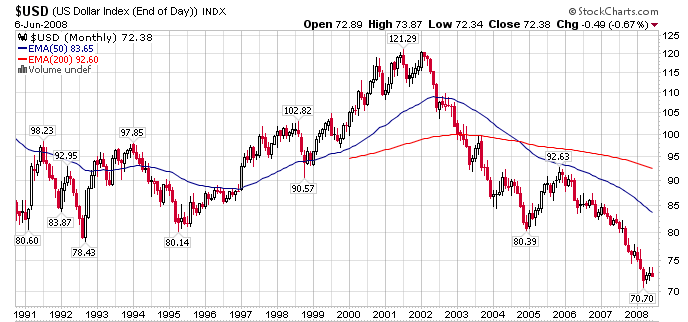

US Dollar Index Monthly Chart

Where did the personality go?

- Oil went from $30 to $140

- Gold went from $280 to $1000+

- The US$ Index fell from 110 to 73

If Bush has no "personality" neither does Paulson, or for that matter, Bernanke. Paulson's strong dollar policy yapping makes him the laughingstock of the world.

And, in a move that that had everyone excited this week, Bernanke started yapping about the dollar, breaking tradition with a long standing policy that only allowed the Treasury department to yap about the dollar. Of course this had everyone, everywhere yapping about the significance of this event. If this all seems counterproductive to you, it's because it is.

Practical Advice For Paulson And Bernanke

Practical Advice For Paulson And Bernanke

Caroline Baum had some practical advice for Paulson and Bernanke along these lines in her Friday commentary Dollar Policy for Dummies, Dimwits and Dolts . It's an interesting read.

Her practical advice: " Choose your timing carefully. When it looks as if the dollar has bottomed of its own accord, as it did in April 1995, start talking it up big. Then you can take credit for the move up. ''

Now that's "personality".

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.