Do Larger Federal Budget Deficits Stimulate Spending? Depends On Where The Funding Comes From

Economics / US Debt Dec 13, 2016 - 07:09 PM GMTBy: John_Mauldin

I’d like to share a counterintuitive argument against the concept that fiscal deficits and/or infrastructure spending consititute effective economic stimulus. It comes from Paul Kasriel (one of my favorite reads when he was at Northern Trust, before he retired). He always has a way of looking at things from different angles than everybody else does.

I’d like to share a counterintuitive argument against the concept that fiscal deficits and/or infrastructure spending consititute effective economic stimulus. It comes from Paul Kasriel (one of my favorite reads when he was at Northern Trust, before he retired). He always has a way of looking at things from different angles than everybody else does.

Paul notes that the post-election US stock market rally has been due in part to the expectation that the Trump administration will enact stimulative fiscal policies, which in turn will jumpstart growth. But Paul begs to differ on that last point.

He tells us that after some years out in the real world, he realized that tracing through where government gets the funds to finance tax cuts and increased spending is the most important issue in assessing the potential effects of stimulative fiscal policy.

Paul engages us in a thought experiment to make his case. I think I’ll just step aside and let him lead the way. He got me thinking, that’s for sure.

Do Larger Federal Budget Deficits Stimulate Spending? Depends on Where the Funding Comes From

By Paul Kasriel

The U.S. equity markets have rallied in the wake of Donald Trump’s presidential election victory. Various explanations have been given for the stock market rally. President-elect Trump’s pledge to scale back business regulations are favorable for various industries, especially financial services and pharmaceuticals. Likewise, President-elect Trump’s vow to increase military spending is an undeniable plus for defense contractors. But another explanation given for the post-election stock market rally is that U.S. economic growth will be stimulated by the almost certain business and personal tax-rate cuts that will occur in the next year, along with the somewhat less certain increase in infrastructure spending. It is this conventional –wisdom notion that tax-rate cuts and/or increased federal government spending stimulate domestic spending on goods and services that I want to discuss in this commentary.

Although I have been a recovering Keynesian for decades, I got hooked on the Keynesian proposition that tax-rate cuts and increased government spending could stimulate domestic spending after having taken my first macroeconomics course way back in 19 and 65. I was so intoxicated with Keynesianism that I made a presentation about it in a political science class. I dazzled my classmates with explanations of the marginal propensity to consume and Keynesian multipliers. My conclusion was that economies need not endure recessions if only policymakers would pursue Keynesian prescriptions with regard to tax rates and government spending. Reading the body language of my classmates, I believed that I had just enlisted a new cadre of Keynesians. That is, until one older student sitting in the back of the class raised his hand and asked the simple question: Where does the government get the funds to pay for the increased spending or tax cuts? I had to call on all of my obfuscational talents to keep my classmates and mein the Keynesian camp.

When I graduated from college with a degree in economics, I still was a Keynesian, perhaps a bit more sophisticated one, but not much. At graduate school, I became less enchanted with Keynesianism. But Keynesianism is similar to an incorrect golf grip. If you start out playing golf with an incorrect grip, you will have a tendency to revert to it on the golf course even after hours of practicing at the driving range with a correct grip. Bad habits die hard. So, even though I had drifted away from Keynesianism, it was easy and “comfortable” to slip back into a Keynesian framework when performing macroeconomic analysis. Yet, I continued to be haunted by that question my fellow student asked me: Where does the government get the funds to pay for the increased spending or tax cuts?

I guess I am a slow learner, but after a number of years in the “real world”, away from the pressure of academic group-think, I realized that tracing through the implications of where the government gets the funds to finance tax-rate cuts and increased spending is the most important issue in assessing the stimulative effect of changes in fiscal policy. And my conclusion is that tax-rate cuts and increased government spending do not have a significant positive cyclical effect on economic growth and employment unless the government receives the funding for such out of “thin air”.

Let’s engage in some thought experiments, beginning with a net increase in federal government spending, say on infrastructure projects. Let’s assume that these projects are funded by an increase in government bonds purchased by households. Let’s further assume that the households increase their saving in order to purchase these new government bonds. When households save more, they cut back on their current spending on goods and services, transferring this spending power to another entity, in this case the federal government. So, the federal government increases its spending on infrastructure, resulting in increased hiring, equipment purchases and profits in the infrastructure sector of the economy. But with households cutting back on their current spending on goods and services, that is, increasing their saving, spending and hiring in the non-infrastructure sectors of the economy decline. There is no net increase in spending on domestically-produced goods and services in the economy as a result of the bond-financed increase in infrastructure spending. Rather, there is only a redistribution in total spending toward the infrastructure sector and away from other sectors.

What if a pension fund purchases the new bonds issued to finance the increase in government infrastructure spending? Where does the pension fund get the money to purchase the new bonds? One way might be from increased pension contributions. But an increase in pension contributions implies an increase in saving by the pension beneficiary. The pension fund is just an intermediary between the borrower, the government, and the ultimate saver, households or businesses saving for the benefit of households. Again, there is no net increase in spending on domestically-produced goods and services in the economy.

What if households or pension funds sell other assets to nonbank entities to fund their purchases of new government bonds? Ultimately, some nonbank entity needs to increase its saving to purchase the assets sold by households and pension funds. Again, there is no net increase in spending on domestically- produced goods and services in the economy.

What if foreign entities purchase the new government bonds? Where do these foreign entities get the U.S. dollars to pay for the new U.S. government bonds? By running a larger trade surplus with the U.S. That is, foreign entities export more to the U.S. and/or import less from the U.S., thereby acquiring more U.S. dollars with which to purchase the new U.S. government bonds. Hiring and profits increase in the U.S. infrastructure sector, decrease in the U.S. export or import-competing sectors.

Now, let’s assume that the new government bonds issued to fund new government infrastructure spending are purchased by the depository institution system (commercial banks, S&Ls and credit unions) and the Federal Reserve. In this case, the funds to purchase the new government bonds are created, figuratively, out of “thin air”. This implies that no other entity need cut back on its current spending on goods and services while the government increases it spending in the infrastructure sector. All else the same, if an increase in government infrastructure spending is funded by a net increase in thin-air credit, then there will be a net increase in spending on domestically-produced goods and services and a net increase in domestic employment. We cannot conclude that an increase in government infrastructure spending funded from sources other than thin-air credit will unambiguously result in a net increase in spending on domestically-produced goods and services and a net increase in employment.

President-elect Trump’s economic advisers have suggested that an increase in infrastructure spending could be funded largely by private entities through some kind of public-private plan. This still would not result in net increase in U.S. spending on domestically-produced goods and services and net increase in employment unless there were a net increase in thin-air credit. The private entities providing the bulk of financing of the increased infrastructure spending would have to get the funds either from some entities increasing their saving, that is, by cutting back on their current spending, or by selling other existing assets from their portfolios. As explained above, under these circumstances, there would be no net increase in spending on domestically-produced goods and services.

Now, it is conceivable that an increase in infrastructure spending, while not resulting in an immediate net increase in spending on domestically-produced goods and services, could result in the economy’s future potential rate of growth in the production of goods and services. To the degree that increased infrastructure increases the productivity of labor, for example, speeds up the delivery of goods and services, then that increase in infrastructure spending could allow for faster growth in the future production of goods and services.

Another key element in President-elect Trump’s proposed policies to raise U.S GDP growth is to cut tax rates on households and businesses. To the degree that tax-rate cuts result in a redistribution of a given amount of spending away from pure consumption to the accumulation of physical capital (machinery, et. al.), human capital (education) or an increased supply of labor, tax-rate cuts might result in an increase in the future potential rate of growth in GDP, but not the immediate rate of growth unless the tax-rate cuts are financed by a net increase in thin-air credit.

At least starting with the federal personal income tax-rate cut of 1964, all personal income tax-rate cuts have been followed with cumulative net widenings in the federal budget deficits. So, for the sake of argument, let’s assume that the likely forthcoming personal and business tax-rate cuts result in a wider federal budget deficit. Suppose that households in the aggregate use their extra after-tax income to purchase the new bonds the federal government sells to finance the larger budget deficits resulting from the tax-rate cuts. The upshot is that there is no net increase in spending on domestically-produced goods and services nor is there any net increase in employment emanating from the tax-rate cuts.

My conclusion from the thought experiments discussed above is that increases in federal government spending and/or cuts in tax rates have no meaningful positive cyclical effect on GDP growth unless the resulting wider budget deficits are financed by a net increase in thin-air credit, that is a net increase in the sum of credit created by the depository institution system and credit created by the Fed.

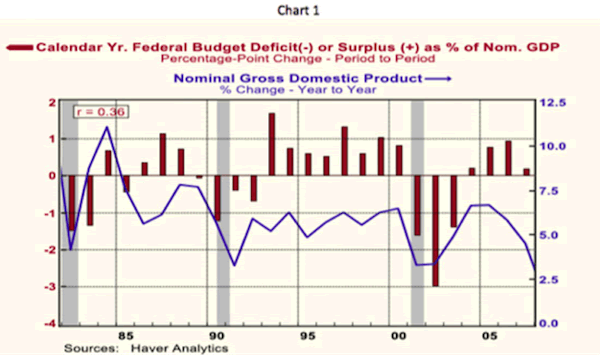

Let’s look at some actual data relating changes in the federal deficit/surplus to growth in nominal GDP. I have calculated the annual calendar- year federal deficits/surpluses, and then calculated these deficits/surpluses as a percent of annual average nominal GDP. The red bars in Chart 1 are the year-to- year percentage-point changes in the annual budget deficits/surpluses as a percent of annual-average nominal GDP. The blue line in Chart 1 is the year-to-year percent change in average annual nominal GDP. According to mainstream Keynesian theory, a widening in the budget deficit relative to GDP is a “stimulative” fiscal policy and should be associated with faster nominal GDP growth. A widening in the budget deficit relative to GDP would be represented by the red bars in Chart 1 decreasing in magnitude, that is, becoming less positive or more negative in value. According to mainstream Keynesian theory, this should be associated with faster nominal GDP growth, that is, with the blue line in Chart 1 moving up. Thus, according to mainstream Keynesian theory, there should be a negative correlation between changes in the relative budget deficit/surplus and growth in nominal GDP. The annual data points in Chart 1 start in 1982 and conclude in 2007. This time span includes the Reagan administration’s “stimulative” fiscal policies of tax-rate cuts and faster-growth federal spending, the George H. W. Bush and Clinton administrations’ “restrictive” fiscal policies of tax-rate increases and slower-growth federal spending and the George H. Bush administration’s “stimulative” fiscal policies of tax-rate cuts and faster- growth federal spending.

In the top left-hand corner of Chart 1 is a little box with “r=0.36” within it. This is the correlation coefficient between changes in fiscal policy and growth in nominal GDP. If the two series are perfectly correlated, the absolute value of the correlation coefficient, “r”, would be equal to 1.00. Both series would move in perfect tandem. As mentioned above, according to mainstream Keynesian theory, there should be a negative correlation between changes in fiscal policy and growth in nominal GDP. That is, as the red bars decrease in magnitude, the blue line should rise in value. But the sign of the correlation coefficient in Chart 1 is, in fact, positive, not negative as Keynesians hypothesize. Look, for example, at 1984, when nominal GDP growth (the blue line) spiked up, but fiscal policy got “tighter”, that is the relative budget deficit in 1984 got smaller compared to 1983. During the Clinton administration, budget deficits relative to nominal GDP shrank every calendar year from 1993 through 1997, turning into progressively higher surpluses relative to nominal GDP starting in calendar year 1998 through 2000. Yet from 1993 through 2000, year-to-year growth in nominal GDP was relatively steady holding in a range of 4.9% to 6.5%. Turning to the George H. Bush administration years, there was a sharp “easing” in fiscal policy in calendar year 2002, with little response in nominal GDP growth. As fiscal policy “tightened” in subsequent years, nominal GDP growth picked up – exactly opposite from what mainstream Keynesian theory would predict.

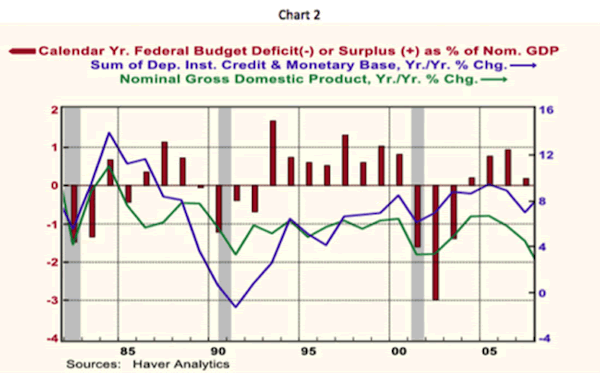

Of course, there are macroeconomic policies that might be changing and having an effect on the cyclical behavior of the economy other than fiscal policy. The most important of these other macroeconomic policies is monetary policy, specifically the behavior of thin-air credit. In Chart 2, I have added an additional series to those in Chart 1 – the year-to-year growth in the annual average sum of depository institution credit and the monetary base (reserves at the Fed plus currency in circulation). “Kasrielian” theory hypothesizes that there should be a positive correlation between changes in thin-air credit and changes in nominal GDP. With three variables in chart, Haver Analytics will not calculate the cross correlations among all the variables. But E-Views will. And the correlation between annual growth in thin-air credit and nominal GDP from 1982 through 2007 is a positive 0.53. Not only is this correlation coefficient 1-1/2 times larger than that between changes in fiscal policy and nominal GDP growth, more importantly, this correlation has the theoretically correct sign in front of it. By adding growth in thin-air credit to the chart, we can see that the strength in nominal GDP growth in President Reagan’s first term was more likely due to the Fed, knowingly or unknowingly, allowing thin-air credit to grow rapidly. Similarly, the reason nominal GDP growth recovered from the George H. W. Bush presidential years and was relatively steady was not because tax rates were increased in 1993 and federal spending growth slowed, but rather because growth in thin-air credit recovered in 1994 and held relatively steady through 1999.

In sum, there may be rational reasons why the U.S. equity markets rallied in the wake of Donald Trump’s presidential election victory. But an expectation of faster U.S. economic growth due to a more “stimulative” fiscal policy is not one of them unless the larger budget deficits are financed with thin-air credit. Fed Chairwoman Yellen, whether you know it or not, you are in the driver’s (hot?) seat.

Get Varying Expert Opinions in One Publication with John Mauldin’s Outside the Box

Every week, celebrated economic commentator John Mauldin highlights a well-researched, controversial essay from a fellow economic expert. Whether you find them inspiring, upsetting, or outrageous… they’ll all make you think Outside the Box. Get the newsletter free in your inbox every Wednesday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.