Trump Avoid Debt Crisis ? “Extremely Unlikely” says Rickards

Interest-Rates / US Debt Mar 02, 2017 - 01:24 PM GMTBy: GoldCore

The upcoming March 15 U.S. debt ceiling deadline is something that is being largely ignored by markets and most media for now. Despite it being just 9 trading days away. This will change in the coming days and is one of the many reasons why we are bullish on gold.

The upcoming March 15 U.S. debt ceiling deadline is something that is being largely ignored by markets and most media for now. Despite it being just 9 trading days away. This will change in the coming days and is one of the many reasons why we are bullish on gold.

Source: CNN

James Rickards writing for the Daily Reckoning today looks at the important ‘next signal to watch’ and explains that Trump and his advisors believe they can avoid a debt crisis through higher than average growth.

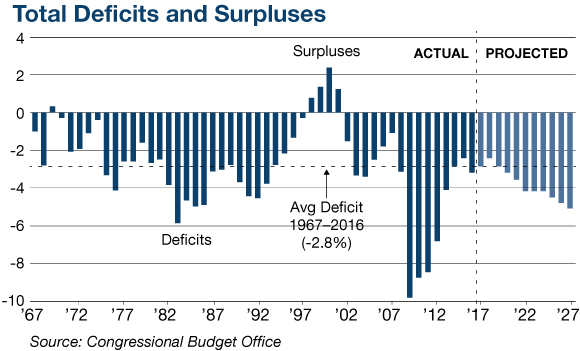

The Congressional Budget Office, CBO, estimates that inflation and real GDP will each grow at about 2% per year in the coming ten years. This means that nominal GDP, which is the sum of real GDP plus inflation, will grow at about 4% per year. Since debt is incurred and paid in nominal terms, nominal GDP growth is the critical measure of the sustainability of U.S. debt.

Rickards warns that while this is “mathematically possible”, it is “extremely unlikely”:

“A debt-to-GDP ratio is the product of two parts — a numerator consisting of nominal debt and a denominator consisting of nominal GDP. In this issue, we have focused on the numerator in the form of massively expanding government debt. Yet, mathematically it is true that if the denominator grows faster than the numerator, the debt ratio will decline.

The Trump team hopes for nominal deficits of about 3% of gross domestic product (GDP) and nominal GDP growth of about 6% consisting of 4% real growth and 2% inflation. If that happens, the debt-to-GDP ratio will decline and a crisis might be averted.

This outcome is extremely unlikely. As shown in the chart below, deficits are already over 3% of GDP and are projected by CBO to go higher. We are past the demographic sweet spot that Obama used to his budget advantage in 2012–2016 (As I noted HERE – Obama Has Tied Trump’s Hands).”

Rickards explains in detail the challenges facing the U.S. in terms of the fiscal budget, growth of real GDP, debt to GDP ratios, inflation and how deficits are set to soar.

He points out how Trump will soon appoint five people “to the Fed board of governors in the next 16 months, including a new chair and two vice chairs” and how gold investors should consider these appointments in terms of readjusting their allocations to physical gold:

“If he appoints doves, that will be the signal that inflation in the form of helicopter money and financial repression is on the way. That will also be the signal to move out of cash and increase our allocation to gold beyond the current 10% level.

If Trump appoints hawks to the board, that will be a signal that his team does not understand the problem and is relying on overoptimistic growth assumptions. In that case, we could expect a recession, possible debt crisis and strong deflation. That is a signal to keep our 10% gold allocation as a safe haven, but also buy Treasury notes in expectation of lower nominal rates.

We are watching for a signal on Trump’s nominations to the Fed board. The first three should be announced soon. Once the names and their views are known, the die will be cast.”

We like the theory and the nuance of what Rickards is suggesting here. At the same time, given the scale of the myriad of risks facing investors and savers today, we believe higher allocations to precious metals are merited. These risks come in the form of very ‘toppy’ looking stock and bond markets and digital deposits being vulnerable to currency debasement, cyber warfare and bail-ins.

We believe that 20% to 30% allocations to physical precious metals – gold as the core position, then silver and smaller allocations to platinum and palladium – are merited.

Cyber war and technology risks underline the importance of not owning all one’s assets digitally – especially the safe haven assets of gold and silver. Avoid precious metal platforms where your liquidity is dependent on just one company and their single website interface, their servers, IT people and IT systems.

Being able to sell coins and bars to numerous dealers ensures competitive pricing and all important liquidity – being able to get cash for your bullion whenever you need to. The ability to visit the vaults and take delivery of your bullion at any time is vital in this regard.

Rickards entire ‘Next signal to watch’ article is well worth a read and can be accessed here

Gold Prices (LBMA AM)

02 Mar: USD 1,243.30, GBP 1,013.17 & EUR 1,181.14 per ounce

01 Mar: USD 1,246.05, GBP 1,007.18 & EUR 1,182.50 per ounce

28 Feb: USD 1,251.90, GBP 1,006.90 & EUR 1,180.79 per ounce

27 Feb: USD 1,256.25, GBP 1,011.16 & EUR 1,187.41 per ounce

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

22 Feb: USD 1,237.50, GBP 994.21 & EUR 1,178.22 per ounce

Silver Prices (LBMA)

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

22 Feb: USD 18.00, GBP 14.47 & EUR 17.14 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.