UK Economy Debt Timebomb Will Explode After Election

Stock-Markets / UK Debt Apr 24, 2015 - 12:31 PM GMTBy: GoldCore

- UK economy a ’timebomb’ and will explode after election – Albert Edwards

- UK economy a ’timebomb’ and will explode after election – Albert Edwards

- Telegraph warns of “Lehman Moment” stemming from possible election chaos

- Currency traders view pound as being particularly vulnerable

- Latest data shows UK poised to slip into deflation for the first time since 1960

- Polls place Labour and Tories neck and neck as election looms

- Hung parliament may force either side to enter coalition with potentially disliked partners

- Outright majority for either side would also lead to further uncertainty

- Political uncertainty may impact sterling and UK assets

- UK has massive debt and vulnerable to Eurozone debt crisis

With the British general election due in just under two weeks on May 7, concerns are growing about the outlook for the UK pound after the election and the long term outlook of the UK economy due to the extremely high levels of debt – particularly in the private sector in the UK.

UK debt has continued to rise throughout the recovery and has soared to an eye-watering £1.48 trillion. In recent days, a slew of foreign exchange analysts have warned that the pound is vulnerable to falling in value.

London’s Telegraph warned last week that election ‘chaos’ could lead to a “Lehman moment” for the pound. The pound has been in steady decline since July apparently due to traders pricing in uncertainty around the election. It is currently trading at $1.51, down from $1.71 in July.

USD per 1 GBP – January 1986 to April 2015 (Thomson Reuters)

The incumbent government have not reined in public and trade deficits and have been accused of juicing the property market and the economy to postpone a crisis until after the election. Indeed, the Guardian reports that the current account deficit “was the widest for more than 60 years in 2014″.

This is under a Tory government. The deficits would likely have been worse under a Labour or coalition government.

To compound the problem, data for February and March show that the UK is on the verge of deflation for the first time in over 25 years.

There was 0% inflation in both months. It was expected that data for March would show negative growth. In the event, the data was neutral which led to what is likely to be a temporary bounce for the pound.

The Telegraph quoted Forex.com analyst Kathleen Brooks as saying “If you got a big shock, say -0.3pc, I think that would be when the panic stations would ring and then we’ll get into a real parabolic phase when you just see the pound drop like a stone.”

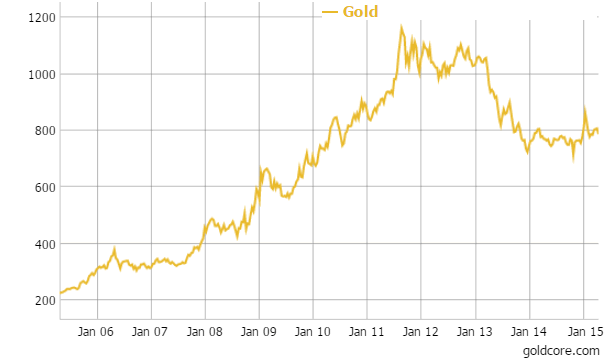

Gold’s hedging properties would then come into their own and this would be bullish for gold in pound terms, after a period of consolidation around the £800 per ounce level in recent months.

Gold in Pounds – 10 Years

Election polls variously place both Labour and the Tories in the lead by a narrow margin. It looks likely that the UK is facing a hung parliament in May.

Under the British system only the party who gain 325 seats out of a total of 650 can form a government. Latest polls show that both the major parties are far short of the necessary majority.

A YouGov poll suggests both parties will have less than 290 seats and so concessions will have to be made with smaller parties to entice them into a coalition.

The same poll sees the Lib Dems gaining 53 seats which places them in the strongest position. Nick Clegg has indicated that he would enter into coalition with either major party and act as a buffer to protect against the excesses of either side.

In terms of seats the Scottish National Party are polling at 6 but at this point neither the Tories nor Labour appear willing to enter coalition with them with Cameron suggesting that the SNP would blackmail Labour if it formed a minority government with the SNP.

UKIP are polling well in terms of percentages although how it will translate into seats remains unclear. The YouGov poll sees UKIP with 13% of the vote. The two leading parties have around 35% while the LibDems score just 7%.

So UKIP are increasingly a force to be reckoned with. However, given that their policies are diametrically opposed to those of Labour and following a stream of defections from the Tories – and therefore posing a serious threat to the Conservatives – it seems certain that they will remain an opposition party.

Either way UKIP’s mandate is strengthening and the potential for a “Brexit” from the EU is a growing one.

However, much could change in the interim period. In the event of a hung parliament the incumbent Prime Minister will remain in office while negotiations begin between the various power brokers.

As London’s Independent explains,

“There is only one clear rule for forming a government in the hung Parliament, and even that is a loose one: the politician who can tell the Queen that he has a workable majority in the House of Commons is the one the Queen will authorise to form a government.”

Time will tell how it all unfolds. In the mean time the uncertainty stemming from a hung-parliament and a potential minority government is likely to affect confidence in the pound and UK assets as investors defer making decisions until Britain’s status within the EU, Scotland’s status within the UK and the fiscal policies of the next government are clarified.

Ironically, an outright majority for either side would also cause uncertainty for the pound.

The pall of uncertainty that would hang over a Tory government as the country awaits the “Brexit” referendum could gravely undermine the pound. Miliband’s more traditional Labour party is likely to exacerbate budget and current account deficits.

Albert Edwards, head of global strategy at investment bank Société Générale has warned that the current coalition government has left a legacy of “grotesquely wide deficits” in both the public sector finances and on the UK’s current account – its overall trading position with the rest of the world.

He says that the Lib Dem Tory coalition has left the UK economy ‘up to its eyeballs in macro manure’ by failing to cut deficit, sterling will suffer and that the UK economy is a “ticking timebomb”.

Given the fragile nature of the London property market, the UK economy and uncertainty regarding a Grexit and new Eurozone debt crisis, such high levels of uncertainty could not come at a worse time.

Given the interlinked nature of so many financial institutions a “Lehman moment” for the pound and the UK could lead to widespread contagion and quickly morph into a Lehman moment for the world.

When this is viewed in the context of the widespread risks to the financial system globally, it would be prudent for UK investors and investors globally to have an allocation to physical gold to hedge against these risks.

Breaking Gold News and Research Here

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,192.15, EUR 1,097.49 and GBP 788.04 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,187.75, EUR 1,107.92 and GBP 792.31per ounce.

Gold climbed 0.67 percent or $7.90 and closed at $1,194.70 an ounce yesterday, while silver rose 0.63 percent or $0.10 closing at $15.89 an ounce.

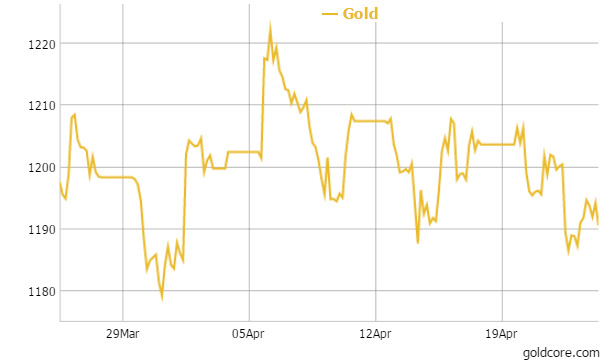

Spot gold in Singapore was $1,194.35 an ounce near the end of day trading and fell slightly more in European trading.

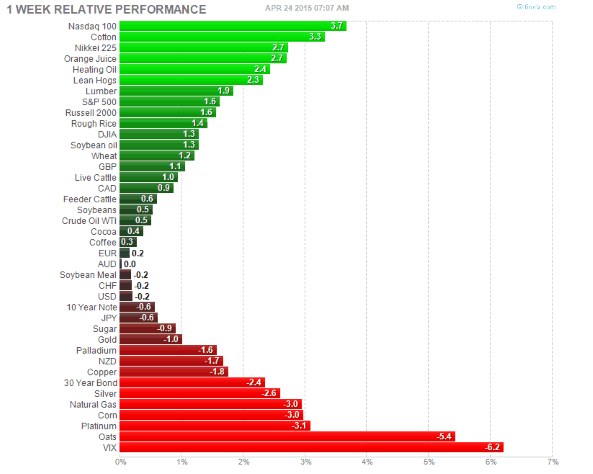

Gold looks set for its third weekly drop in spite of more mixed U.S. economic data. The weekly losses have been very marginal but this is bearish technically. Gold’s likely third lower weekly close and the poor technicals mean that gold looks likely to succumb to further weakness in the short term.

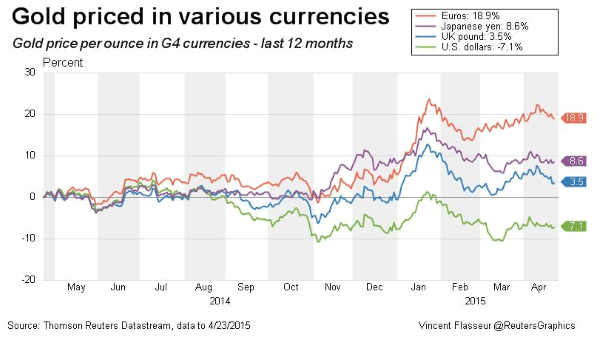

Gold is also marginally lower in euros and pounds this week. The short term trend is lower and momentum is a powerful thing.

Gold in U.S. Dollars – 1 Month

The same is the case with silver which is heading for 2.6 per cent loss for the week. Contrarian investors see silver as great value below $16 per ounce and are buying the dip. We continue to see flows into silver while gold has seen mixed flows with some buying this week but nearly as much liquidations as some gold owners throw in the towel.

U.S. weekly unemployment claims rose more than expected to 295,000 in April, against an estimate of 288,000. U.S. new home sales for March were lower than the previous month at 481,000 below the forecast of 514,000 and 11.4 percent less than last month.

Potential ‘Grexit’ is still weighing on the markets and things appear to be getting worse between Greece and its creditors.

Greek Finance Minister Yanis Varoufakis was heavily criticised by his euro-area colleagues today amid mounting frustration at what they say is his refusal to deliver measures to fix his country’s economy and release financial aid, “three people familiar with the talks” told Bloomberg.

Greece offered further concessions today on reforms demanded by international lenders in return for new funding before Athens runs out of money, but euro zone creditors said negotiations needed to speed up to get a deal done by June.

German Chancellor Angela Merkel commented yesterday that everything must be done to prevent Greece running out of money before it reaches a cash-for-reform deal with its international creditors, amid heightened concern that Greece is nearing the brink.

The Greek Prime Minister told Merkel that Greece has already done everything it can for the euro and eurozone and it was time for the eurozone partners to help Greece.

Investors have the U.S. Federal Open Market Committee meeting next week to try and gain more clues on the Fed’s much vaunted first interest rate hike in nearly ten years. Even a small interest rate will likely badly impact frothy risk assets such as bonds and stocks.

Gold could also be vulnerable in the short term but would benefit from renewed weakness in paper assets.

Chinese premiums are still above the global benchmark by $2. Although weaker than the prior session they show that Chinese demand remains robust. Sales from Akshaya Tritiya festival in India saw a 15 percent increase over the holiday.

Indian demand continues and looks set to be near the 1,000 metric tonnes again this year.

For now, markets are ignoring considerable geopolitical risk emanating from the Middle East and from tensions between the U.S. and Russia.

The Russian Defense Ministry said overnight that U.S. specialist troops were training Ukrainian forces in the conflict zone in eastern Ukraine. The Pentagon denied it, accusing Moscow of a “ridiculous attempt” to obscure its own activity in the region.

Interfax quoted Russian Defense Ministry spokesman Major General Igor Konashenkov as saying U.S. troops were training Ukrainian forces not only in western Ukraine “as Ukrainian TV channels show, but directly in the combat zone in the area of Mariupol, Severodonetsk, Artyomovsk and Volnovakha.”

This would appear to be an escalation and may result in deepening tensions and an intensification of the conflict.

In London in late morning trading gold for immediate delivery is at $1,191.64 an ounce or off 0.18%. Silver is down 0.16 percent at $15.86 and platinum is also down in U.S. dollars at $1,131.46 an ounce.

Download: 7 KEY GOLD STORAGE MUST HAVES

This update can be found on the GoldCore blog here.Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.