US Economy GDP Growth Estimates in Free-Fall: FRBNY Nowcast 2.26% Q3, 1.22% Q4

Economics / US Economy Sep 24, 2016 - 01:03 PM GMTBy: Mike_Shedlock

GDP estimates for third and fourth quarter are now in a free-fall.

GDP estimates for third and fourth quarter are now in a free-fall.

Last Friday the FRBNY Nowcast was in a blackout period because of the FOMC meeting on Wednesday.

Today we see estimates tor the last two weeks. Let's also take a look at my guess of the estimates vs. how the estimates came in.

September 23, 2016 Nowcast Highlights

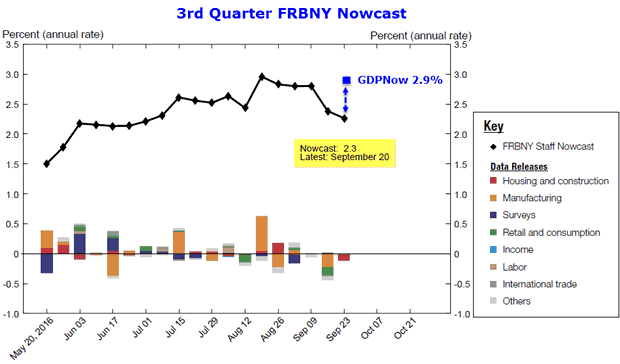

- The FRBNY Staff Nowcast stands at 2.3% and 1.2% for 2016:Q3 and 2016:Q4, respectively.

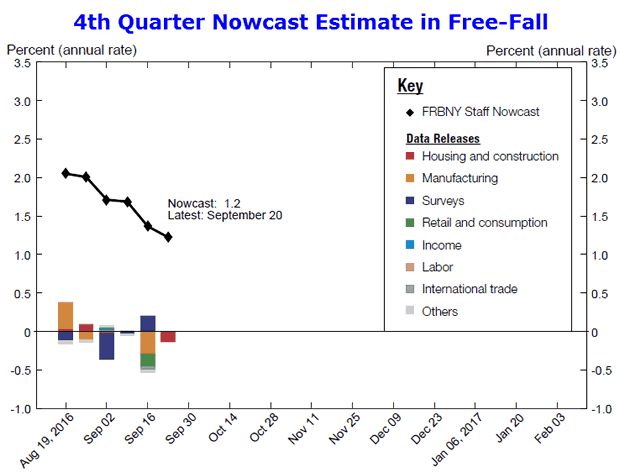

- Negative news since the report was last published two weeks ago pushed the nowcast down 0.5 percentage point for both Q3 and Q4.

- The largest negative contributions over the last two weeks came from manufacturing, retail sales, and housing and construction data.

3rd Quarter Nowcast vs. GDPNow

GDPNow is still strongly divergent with the Nowcast. However, the current GDPNow estimate of 2.94% is down from the initial August 3 estimate of 3.64% and the peak estimate on August 5 of 3.80%.

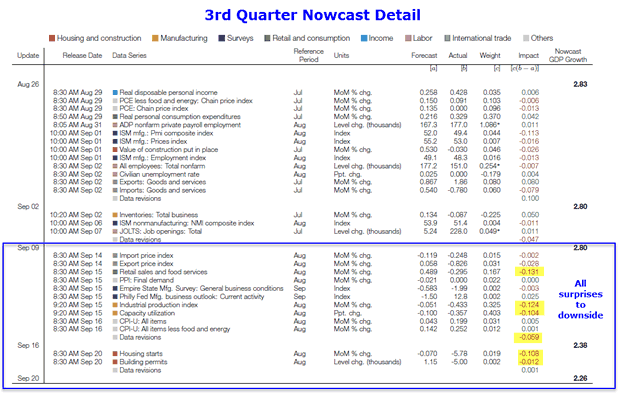

3rd Quarter Nowcast Detail

It's not the data itself that matters, but rather how well the data came in vs. what the model estimated. Since the last estimate, nearly all data did worse than the model expected.

4rd Quarter Nowcast in Free-Fall

The initial 4th quarter Nowcast was 2.01 on August 26. On September 20, the Nowcast stood at 1.22.

October Surprise Revisited

On September 19, the Wall Street Journal was talking about an "October Surprise" to the upside. My rebuttal, on the same day was 3rd Quarter GDP: October Surprise? Which Way?.

Guess of the Next Nowcast Guess

Based on recent data, my guess of the next FRBNY Nowcast guess is 2.4% for third quarter and 1.4% for 4th quarter. We will find out this Friday.

On Oct. 28, 11 days before the Nov. 8 presidential election, the Commerce Department's publishes its first (advance) estimate of gross domestic product for the 3rd quarter.

Meanwhile there's 39 days for economists to change their minds as to what will constitute a "surprise".

As it stands now, 2.8% to 3.0% is a consensus estimate, not a surprise.

Downward Surprise?

By definition, surprises have to be what most don't expect.

I suspect 3rd quarter GDP will be closer to 2.0% than 3.0%. I will make a comparatively shocking prediction of 1.8%, subject to revision between now and the final guess everyone gets to make.

There's still five weeks of economic data yet to come in.

If the inventory build occurs that economists expect, it will be at the expense of 4th quarter GDP.

No miracles are to be found in Janet Yellen's hat.

Existing Home Sales

On September 22, I commented Existing Home Sales Sink Second Month: NAR, Economists Surprised.

"I am going to mentally take a couple of ticks off of my guess of the next FRBNY Nowcast report due tomorrow. Most likely it will be a surprise to the economists."

My initial guess of the guess was nearly spot on. However, today's Nowcast report was through September 20, not September 22.

So mentally subtract another tick or two off the current Nowcast estimates of 2.26% and 1.22% for 3rd and 4th quarter respectively. Next week start off in a hole.

Looking further ahead, if there are more downward surprises, and I certainly expect some, 3rd quarter GDP will be under 2%, perhaps substantially.

October Surprise Indeed!

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.