Here’s the Real Oil Price Russia Needs to Break Even

Commodities / Crude Oil Jan 04, 2017 - 11:54 AM GMTBy: John_Mauldin

BY JACOB SHAPIRO : We published our 2017 forecast earlier this week. One of our predictions is that Russia is in for a difficult year economically. This is because Russia’s economy depends significantly on oil.

BY JACOB SHAPIRO : We published our 2017 forecast earlier this week. One of our predictions is that Russia is in for a difficult year economically. This is because Russia’s economy depends significantly on oil.

The price of oil in 2016 has averaged roughly $43 a barrel. That’s a far cry from two years ago, when it was more than double. According to Russia’s Federal Customs Service, oil-export revenue accounts for 26 percent of total revenue from Russian exports. For an economy with exports making up almost 30 percent of GDP, that’s fairly significant.

Russia has seen this problem manifest in its ballooning 2016 budget deficit. The budget deficit was $25 billion in 2015, or 2.6 percent of total GDP, according to Russia’s Finance Ministry. But Russia’s finance minister said last September that 2016 budget deficit projections had been revised upward. It could reach 3.7 percent of Russia’s GDP by year’s end.

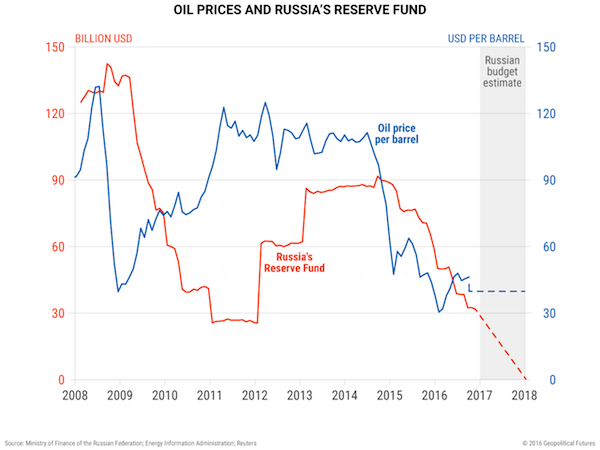

This is why Russia has been dipping into reserve funds. They’ve also slashed social services and pension benefits.

Doing the Math

A great deal of ink has been spilled over the rise in oil prices since the OPEC agreed to production cuts on November 30. Let’s leave aside that oil has not actually surged upwards. (The price for Brent crude at closing on December 14 was only 11 percent higher than November 28.)

Instead of speculating on market gyrations, it is more interesting to figure out the exact oil price that would be geopolitically significant from Russia’s point of view.

Russia’s finance minister said last January that Russia could balance its budget if oil reached $82 a barrel. But we have a doctrinal distrust of politicians’ statements. So, we wanted to see if we could discover a similar figure—or a more accurate one—on our own.

Russia reports oil-export revenue in both metric tons and dollars. According to Russia’s Federal Customs Service, from January to October 2016, Russia exported $59.6 billion worth of oil. That’s about 213 million metric tons of crude. Converting metric tons to barrels for crude is not simple. Each type differs in density. The generally accepted conversion for metric tons to barrels is 7.33 (according to BP’s Statistical Review of World Energy).

By analyzing Russia’s export statistics this way, it is possible to make two observations. One is that in the first 10 months of 2016, Russia produced almost 5 percent more oil than in all of 2015. That means, it needed to sell more this year than last. The other is that we can roughly estimate Russia thus far this year has exported approximately 5.13 million barrels of oil per day.

Breaking Even

From here we have to make a bit of a leap. Russian statistics show it exported $76.7 billion of oil in 2015, when the average price was $41.85. With data from the first 10 months of 2016, we have to do a little guesswork. But let’s assume that in November and December of this year, Russia will have exported the average value it exported in the first 10 months of the year. (In reality, it probably will be a little more.) That means total Russian oil exports in 2016 would be approximately $71.52 billion.

We also must factor in recent comments by Russia’s energy minister that indicate Russia has, at least verbally, agreed to coordinate its oil production with OPEC’s cuts. Russian would reduce production by 300,000 barrels per day (bpd) in 2017. If we assume that is removed from Russia’s average production next year, we conclude Russia will export roughly 4.8 million bpd next year.

As stated above, Russia expects to run a budget deficit of $48.1 billion in 2016. If Russian oil exports are valued at $71.52 billion in 2016, that means Russia would have to export $48.1 billion more oil in order to break even just on its budget deficit. That comes to approximately $68 a barrel, assuming daily production of 4.8 million barrels. That is a little lower than Russia’s finance minister suggested earlier in the year. But it’s not overly surprising.

The State Duma in Russia recently approved next year’s budget, and parts of it—such as certain types of defense spending—are not publicly reported. The finance minister may know of other costs that must be factored in that we don’t. Or he may simply have wanted to lower expectations.

Too Much Supply

This means that Russia needs oil prices to increase by about 30 percent from the current position. That’s just to break even on the budget. Even that much of a rise would not solve Russia’s economic problems. It would only mean that Russia would be able to continue current levels of spending without having to dip into various reserve funds.

That spending already includes cuts to various social services. Russia’s Finance Ministry has already indicated it expects one of those funds to be spent covering the budget deficit in 2017. Russia expects the budget deficit to slightly decrease to 3 percent of GDP.

A significant increase in oil prices in 2017 at this point seems unlikely. The market is oversupplied. Growth projections for major economies in the world are stagnant at best. And the higher the price increases, the more likely the US will increase production.

OPEC and other oil exporters participating in production cuts may be able to make a dent in oversupply. (That’s assuming they break historical precedent and don’t cheat on quotas). But they won’t be able to solve the problem entirely, nor prevent other countries from increasing production.

Getting caught up in market swings can be addictive. Since we care about such things because of what they mean geopolitically, we discipline ourselves as much as possible. The above logic shows why oil prices would have to be maintained over at least $68 a barrel for a sustained period before we start getting too excited.

Grab This Free Report to See What Lies Ahead in 2017

Now, for a limited time, you can download this free report from Mauldin Economics detailing the rocky roads that lie ahead for three globally important countries in 2017—and how the economic fallout from their coming crises could affect you. Top 3 Economic Surprises for 2017 is required reading for investors and concerned citizens alike. Get your free copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.