Is This The End for Crude Oil?

Commodities / Crude Oil Mar 22, 2016 - 07:53 PM GMTBy: Sol_Palha

"The end is never as satisfying as the journey. To have achieved everything but to have done so without integrity and excitement is to have achieved nothing." ~ Anonymous

Source www.bloomberg.com

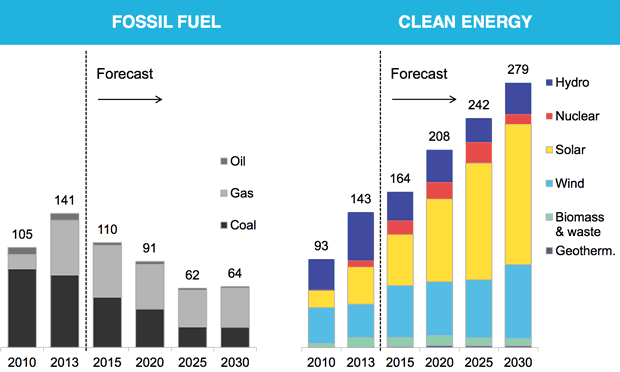

The data above indicates that the race between renewable energy and fossil fuels is over; the inflection point was hit back in 2013 when 143 gigawatts of renewable energy were added versus 141 gigawatts that came from traditional power plants that burn fossil fuels. If you look at the chart above, the trend is expected to gain momentum in the years to come. In most cases, the cost of solar energy is on par if not cheaper than grid electricity. This is perhaps why the Saudi's are panicking and want to destroy competition so that they can push prices back up and try to lock in as much money as they can before they knocked out of the game. They are even planning on selling shares in Aramco.

Mohammed bin Salman, the kingdom's deputy crown prince, said he was "enthusiastic" about launching an initial public offering of Saudi Aramco, and a decision would be made "over the next few months".

They must be getting nervous to even consider the idea of selling shares in Aramco; this clearly suggests that they are aware that the world might finally have found a way to wean itself of fossils fuels.

By 2030, the gap between capacity added by fossil fuels and renewable energy will widen to as much as 400%. The trend is in, and it appears that oil will have a hard time trading back to the lofty levels of $140.00. For the next 12 months, oil is not projected to trade past $60 for any prolonged period. Note the cost of batteries continues to drop and at some point; the electric car is going to become a real threat to the fossil fuel industry.

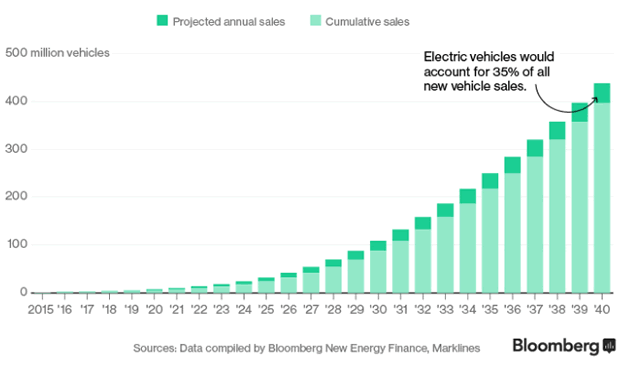

Battery prices fell 35% last year and at this pace, the cost of an electric car should be comparable to the cost of the gas-powered car by 2020. Bloomberg states that by 2040 long range electric cars will cost less than $22,000 in today's dollars.

By 2040, electric vehicles could account for 35% of all new vehicle sales

Game Plan

You can invest in Battery makers and the makers of electric cars; the most famous of these is TSLA (Tesla Motors). However, we suspect there will be a lot of competition in this field soon, and the price of these vehicles could plummet a lot faster than projected. Regarding TSLA, we would use strong pullbacks to open positions, other car makers such as NSANY (Nissan) and TM (Toyota) merit attention too. In terms of battery manufacturers, NIPNF (NEC Corp) and Panasonic Corp (PCRFY) are two companies you could take a closer look at.

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.