Dow Down Nearly 1,500 Points This Year While Obama Claims U.S. Economy Is Great

Economics / US Economy Jan 14, 2016 - 05:44 PM GMTBy: Jeff_Berwick

America, the individual triumph of millions of individuals through the generations has now become the “United State” and like any fascist or communist dictatorship, lies have increased as freedom has decreased. Many huddled around their TV sets (although in decreasing numbers – which is the real hope!) and heard a concentrated dose of untruths last night from the Great Leader for the “State of the Union”.

America, the individual triumph of millions of individuals through the generations has now become the “United State” and like any fascist or communist dictatorship, lies have increased as freedom has decreased. Many huddled around their TV sets (although in decreasing numbers – which is the real hope!) and heard a concentrated dose of untruths last night from the Great Leader for the “State of the Union”.

I didn’t watch. Politicians make me sick to my stomach and the sight of an entire throng of welfare-recipients (Congress) cheering for minutes on end for a man who has never held a real job in his life as he reads from his teleprompter is too much of a chore.

I did skim the speech, however, and it was full of the usual lies and collectivist rhetoric.

Here are just a few dandies.

Our unique strengths as a nation — our optimism and work ethic, our spirit of discovery and innovation, our diversity and commitment to the rule of law — these things give us everything we need to ensure prosperity and security for generations to come. In fact, it’s that spirit that made the progress of these past seven years possible. It’s how we recovered from the worst economic crisis in generations.

I’ll ignore the comments on how people who live in the geographical tax region known as the US are “unique” in all manner of things, including optimism (which they are really going to need), and focus on some of the false facts. By almost any metric there has been no recovery.

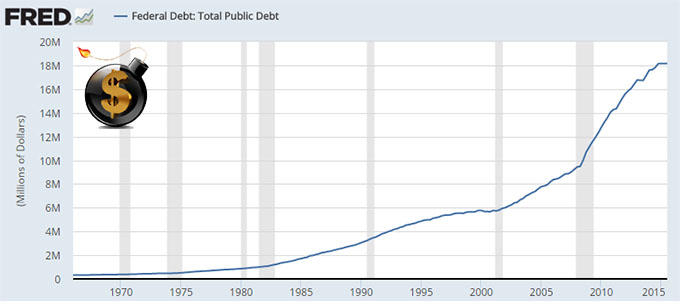

Certain charts have risen dramatically in the last seven years, however.

Total US government debt at the start of 2008 was $9.4 trillion. It now currently stands $18.9 trillion, more than doubling in a few short years.

To put that into context, Barrack Obama has increased the government debt more than all past Presidents combined.

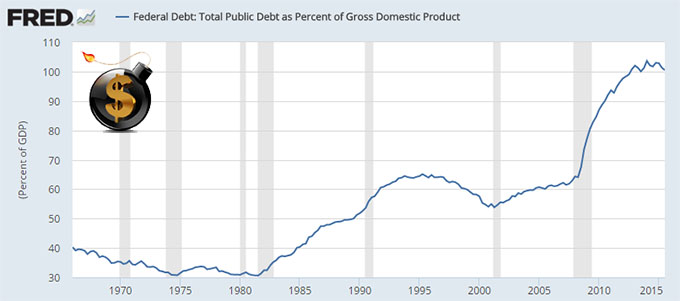

When looking at government debt-to-GDP, it is even more stark rising from 60% to over 100% in just the last seven years.

Here is some more inaccurate triumphalism from the Comrade-In-Chief.

We’re in the middle of the longest streak of private-sector job creation in history. More than 14 million new jobs; the strongest two years of job growth since the ’90s; an unemployment rate cut in half. Our auto industry just had its best year ever. Manufacturing has created nearly 900,000 new jobs in the past six years. And we’ve done all this while cutting our deficits by almost three-quarters. Anyone claiming that America’s economy is in decline is peddling fiction.

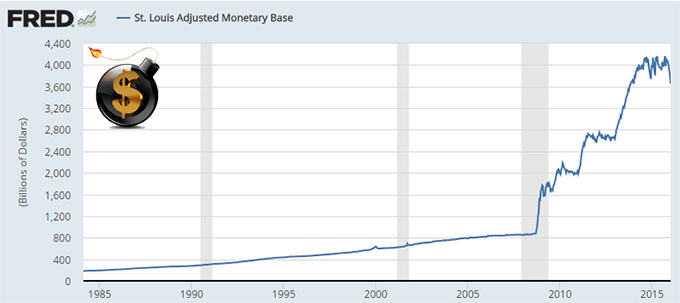

Sure, some “jobs” have been created (way less than he claims as we will show below). But such employment is ephemeral because it is not the product of marketplace forces. When you print massive amounts of money out of thin air (Quantitative Easing) you can fool the economy into thinking things are going well… for a little while anyway.

You may notice something went quite askew in the following chart in 2008.

The total monetary base rose from near $800 billion to $4 trillion in just a few years! This is what banana republics do and it can seem to make a dead economy look stillborn for a period of time.

But what it really does is destroys capital. Take for example the oil market. The massive amount of money printing since 2008 pushed up the price of oil, creating a whole new industry in the US, and yes, for a time, jobs were created. But now that that bubble is being deflated all the billions of dollars of capital that were poured into that sector are lost. Sure, some people had jobs for a few years, at the expense of the entire economy.

But, even if you take Obama’s 14 million new jobs number and divide it by the $9 trillion in government debt that has been added, it means that it cost about $640,000 for every job created! And it hollowed out the capital base of the economy. Well done Obama!

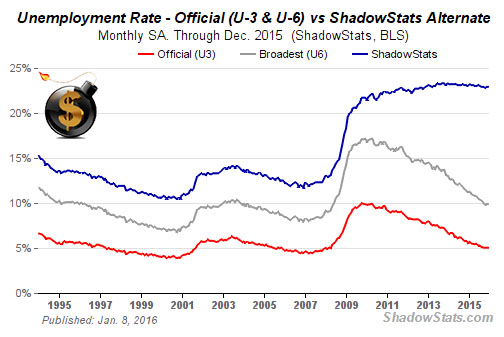

And that’s assuming that 14 million jobs were temporarily created… which is a stretch. The US government has learned how to take the unemployment out of the employment numbers over the last few decades.

In 1994, the way unemployment was calculated was changed dramatically to take out long-term, discouraged unemployed people out of the employment numbers. If that wasn’t changed, here is what the number would look like today (the blue line in the following chart).

A much better statistic for gauging employment in the US is the labor force participation rate.

According to that stat, unemployment as a percentage of the population hasn’t been this bad since the 1970s.

Obama maintains, “Anyone claiming that America’s economy is in decline is peddling fiction.” Look at those numbers and you decide who is peddling fiction!

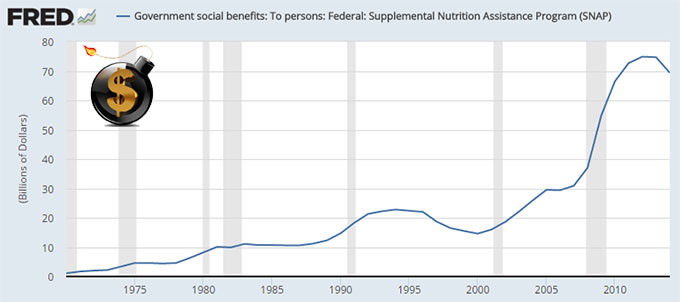

He also went on to say, “Food Stamp recipients didn’t cause the financial crisis; recklessness on Wall Street did. ”

Actually, the Federal Reserve system caused the financial crisis. That same Federal Reserve that Congress just voted against auditing.

It was strange Obama didn’t grandstand on his success with creating food stamp recipients, however. Having the largest amount of Americans who can’t afford to eat is surely one of his biggest accomplishments.

The amount of people on food stamps in 2014 was 46.5 million, up from 28 million in 2008. At 46.5 million, that is nearly one in five Americans who need help to eat.

Obama has been successful at creating welfare recipients, hiding unemployment and going into massive amounts of debt.

Apparently the markets don’t see things quite as rosily as Obama… and for very good reason. Today, the Dow closed down 364 points and is now down 1,500 points since just the start of the year.

Our analysis of the economy has had us heavily short the market and so far it has been a great year. Just in the last week alone, one of our put options recommended to subscribers was up over 100%.

When it comes to advice on the markets, you can listen to Obama... or listen to us. We think we have a much better take on reality and continue to prove it. Remember, rates rise for our newsletter on February 1st so if you’d like to lock in our current rates and position yourself for profitable advice for 2016, do so now by clicking here. You’ll also want to consider attending our upcoming conferences. Consider joining us in sunny Acapulco at our Internationalization and Investment Summit with numerous experts on international diversification. And stay on for the three-day Anarchapulco Conference as well. The Royal Bank of Scotland, who warned of a crisis prior to the 2008 collapse just warned this week that 2016 will be "cataclysmic". We agree with them and I have already said that 2016 would be a bloodbath in the markets. So far, we are already right. And if we continue to be right things will get far worse before they get better. By subscribing now and/or attending our conference you’ll be prepared to profit and survive 2016 while those who listen to Obama lose their shirts.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2015 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.