A Key Oil Price Trend That Everyone Is Missing

Commodities / Crude Oil Oct 06, 2015 - 05:53 PM GMTBy: Investment_U

David Fessler writes: My friend Rick Rule likes to say, “The cure for low prices is low prices.”

David Fessler writes: My friend Rick Rule likes to say, “The cure for low prices is low prices.”

Here’s what’s supposed to happen...

Marginal producers can’t make money at today’s prices. Therefore they shut in wells (turn them off). As supplies get tighter, prices move higher.

But that hasn’t happened. Prices and drilling activity have both continued to move lower... until now.

U.S. crude futures got a major boost on Friday, closing almost 2% higher than where they stood when the market opened. Meanwhile, the number of oil rigs has continued to slip, narrowing our domestic supply-demand gap.

Back in February, I spoke about the future course of oil prices with John Hofmeister. (You can listen to the interview by clicking here or on the image below.)

John is the former president of Shell Oil. It was his prediction that WTI production would begin to tail off during Q3 2015. Then, starting slowly at first, it would accelerate.

The reason? Well depletion rates would begin to reduce production as the number of wells coming online decreased.

Eight months later, it’s happening. Right on cue.

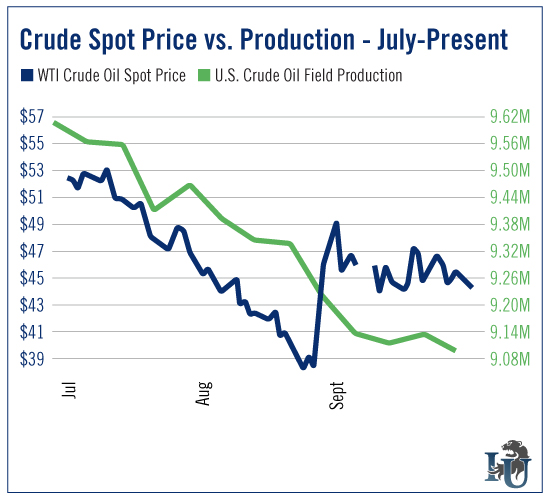

Once again, allow me to refer you to my favorite chart...

As you can see, WTI crude production fell by 40,000 barrels per day the week of September 25, 2015. That’s a level not seen since November 2014.

And note that the above graph does not show the rise in the price of WTI crude (the data is a week old). But as of Monday’s close, crude was $46.26 per barrel - up more than 1.5% since Friday.

It looks as though prices might just be starting to respond to lower production numbers.

Rig counts have been dropping, too. Last week’s count, according to Baker Hughes (NYSE: BHI), dropped by 26 to 614. That was the fifth straight weekly drop - and the sharpest since late April 2015.

U.S. oil rigs are now at their lowest since August 2010. Last October, they peaked at 1,609. Which means there are almost 1,000 fewer rigs drilling today than a year ago.

It took a while, but U.S. production is finally starting to slow.

And, at the same time, oil prices are starting to rise.

So is John’s prediction finally becoming a reality? Is supply and demand really starting to equalize domestically? The chart above surely supports his thesis.

The important takeaway here? Industry analysts... the mainstream media... and even the dozens of oil and gas industry rags I scan daily... they almost never mention production.

Instead, they’re fascinated with oil storage numbers. The amount of oil in storage is important for short-term commodity traders, sure. But it has almost no bearing on long-term crude prices. Other indicators - like dwindling production - suggest we are at or near a bottom in U.S. WTI pricing.

And with mergers and acquisitions activity on the upswing - marginal players are throwing in the towel and teaming up with stronger ones - now is the perfect time to go bargain hunting.

I’m looking at strong exploration and production companies as well as midstream pipeline master limited partnerships.

All the signs point to a continued drop in U.S. unconventional crude production. This can’t help but lead to higher crude prices and, more importantly, higher share prices for those with the patience to wait.

Good investing,

Dave

Source: http://www.investmentu.com/article/detail/47877/key-oil-stat-everyone-is-missing#.VhQXjk3bK0k

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.