U.S. Dollar Danger Zone

Currencies / US Dollar May 08, 2015 - 01:51 PM GMTBy: DeviantInvestor

The US dollar has been the world’s reserve currency since Bretton Woods – about 70 years. The power and importance of Middle-East oil and the US economy and military have supported the dollar for about 40 years. Quick story:

The US dollar has been the world’s reserve currency since Bretton Woods – about 70 years. The power and importance of Middle-East oil and the US economy and military have supported the dollar for about 40 years. Quick story:

- The world buys oil in dollars. (Thank you Saudi Arabia and Kissinger.)

- Therefore the world must purchase (support) dollars to obtain oil.

- The US supports the oil producing nations with military might.

- The oil producing nations collect dollars in exchange for oil and recycle those petrodollars back into US T-bonds and equities thereby supporting the dollar and the US stock and bond markets.

The process works exceedingly well for the US since, as Bernanke noted, we have a printing press and can “print” the dollars to pay for oil and other imported goods.

But how much longer can the US maintain this dollar support process? Consider:

FUNDAMENTAL ISSUES:

- AIIB: The Asian Infrastructure Investment Bank is clearly a threat to dollar dominance. Over 50 nations joined, including the UK, France, Germany, and Australia. This will weaken the dollar’s importance in world trade.

- China has purchased and imported a massive amount of gold bars in the past 5 years. The magnitude of the gold migration from the west to Asia has been obscured intentionally. Clearly the western central banks and governments do not want the world to know how much gold they have sold to China. China does not want to announce how much gold they have purchased, which might panic the gold market and elevate prices, making additional purchases more expensive. China’s gold hoard will become a threat to the reserve currency status of the dollar, a fiat currency backed only by “faith and trust.”

- China will announce their gold holdings when it is convenient and beneficial to China. They might even tell the truth. Worse, they might demand the US and the UK tell the truth and produce auditable reports on their remaining gold. An audit could be catastrophic for the relative value of the dollar. Since consequences might be destructive to all parties, a “trust me” solution will probably be found unless China is ready for an all-out assault on the dollar. The dollar is clearly in danger if China announces total gold holdings close to or larger (likely) than the official US gold stockpile.

- Reasonable analysis by many individuals and organizations suggests that much of the gold supposedly held by the US and UK is gone. Do not expect official confirmation. Regardless of denials and obfuscation, gold is important for confidence in all currencies. Admitting most of the US gold has been “leased,” sold, or stolen will create a danger zone for the dollar.

- “He who has the gold makes the rules.”

- We no longer hear, “The dollar is as good as gold.” Could that change in the next decade to “The yuan is as good as gold?”

CHART ANALYSIS

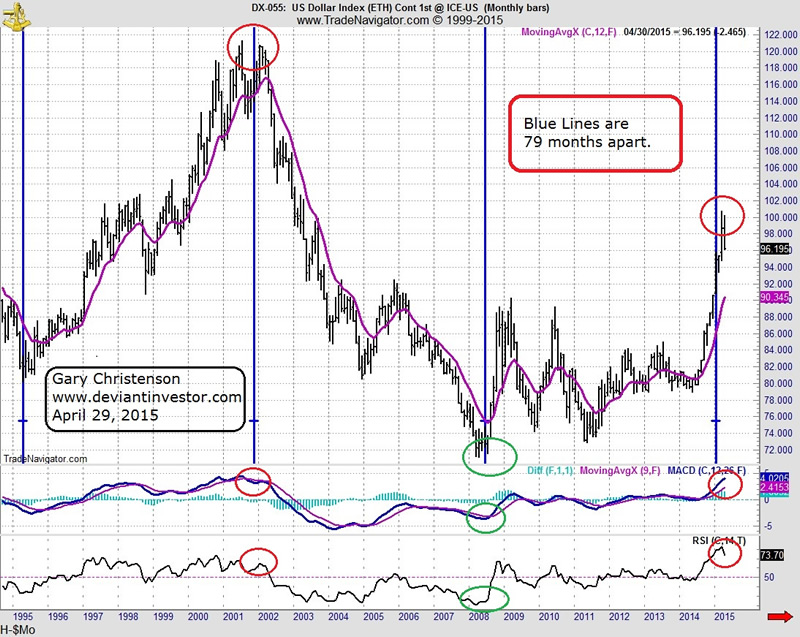

For a long term perspective, examine the monthly chart of the dollar index.

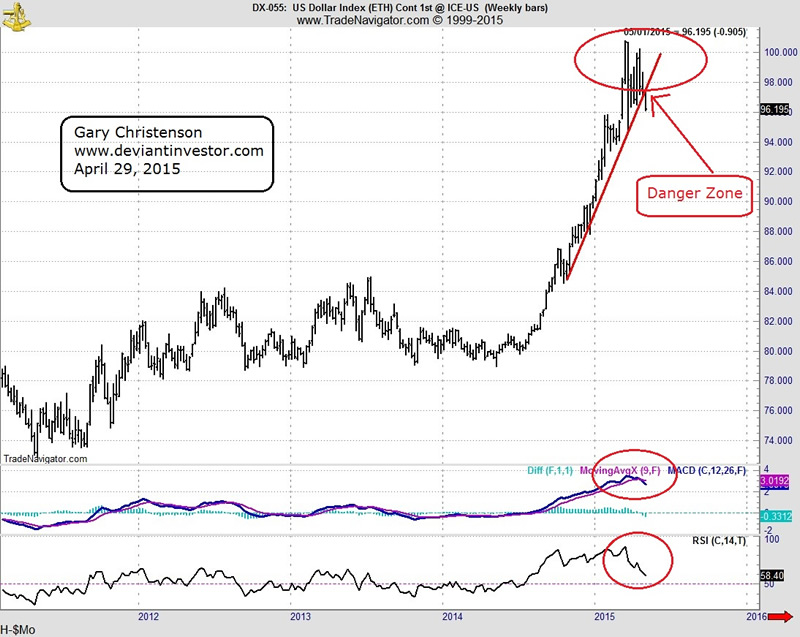

For an intermediate term perspective, examine the weekly chart.

What I see in the charts:

The dollar index made major turns in 1995, 2001, 2008 and 2015, about every 6.5 years. Note the vertical blue lines on the chart and the following comments regarding changes in the S&P 500 Index:

- 1995: The S&P began a major move from about 470 to about 1,570.

- 2001: The S&P peaked in 2000 above 1,500 and corrected from there.

- 2008: The S&P crashed in 2008 and bottomed in early 2009.

- 2015: The S&P made a new all-time high in early 2015.

The monthly dollar index has moved too far and too fast. Further, major turns in the dollar are often associated with turns in the S&P and general economic activity. Be cautious.

The weekly chart of the dollar index (April 29) has broken the up trending red support line, as I have drawn it. This could be the start of a major dollar index downturn. Be cautious.

Could the dollar index strengthen and rally further? Almost anything is possible in central bank managed currency, bond, and equity bubbles, but this looks like a danger zone for the dollar.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.