Today’s Fed Makes Volcker Look Timid

Interest-Rates / US Federal Reserve Bank Sep 30, 2016 - 03:17 PM GMTBy: John_Mauldin

Let’s look at the Fed’s (and other central banks’) magnitude of monetary manipulation in recent years and the very constrained maneuvering room they now have as a consequence.

Let’s look at the Fed’s (and other central banks’) magnitude of monetary manipulation in recent years and the very constrained maneuvering room they now have as a consequence.

Of course, it’s questionable whether they should even be trying to maneuver the economy to the degree that they are. The current problem is a direct result of mistakes made during and after the last financial crisis.

Two Charts: Bernanke Was More Extreme Than Volcker

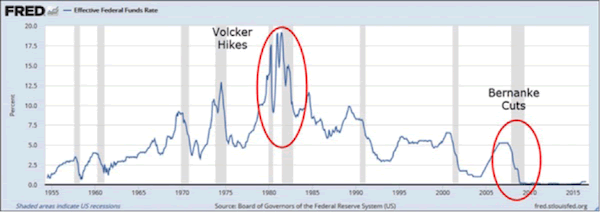

Here’s a long-term chart of the federal funds rate, the Fed’s main policy tool:

The gray vertical bars represent recessions. You can see how the Fed has historically dropped rates in response to recessions and then tightened again when those recessions ended. I red-circled the drastic loosening and retightening under Paul Volcker in the early 1980s and Ben Bernanke’s cuts to near-zero in 2008.

To this day, the Volcker rate hikes are legendary. No Fed chair has ever done anything like that—before or since. You hear it all the time.

Problem: it’s not true.

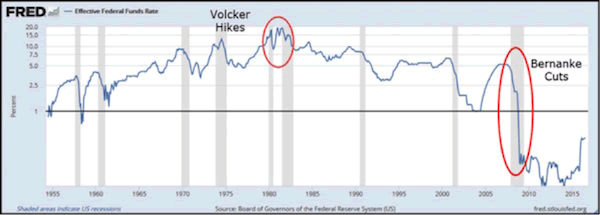

Here’s the same chart again. This time with a log scale on the vertical axis. This adjusts the rate changes to be proportionate with percentage rises and falls. The percentage change between 5% and 10% is the same as between 10% and 20%, since both represent a doubling of the lower number.

Looking at it this way, the Volcker hikes are tame.

But the Bernanke cuts dwarf all other interest rate changes since 1955. Nothing else is even close.

Bernanke’s rate cuts were far, far more aggressive than Volcker’s rate hikes.

Why did Bernanke—et al.—cut rates to zero? Because moving rates up and down was all they knew to do.

The Fed Is Scared of Wall Street

Moving rates had always worked before. If it wasn’t working this time, the Bernanke-led Fed figured more of the same should do the trick. And it might have worked for a year or two. After that, though, the Fed was so scared of a negative stock market reaction that they kept rates artificially low for eight years.

Central banks all over the world did the same—and more. The suffering caused by this bone-headed policy has intensified for all these years. You may not be suffering yourself, but I bet someone close to you is. And I guarantee you that your retirement funds have suffered.

Now, the supposedly humming economy is going to suffer another recession in the not-too-distant future. What then?

The Fed Is Ready to Go Negative

For lack of anything else, the Fed is preparing to send interest rates below zero. That was clearly the message from Jackson Hole.

How in Hades did we get to a place where negative rates were considered a good idea? One of the most stupid ideas ever cooked up in academia is now seen as rational and globally applicable.

What should we do? There are not many options. There is no magic wand to get us to normal. If there were, I’m pretty sure the Federal Reserve would wave it at once, because I think everybody realizes that rates should already have been normalized—and that to do so now is going to be problematic.

We really have come to a place where there are no good choices.

Join Hundreds of Thousands of Readers of John Mauldin’s Free Weekly Newsletter

Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news and analyzes challenges and opportunities on the horizon.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.