Crude Oil Price Time for Reversal?

Commodities / Crude Oil Aug 19, 2015 - 12:54 PM GMTBy: Nadia_Simmons

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 1.17% as hopes that crude oil inventories could decline for a third consecutive week weighed on investors' sentiment. Thanks to these circumstances, light crude bounced off its key support line, but will we see the commodity above $43 in near future?

Yesterday, the Commerce Department showed that housing starts rose 0.2% to the highest level since October 2007, which pushed the USD Index above 97. What's interesting, although the greenback moved higher against other currencies, crude oil didn't extend its losses, showing some strength. Does it mean that investors' sentiment has improved and higher values of the commodity are ahead us? Let's examine the technical picture of light crude and find out where it will head next (charts courtesy of http://stockcharts.com).

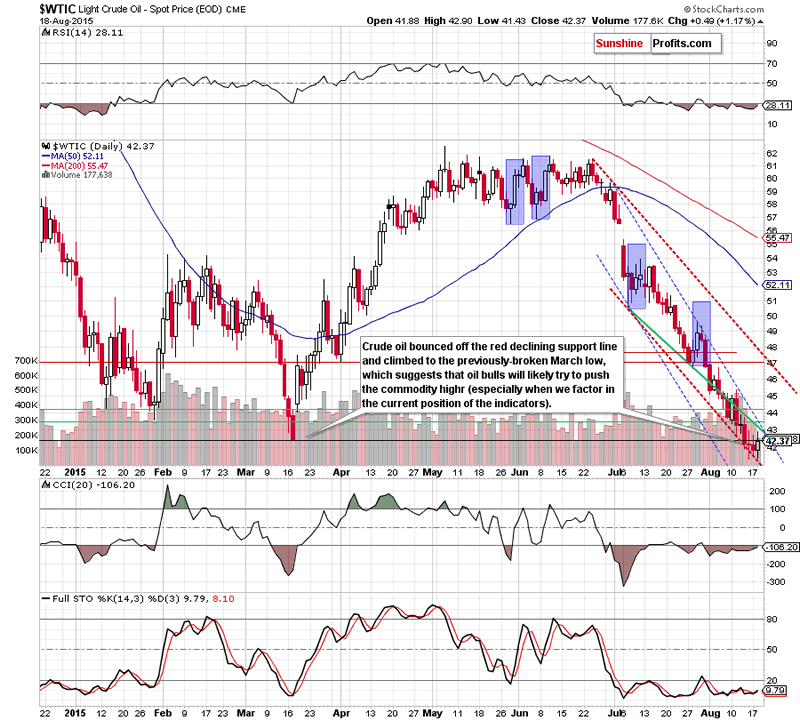

From today's point of view we see that although crude oil moved little lower after the market's open, the combination of the recent multi-month low and the key support line (marked with red) encouraged oil bulls to act. As a result, light crude rebounded and climbed above the previously-broken March low, hitting an intraday high of $42.90.

Despite this increase, the proximity to the nearest solid resistance zone (created by the green and blue lines) triggered a pullback and the commodity closed the day a few cents below the March low. What's next? Taking into the current position of the indictors (there are positive divergences and the Stochastic Oscillator generated a buy signal - not strong, but still) it seems that the space for declines is limited and further improvement is just around the corner.

Nevertheless, in our opinion, as long as there is no invalidation of the breakdown under green and blue lines, higher prices of the commodity are questionable and another test of the red declining support line (currently around $41.16) can't be ruled out. However, if oil bulls manage to push crude oil above $43-$43.58, the way to $45.34 (the Aug 11 high) would be open.

Finishing today's alert please note that yesterday, after the market's open, the American Petroleum Institute reported that crude oil inventories declined by 2.3 million barrels last week, beating expectations for a 2.0 million barrel drop. If today's EIA report confirms another drop (or shows a bigger-than-expected decline), oil bulls would have another argument to push the commodity higher.

Summing up, crude oil bounced off the recent low and the key support line, closing the day slightly below the March low. Taking this fact into account, and combining with the current position of the indicators (and another weekly drop in crude oil inventories showed by the API), it seems to us that oil bulls will try to push the commodity higher. Nevertheless, the outlook for crude oil is not clear enough to justify opening any positions. We will continue to monitor the market, look for another profitable trading opportunity and report to you accordingly.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski

Founder, Editor-in-chief

Sunshine Profits: Gold & Silver, Forex, Bitcoin, Crude Oil & Stocks

Stay updated: sign up for our free mailing list today

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons is not a Registered Securities Advisor. By reading Nadia Simmons’ reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Nadia Simmons Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.