George Soros Warns of “Third World War”

Politics / GeoPolitics May 28, 2015 - 01:58 PM GMTBy: GoldCore

- War “inevitable” if U.S. meddles in South China Sea – Global Times

- War “inevitable” if U.S. meddles in South China Sea – Global Times

- Senior NATO official warns that “we’ll probably be at war this summer”

- Soros warns of ‘New World Order’ and war with China

- Soros warns could be “on the threshold of a Third World War”

- Many countries in Pacific lay claim to strategically important and mineral rich islands

- Tensions between U.S. and China and Russia escalating

- War would have many facets including cyber-warfare and currency wars

The ‘war’ word is being increasingly heard internationally as the U.S., EU, Russia and China adopt provocative postures over various disputes including Ukraine and in the Pacific.

War with the U.S. is “inevitable” if the U.S. involves itself in the dispute which has arisen over the Spratley Islands in the South China Sea according to China’s state controlled newspaper the Global Times.

“If the United States’ bottom line is that China is to halt activities, then a US-China war is inevitable in the South China Sea” according to an editorial in the popular government paper.

China has since last year been taking over a greater part of the long-disputed Spratleys and has begun land reclamation projects to make the archipelago a part of its sovereign territory. The move angered many of its neighbours like the Philippines and Vietnam who also claim the islands.

Geographically, the archipelago is close to the Philippines, Malaysia, Brunei and the Philippines. However, China has maintained a presence in the region on and off for centuries which is the basis for its claim.

The islands are believed to be located over large reserves of undersea oil and are also strategically vital as a shipping corridor through which vast amounts of goods are shipped. The islands also provide a platform from which China could project military power into the afore-mentioned countries.

Tensions between the U.S. and China, while low-key in other regards, have been escalating with China responding angrily to U.S. reconnaissance flights in the region.

The Global Times suggests that China is not daunted by a military conflict with the U.S. – “We do not want a military conflict with the United States, but if it were to come, we have to accept it.”

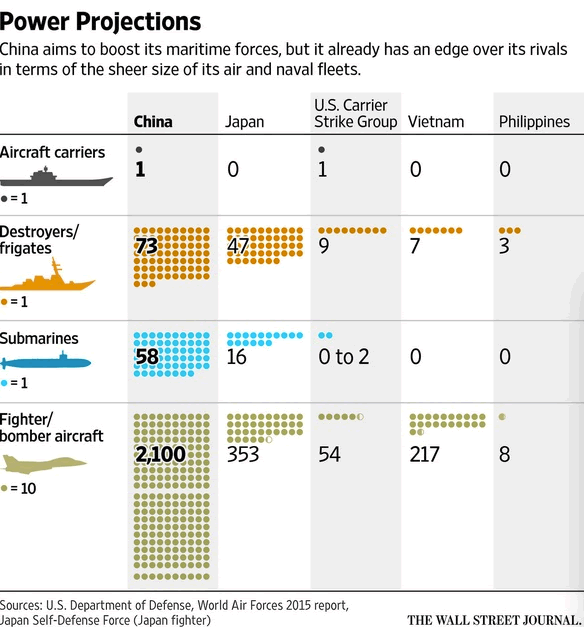

Indeed, The Wall Street Journal has shown that in terms of conventional warfare China is the undisputed heavyweight in the region with a massive airforce and navy – see infographic.

The Chinese are utterly scathing of U.S. “meddling” in the South China Sea, thousands of miles from its own borders and clearly views itself as the new hegemon in the region. This seemingly innocuous dispute has the potential to rapidly spiral out of control.

There are also simmering tensions between China and Japan.

Both have long held claims to the Japanese-administered islands — known as Diaoyu in China and Senkaku in Japan. Tensions have intensified in recent months, and observers fear that a political or military misstep could rapidly escalate.

In late 2013, China announced an air defense zone over the East China Sea, encompassing the disputed islands. The new policy would require airlines to give Chinese authorities their flight plans before entering the airspace designated by China.

Japan’s Prime Minister Shinzo Abe said the new policy “escalates the situation and could lead to an unexpected occurrence of accidents in the airspace.” The United States called China’s announcement “unnecessarily inflammatory.”

Military posturing is quietly reaching new extremes in Europe, the Mediterranean and the South China Sea and the provocative bluster is reaching new heights.

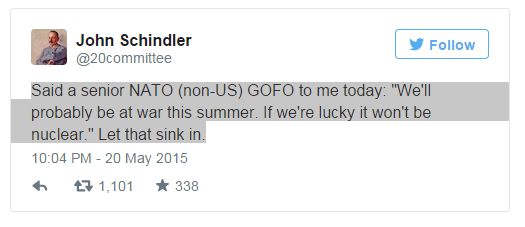

Separately, it is believed that a senior NATO official has warned that “we’ll probably be at war this summer.”

Former NSA intelligence analyst John Schindler has said that a senior NATO official told him that the world would “probably be at war” sometime this summer. Although the tweet was retweeted over 1,000 times, the comment did not get any media coverage.

Finally, the ‘trumpets of war’ became a triumvirate when one of the most powerful men in the world today – George Soros - warned that we “are on the threshold of a Third World War.”

As China’s economy slows down, this could trigger a global military conflict as might other tensions in the region, Soros warned.

“If the transition runs into roadblocks, then there is a chance, or likelihood in fact, the leadership would foster some external conflict to keep the country united and maintain itself in power,” Soros said in remarks at a Bretton Woods conference at the World Bank.

“If there is a military conflict between China and an alley of the U.S., like Japan, it is not an exaggeration to say we could be on the threshold of a Third World War. It could spread to the Middle East, then Europe and Africa.”

Since Soros made his remarks, tensions between China and the U.S. have further escalated. China has released a new white paper which threatens military action unless the U.S. stops its current actions in the South China Sea.

If China’s efforts to transition to a domestic-demand led economy from an export engine falter, there is a “likelihood” that China’s rulers would foster an external conflict to keep the country together and hold on to power.

To avoid this scenario, Soros called on the U.S. to make a “major concession” and allow China’s currency to join the International Monetary Fund’s basket of currencies. This would make the yuan a potential rival to the dollar as a global reserve currency. In return, China would have to make similar major concessions to reform its economy, such as accepting the rule of law, Soros said.

An agreement along these lines will be difficult to achieve, Soros said, but the alternative is a brutal war.

“Without it, there is a real danger that China will align itself with Russia politically and militarily, and then the threat of third world war becomes real, so it is worth trying.”

The warning comes as Europe engages in some of its biggest ever war games — right on Russia’s front door. It’s a deliberate ploy, intended to warn regarding Ukraine but could be seen by Russia as a provocation.

War, if it comes, will be multi faceted and poses risks to markets. Modern warfare would involve many facets including cyber warfare and currency wars.

Geopolitical risk continues to be seriously underestimated by investors and will likely impact markets in the coming months.

Must Read Guide: 7 Key Bullion Storage Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,189.45, EUR 1,087.08 and GBP 775.94 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,187.85, EUR 1,088.07 and GBP 770.64 per ounce.

Gold fell $0.20 or 0.2 percent yesterday to $1,187.50 an ounce. Silver slipped $0.05 or 0.3 percent to $16.69 an ounce.

Gold in Singapore for immediate delivery was steady at $1,188.55 an ounce while gold in Zurich also flatlined in lack lustre directionless trading as gold continues to be capped below $1,200 per ounce.

Gold bullion seems to be taking trading direction from the U.S. dollar with no major economic data on the horizon. The dollar has continued its strength since Fed Chair Janet Yellen once again suggested last week that the U.S. Fed is set to raise interest rates later this year.

Although safe haven demand has waned for the yellow metal, the Greek debt crisis is still not solved and may bolster bullion demand once again. June 5th is Greece’s next payment due to the IMF.

European markets are mostly lower this morning although the FTSE is marginally higher, as talks on Greece continue to bear little fruit.

Yesterday, the new government met its international creditors in Brussels to discuss a possible reform deal to unlock its last tranche of bailout money. It desperately needs this money to make repayments to the IMF and ECB over the coming months.

While the Greek government hinted a deal was on the way, saying it was in the process of drafting an agreement, others were less optimistic. Hawkish German Finance Minister Wolfgang Schaeuble said he was “surprised” by Greece’s positive outlook, while European Commission Vice President Valdis Dombrovskis said the two sides still had “some way to go”.

Greece is one of the main topics on the agenda at the G7 meeting of finance ministers and central bank chiefs this week and there could come interesting developments from this.

In late morning European trading gold is up 0.07 percent at $1,188.35 an ounce. Silver is off 0.07 percent at $16.67 an ounce, while platinum is up 0.17 percent at $1,121.78 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.