Important Stock Market Top?

Stock-Markets / Stock Market 2017 Mar 05, 2017 - 03:04 PM GMTBy: Brad_Gudgeon

Cycle-wise, we are at a crest of the 18 month cycle, which is due to bottom in early August 2017. Astro-wise we have a myriad of reversal aspects in this general time frame: Mars conjunct Uranus/opposite Jupiter (February 26/27); Sun conjunct Neptune (March 1); Jupiter opposite Uranus (second of 3 passages), with a cardinal T-Square to Pluto (March 2); Mars trine Saturn (March 4); Venus Retrograde (March 4).

Watch for war-like agitations ahead and a test of the Trump administration. Bad storms and earthquakes could also be in the offing in the next 3-5 months.

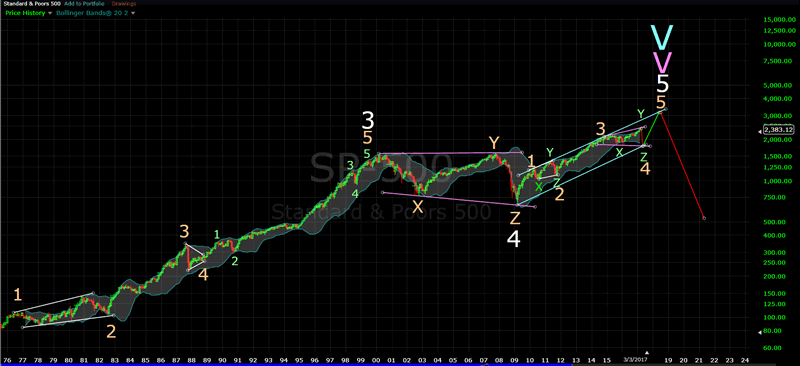

My indicators suggest that the top occurred on March 1. From here into early August, it is my opinion that we see at least a return to the 1800 area on the SPX terminating Primary 4 of Cycle Wave 5 (2009) of Super-Cycle Wave V (1942) of Grand Super-Cycle Wave (V) (1776) of Millennial Wave [III]. What this implies is, after one more Wave 5 rally into 2018, we are about to enter Millennial Wave [IV]. The implications are staggering: a 250-year bear-market, sideways at best!

My observation of many 4th Waves is the first 22% (time-wise), or 55 years may be the worst part of the wave, Wave A. 2018 + 55 years = 2073. Cycle-wise, the first down move should occur from about 2018-2021 and could take out as much as 79-89% of the value of the stock market! We are about to enter to enter a recurring major war cycle that runs on average about every 80-84 years. The revolution cycle runs about every 240-252 years and is due from 2016-2028.

Trump's tax reforms are due in August of 2017. Could it be that the final 5th wave rally will be due to corporate tax reforms? The recent Trump rally was a highly irregular topping action (intermediate wave Y) of Primary Wave 4. Wave Z of 4 should correct us back to at least near 1800 by early August or about 25%.

The Volatility sector looks promising to me. I really like UVXY. Currently near 21-22, a move to near 80 would not surprise me by early August.

As far as the mining sector is concerned, we recently started shorting the miners, but have now gone to neutral. The 10 week low is due in this general area and could kick off another short term rally soon. The COT information does not look promising at this juncture though. Any rally we have now should be viewed with suspicion, IMO. We'll see.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2017, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.