King of Debt vs. Queen of Deficits

Interest-Rates / US Debt Aug 30, 2016 - 05:31 PM GMTBy: Michael_Pento

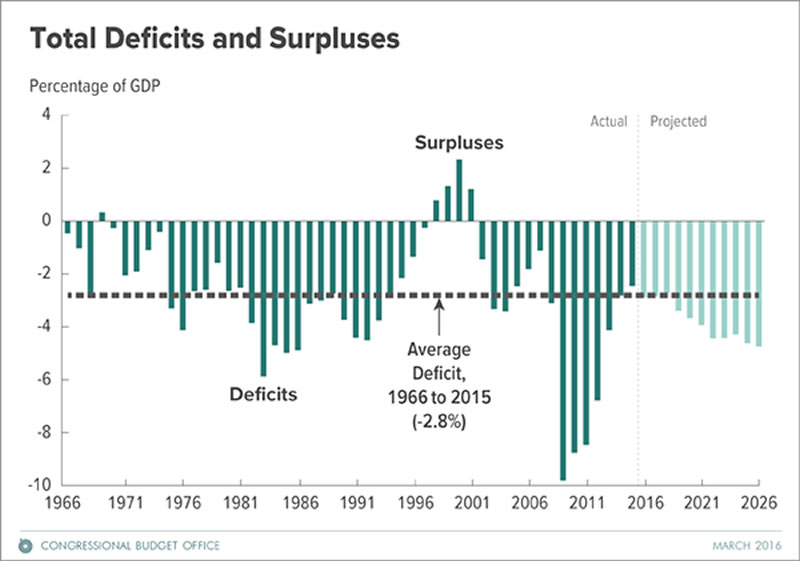

The Congressional Budget Office (CBO) estimates the total deficit for fiscal 2016 will be $590 billion. This is $152 billion (34%) greater than the shortfall posted in fiscal year 2015. And by 2026 the deficit would be considerably larger as a share of the nation’s output (GDP) than its average over the past 50 years.

The Congressional Budget Office (CBO) estimates the total deficit for fiscal 2016 will be $590 billion. This is $152 billion (34%) greater than the shortfall posted in fiscal year 2015. And by 2026 the deficit would be considerably larger as a share of the nation’s output (GDP) than its average over the past 50 years.

In addition to this, debt held by the public would rise significantly from its already high level, reaching 86% of GDP by 2026.

These accumulating budget deficits add to the Gross Federal debt that is now over $19.4 trillion dollars (105% of GDP). Most importantly, the debt and deficit estimates from the CBO assumes a growth rate in nominal and real GDP that is markedly higher than any other enjoyed in recent history; and also do not include any recessions over the next decade.

But the nation’s growing debt and deficits don’t appear to be weighing on anyone’s mind. After all, Americans are burdened on a daily basis by more pressing issues such as an Olympic swimmer's drunken exploits and the ongoing search for Pokémon. Unfortunately, while the hypnotism of America intensifies, our debt burden grows unabated.

But with the election year upon us, one would have hoped this topic was at least superficially broached. That the two candidates would have at the very least made a glib proposal as to how they would avert our impending debt crisis.

Instead, both Clinton and Trump appear hell-bent on outspending each other at every campaign stop.

Hillary says if you are with “her” you’ll get free college tuition! Her $350 billion proposal covers millions of voters set to pay for college, as well as interest rate relief for those saddled with student loans. Clinton has gotten applause when she suggests she will stick the rich with the bill. But this no growth economy isn’t churning out enough Beyoncé’s, to pick up the cost of college for the other ninety-nine-point-nine-nine percent. And a transfer of the cost of college education from the individual to the state will explode future federal deficits.

Ivanka Trump described her father as “a tough-talking deal-maker who also worries about family leave, equal pay for women and the cost of child care.” But this softer side of Trump that Ivanka reveals is certain to make America broke again. Trump is promising working moms free child care. It’s unclear how much this will cost since the proposal keeps changing but unless he can get Mexico to pay for it, it will add a lot to the deficit. In fact, the self-proclaimed lover and king of debt even goes so far to claim, “I would borrow, knowing that if the economy crashed, you could make a deal.”

But the proposed spending doesn’t just stop at child care and college. Both candidates promise infrastructure programs to rebuild America’s roads, bridges, and airports.

Clinton's plan, which is estimated to cost $275 billion over five years, calls for setting up a national infrastructure bank to help fund large-scale projects. For the record, an infrastructure bank is a euphemism for off balance sheet government borrowing. And if Hillary’s spending plan is big, Trump’s, as you can imagine, is “Yuge” – his program is set to be double that of Clintons…not including the wall.

Both candidates will significantly add to the amount of red ink. The Committee for a Responsible Federal Budget estimates that Donald Trump’s plan would add $2.55 trillion to the deficit over the next decade. And a study by the American Action Forum says Clinton's plan will increase the deficit by $2.2 trillion.

But the scary truth is that even if current laws remain in place, the pressures from rising deficits will catapult debt held by the public three decades from now to constitute 155% of GDP, a far larger percentage than any recorded in the nation’s history.

The last recession saw an increase in the 2009 annual deficit of $1.2 trillion; bringing it to $1.4 trillion. Since annual deficits are already rising quickly--and are set to increase dramatically regardless of who is president--we can anticipate an unmitigated disaster if interest payments begin to rise towards more normal levels.

The major take away is this: Deficits will quickly explode over $2 trillion once the next recession hits, which is already overdue, and will go significantly higher if debt service payments are rising. This massive debt burden is only made manageable by eight years of near-zero percent interest rates and the global $200 billion worth of monthly QE. This incendiary cocktail will explode in a deflationary implosion if QE were to ever stop; or will soon result in a pernicious outbreak of global inflation if central banks keep printing money at this torrid and unprecedented pace. Therefore, a dynamic investment strategy that can profit from either of these scenarios has now become mandatory.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.