US Soaring Jobless Claims and the "L" Shaped Recession

Economics / US Economy Aug 07, 2008 - 04:08 PM GMTBy: Mike_Shedlock

Implications Of An Overleveraged Consumer

Implications Of An Overleveraged Consumer

For an economy overleveraged on consumer spending the chart could hardly look worse. Yet, it is going to get worse, lots worse. Hiring has stalled, commercial real estate is hitting the skids, vacancy rates at malls are rising, lease rates are dropping. In short, the Shopping Center Economic Model Is History .

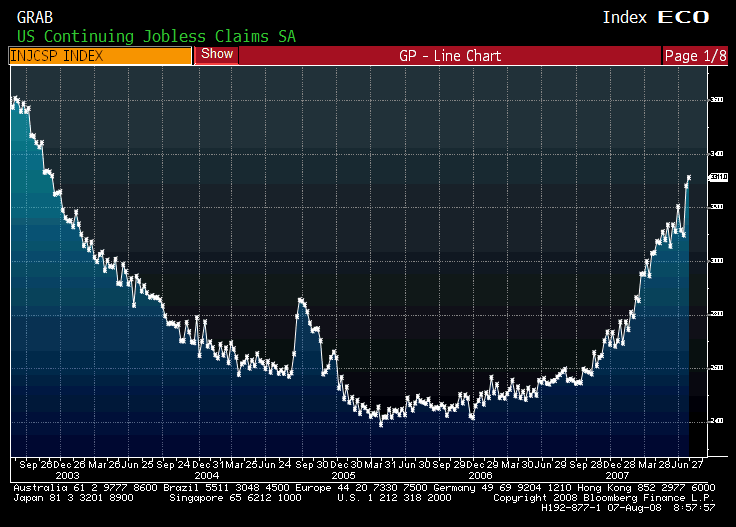

Continuing Jobless Claims

The reported unemployment rates is 5.7% and rising rapidly. It takes somewhere between +100K and +150K jobs a month to keep up with the birthrate and immigration. Yet, Jobs Have Declined 7 Consecutive Months .

It will be interesting to see what the above chart looks like and what the economy looks like when the unemployment rate hits 6.5% or 7% sometime next year.

Some will point out that unemployment is a lagging indicator. It indeed is. That means unemployment will keep rising even after the economy has turned.

Now think of the implication of housing foreclosures and housing prices in light of that.

Short Squeeze In Reverse

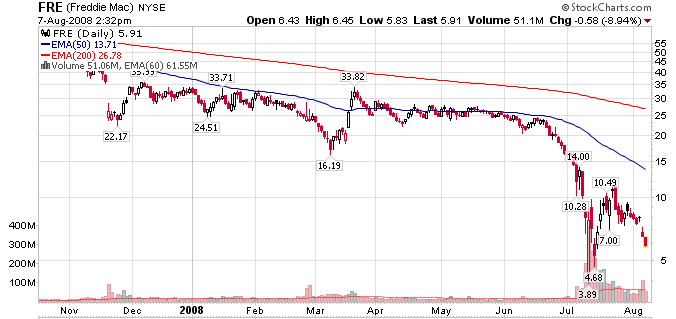

The SEC triggered a short squeeze in financials by proposing to prop up the share price of the GSEs and instituting Selective Enforcement of Regulation SHO .

In addition, Treasury Secretary Paulson asked for and received permission to buy unlimited positions in Fannie Mae (FNM) and Freddie Mac (FRE) stocks and bonds. See US Blackmailed By China? for more on the story.

Fannie Mae Chief Executive Officer Daniel Mudd called Paulson's move a "confidence building measure". Mudd cannot possibly be further from the truth.

Let's take a look at how well those "confidence building measures" worked.

Fannie Mae (FNM) Daily Chart

Freddie Mac (FRE) daily chart

Market intervention and manipulation cannot change the long term trend.

The "L" Shaped Recession

In my opinion, the past 7 years have been among the most fiscally reckless ever in the entire history of the world. The hangover is going to be long and deep. I am sticking with my Case for an "L" Shaped Recession .

Ironically, clowns on CNBC are debating every day whether or not a recession has even started. The only way a recession hasn't started is by using a definition of 2 consecutive quarters of declining GDP. That definition is widely used but it simply is not how recession calls are made.

What actually happens is the National Bureau of Economic Research (NBER)decides recessions using a wide range of data, not just quarter to quarter GDP.

The Library of economics has a discussion of the above as well as data on the average length of a recession . From 1920 to 1938 the average length was 20 months. The average length of a recession from 1948-1991 was 11 months. The longest was the great depression that lasted 43 months.

Given that this was the greatest global fiscal party ever, the likelihood that this will be one of the greatest hangovers on record is very high. In other words, this recession will neither be short nor shallow.

For the sake of argument consider the recession began in December 2007. If 20 months is the target, the recession still has another year to go. Those who think a depression is coming may wish to add another year or more to that. Another possibility is the US will slip in and out of recession for a number of years just as Japan did.

With the above in mind....

It's Time To Think

- Think foreclosures have topped? Think again.

- Think housing has bottomed? Think again.

- Think CEOs are being honest about forward guidance? Think again.

- Think corporate earnings are going to improve? Think again.

- Think the parade of bottom callers is correct? Think again.

The big irony in all of this is bottom callers are calling the end to a recession they claim has not even started. The truth of the matter is there is no reason whatsoever to think that the economy is remotely close to turning up. The teeth of this recession have barely begun to bite.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

James

26 Aug 08, 14:38 |

Jobs and stats

Despite the stats, I see thousands of high paying jobs posted on popular employment sites: With so many 100K and 150K jobs posted, I wonder about the stats. |