Why Did Britain Vote to Leave the EU?

Politics / BrExit Aug 05, 2016 - 02:35 PM GMTBy: Arkadiusz_Sieron

To better understand the consequences of the British referendum it is necessary to figure out the reasons behind the Brexit vote. We all know that David Cameron organized the plebiscite just to resolve internal disputes and end the divisions within the Conservative Party. He counted on Britons voting to “remain”, which would silence the anti-EU Tories. But as we know, he tragically miscalculated the odds. Why did Britain vote to leave the EU? Well, many factors contributed to this complex decision/issue.

To better understand the consequences of the British referendum it is necessary to figure out the reasons behind the Brexit vote. We all know that David Cameron organized the plebiscite just to resolve internal disputes and end the divisions within the Conservative Party. He counted on Britons voting to “remain”, which would silence the anti-EU Tories. But as we know, he tragically miscalculated the odds. Why did Britain vote to leave the EU? Well, many factors contributed to this complex decision/issue.

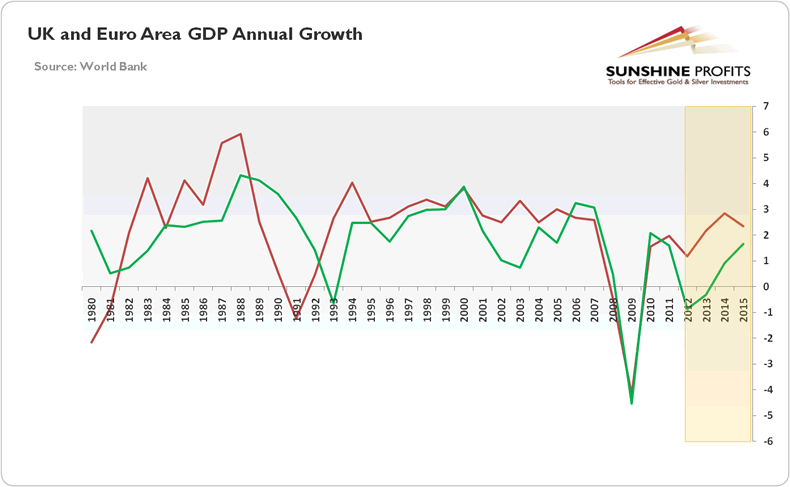

Britons have always been skeptical of deeper integration with the rest of Europe. You may think of this lack of optimism as an inland’s mentality (“splendid isolation”) combined with the imperial hangover and the memory of the incessant historical struggles with France, and the lonely fight against Nazi Germany in 1940-41. This hesitation how to arrange its relationship with the Europe is clearly seen in the contemporary political history. Despite the fact that Churchill opted for “the United States of Europe”, the UK declined an invitation to join the six founding nations of the European Economic Community (the EU’s predecessor) in signing the Treaty of Rome in 1957. Only in 1973 did Britain join (ok, the UK applied earlier, but France vetoed it) and just two years later there was the membership referendum (and 67 percent of voters supported integration at that time)! The euro-skeptical UK did not adopt the Euro instead of the pound, and did not join the Schengen Area, which would eliminate internal border controls. The dissatisfaction with the EU has intensified in recent years as the union struggled with the aftermath of the 2008 financial crisis. As the chart below shows, the UK’s economy recovered much faster than the Eurozone. The poor economic performance of the Eurozone highlighted the problems with the common currency and strengthened the belief that the UK’s future would be brighter outside the EU.

Chart 1: The UK’s (red line) and Eurozone’s (green line) GDP annual growth from 1980 to 2015

Although Britain always had a special status within the EU (a permanent rebate for contributions negotiated by Thatcher, opt-outs from the single currency and from some of EU’s rules, etc.); advocates of Brexit argued that the country would be better outside the European bloc. The most common arguments focused on the UK’s net contribution to the EU budget and the EU’s burdensome economic regulations. For us, these arguments were flawed, as the UK’s net contribution amounts only to about 0.35 percent of GDP and is similar to what Norway pays while not being within the EU. The economic costs of the Brexit (higher uncertainty and reduced trade, immigration and foreign investment) would be much higher than that (the exact number depends on the model, but most of the economic reports agree that it would be around few percentage points of the GDP). Moreover, despite being a member of the EU, Britain is already the least regulated country in the world. Therefore, scrapping the EU’s regulations would bring only limited benefits – the truth is that many of the strictest British regulations are domestic (for example, rules for climate change have gone further than the EU’s standard). Funnily enough, supporters of the Brexit and deregulation complained about too immigration rules that were too liberal.

Actually, the main reasons behind the Brexit vote were citizens’ growing alienation from a technocratic elite and the opposition to immigration. It would have been quite ironic given the fact that the UK colonized much of the world, but it is rather depressing instead, as OECD noted that immigration actually accounted for one-half of the UK’s GDP growth since 2005, with more than 2 million jobs created. To be clear, we are not fans of EU’s bureaucracy – we can note absurd EU’s regulations and a democratic deficit in it. However, the problem is that the Brexit vote was not only anti-establishment, but mainly anti-immigration. The sad truth is that the Britons’ decision was motivated by the protectionism uprising and nostalgia for the allegedly safer and more predictable past. Indeed, the results of the referendum may be considered as part of a global wave of populist anger rejecting international cooperation in favor of nationalism. Britons (and basically people all over the world) just fear globalization, which, according to them, has brought migrants to their countries, has undermined job security and has benefited only the privileged elites.

The simple fact is that, despite many complex and multi-faceted reasons, the UK always was skeptical of political union and preferred the EU as only a common, single market. The British euro-skepticism has been amplified by the poor economic performance of the European economies after the 2008 financial turmoil, the protracted Greek debt-crisis, the EU’s dysfunctional response to its migrant crisis, and some myths about alleged benefits of the divorce. However, for us, the major cause of the Brexit vote was populist and anti-immigration insurgency.

If our diagnosis is correct, it should be great news for the gold market in the coming years. After the British referendum, anti-EU parties in Europe and protectionist politicians abroad, like Donald Trump, may find more wind in their sails. The populist uprising increases the risks of implementing more nationalistic and protectionist economic policies all over the world, not to mention the threat of the EU’s disintegration, which should support the price of gold, due to growing safe-haven activity.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.