What New Economic Recovery?

Economics / US Economy Apr 03, 2016 - 12:02 PM GMTBy: Chris_Vermeulen

The rise of the ‘dollar store business model’ caters to a disappearing ‘middle class’ who are incurring shrinking incomes. This has made ‘dollar stores’ prosper, in the last decade. Dollar stores, for most Americans, have carried an odd sort of stigma. In the past, these stores were seen as shopping for the poor, only. We are all now aware that many people who were in the once strong American ‘middle class’ were thrown off of the prosperity path and into ‘lower income’ brackets from business layoffs, downsizing, and salary reduction. While regular product companies struggle the expanding ‘dollar stores’ have found a niche in this economic climate. The shrinking ‘middle class’ means more customers for ‘dollar stores’.

The rise of the ‘dollar store business model’ caters to a disappearing ‘middle class’ who are incurring shrinking incomes. This has made ‘dollar stores’ prosper, in the last decade. Dollar stores, for most Americans, have carried an odd sort of stigma. In the past, these stores were seen as shopping for the poor, only. We are all now aware that many people who were in the once strong American ‘middle class’ were thrown off of the prosperity path and into ‘lower income’ brackets from business layoffs, downsizing, and salary reduction. While regular product companies struggle the expanding ‘dollar stores’ have found a niche in this economic climate. The shrinking ‘middle class’ means more customers for ‘dollar stores’.

A big part of the ‘new recovery’ is lining up at midnight at Wal-Mart stores in order to purchase food. There are families not able to feed their families by the end of the month. They are literally lining up at midnight at Wal-Mart stores, waiting to buy food along with their Electronic Benefit Transfer (EBT) Cards when their funds are deposited into their accounts.

EBT cards are an electronic system that allows state welfare departments to issue benefits via magnetically encoded payment cards, used in the United States. The average monthly EBT payout is $125.00 per person!

Common benefits provided (in the United States) via EBT, are typically of two general categories: food and cash benefits. Food benefits are federally authorized benefits that can be used only to purchase food and non-alcoholic beverages. Food benefits are distributed through the Supplemental Nutrition Assistance Program (SNAP), formerly the Food Stamp Program. Cash benefits include state general assistance, Temporary Assistance for Needy Families (TANF) benefits, and refugee benefits.

There appears to be a ‘growing great divide’ within the current U.S. economy. The financial sector is swimming in their ‘bailout-induced profits’. Within their elite circles, it appears as if the ‘recession’ is over.

However, within the average American family, they are not experiencing available access to new credit cards, equity in their homes is vanishing and they do not have a store of available capital they can access like a ‘stock portfolio’.

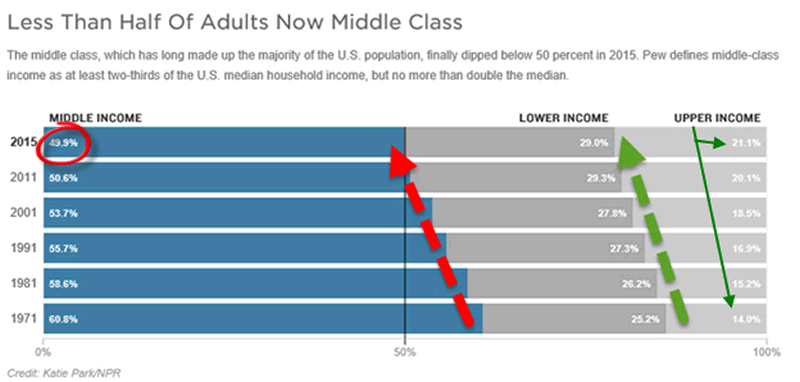

The table below clearly shows the middle class making less money year after year while the wealthy earn more each year. The money is slowly shifting from everyone to just the one-percenters – YIKES

Conclusion:

In short, the average American is slowly earning less and becoming financially stressed about their future outlook.

If you are one of these hard working individuals experiencing a decline in business/income its best you do some research and change what you are doing because things will likely get much worse before they get better.

Mainly because of Trump thousands of Americans are looking to leave the country with the search term “How to Move to Canada” up over 1000% last month. While I love Canada, myself being a Canadian and all, there are many other great places to live and a very full life at a fraction the cost of Canada/USA.

Couple years ago I went to the DR (Dominican Republic) to see if it would work for my family in the winters to escape the cold and be surrounded in palm trees, ocean and kitesurfing. It was an awesome experience with a huge amount of development, tons of Canadians, retirees, and elegant vacation properties available at Holden Sotheby’s.

There are many ways to preserve capital and also ways to grow it substantially no matter what the economy does and I share this information in the video on the home page of my Trading Newsletter Website.

See how we made money in the last 5 days trading – Click Here

Join my pre-market video newsletter and start your day with a hot cup of coffee and my market forecast video: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.