Commodity Prices Slump Signals Slow Economic Growth Outlook

Commodities / Commodities Trading Aug 02, 2015 - 09:23 PM GMTBy: Dan_Norcini

In my opinion, the surest method for ascertaining what the sentiment is towards overall global economic growth prospects is the commodity sector performance.

In my opinion, the surest method for ascertaining what the sentiment is towards overall global economic growth prospects is the commodity sector performance.

When sentiment is upbeat towards global growth, commodities tend to be in a strong uptrend on the charts. The reverse is true when prospects turn sour; commodities have a general tendency to sell off.

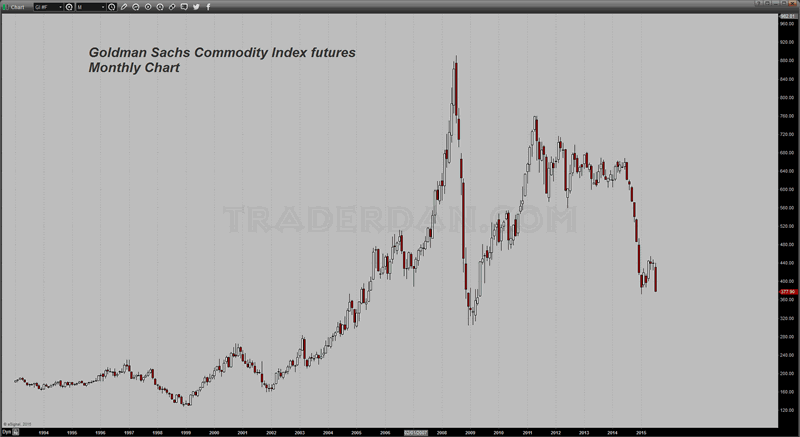

What does the following chart therefore say to you about where investors/traders are in regards to their current sentiment?

Gold Sachs Commodity Index Monthly Chart

What is so astonishing (and disconcerting ) about this chart is that after $4.5 TRILLION in QE here in the US alone, not to mention the enormous amounts of QE in Japan, and the current ongoing QE in the Eurozone, commodities as a group are back to almost the same exact starting level they were back in late 2008 when the first round of QE here in the US was announced. That is simply stunning to me!

My question is: "Now what?". What do the Central Bankers try next if they cannot generate their beloved 2% annual rate of inflation?

I am on record as stating that QE in and of itself cannot produce lasting growth. At the best, all it can do is prevent a further falloff in economic activity by keeping the patient essentially flatlining. For growth, one needs business friendly policies involving cutting excessive regulation (regulatory reform), tax policy reform, sensible health care reform (not the current abysmal monstrosity known as obamacare), tax breaks or incentive on repatriated capital, etc. None of those are currently in the cards here in the US nor from what I can see, either in Japan or in the Eurozone.

China is slowing on account of too many years of unbridled expansion financed by easy credit and now is dealing with its own version of an economic boom and bust cycle.

So where exactly is the catalyst going to come from to generate the kind of growth needed to really kick start the demand side of the commodity complex? Answer - Unknown - at least it is to me.

I shudder to think we may have to wait until as long as January 2017 when we have a new and hopefully business=friendly administration in office. In the interim, it seems like we are going to merely muddle along.

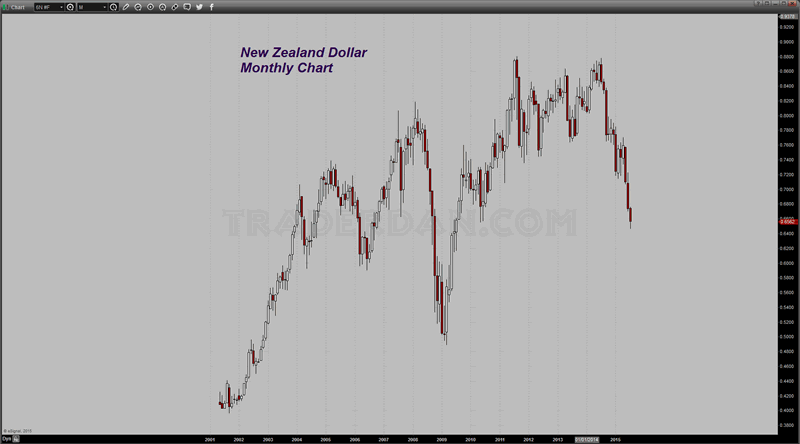

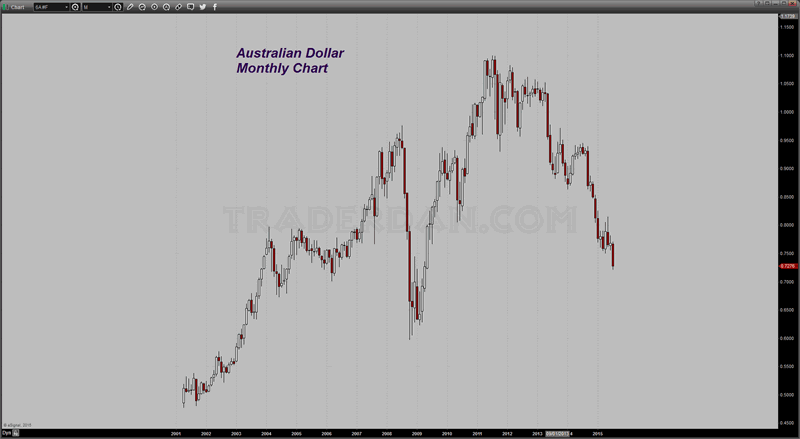

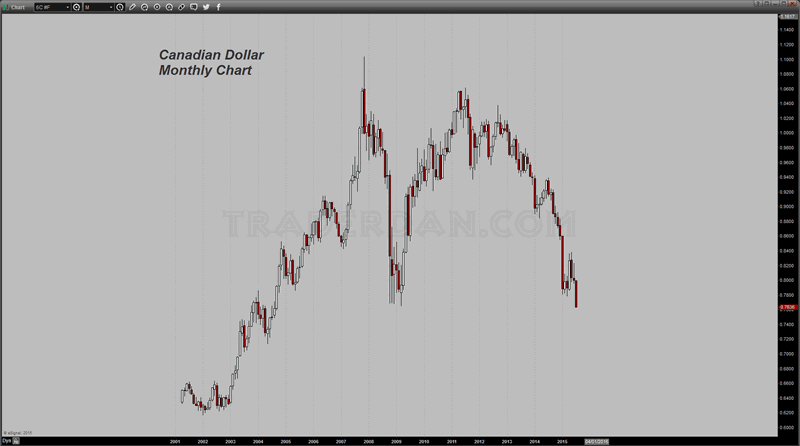

I do think that if we ever do see sentiment shift towards an improving economic growth outlook, we will see that reflected in the commodity currencies FIRST. By those I am referring to the Canadian Dollar, the Australian Dollar and the New Zealand Dollar.

The economies of those nations is so heavily dependent on the production and sale of raw materials that during a time of slow global growth, their currencies tend to fall in value against the US Dollar. The opposite is true during times of upbeat sentiment towards global growth; they tend to rise against the greenback.

Look at the charts of all three of these currencies and tell me what you think they are telling us the current sentiment is:

New Zealand Dollar Monthly Chart

Australian Dollar Monthly Chart

Canadian Dollar Monthly Chart

Isn't it uncanny how closely the charts of these currencies resembles that of the Commodity index charted? Out of the three, the Canadian Dollar has actually broken down below its 2008 low as Canada is getting hit especially hard by the collapse in crude oil prices and is probably in recession at this point.

I try to keep an eye on these three currencies for any sort of signal that sentiment towards growth prospects might be undergoing a change. For now, there is not a single shred of evidence that suggests that is the case. The exact opposite is true - namely that growth is slowing and with it, so is demand for commodities.

Keep this in mind whenever you read some scribble from one of the gold bug gurus or hear an interview in which they are doing their usual "analysis" about soaring gold and silver prices (as soon as the price manipulators get buried by the "free, physical market"). If anything, the charts are telling us the exact opposite, that the metals have further to fall.

Until we see these currencies turn strongly around, deflation, as far as commodity prices go, is what the future holds for us. The global economy desperately needs a spark from somewhere and I have no idea where that "somewhere" is going to be right now.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.