Charting the Maddening Stock Market Messages

Stock-Markets / Stock Market 2017 Mar 08, 2017 - 03:00 PM GMTBy: Gordon_T_Long

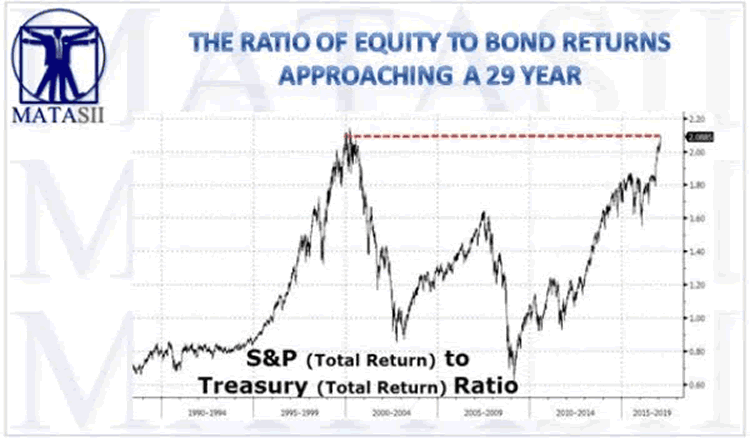

Why are we getting such diverging and maddening market messages from the equity and bond markets? Which one is right? Are either right?

Why are we getting such diverging and maddening market messages from the equity and bond markets? Which one is right? Are either right?

Market Perceptions

Let's consider the perceptions of each of these markets:

Equity market

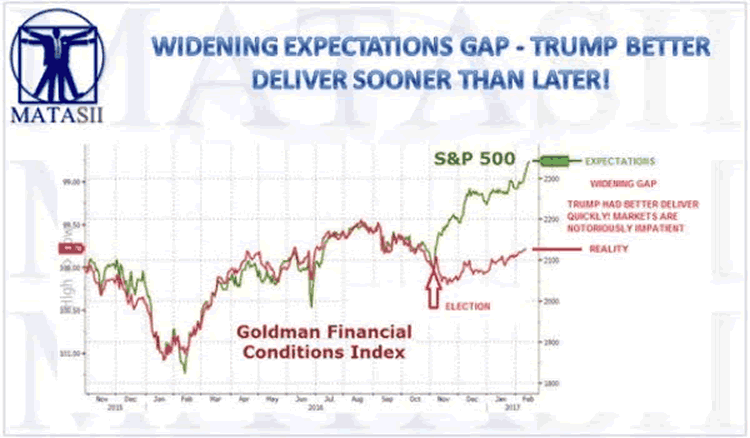

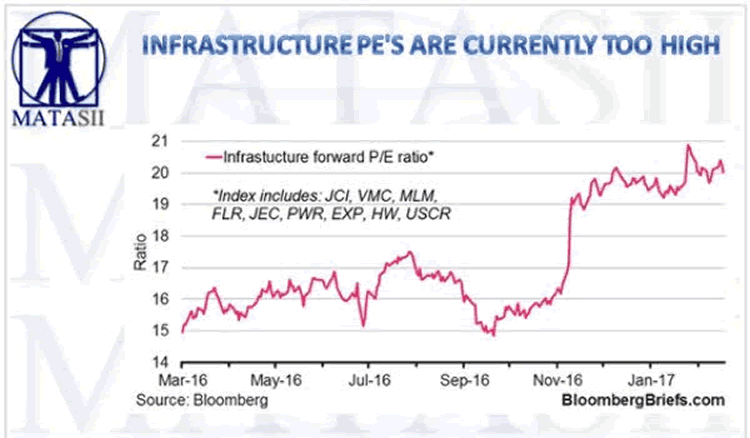

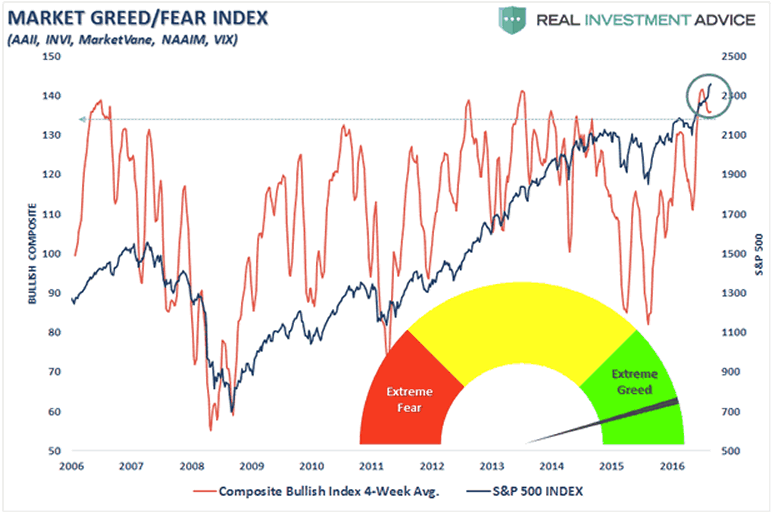

- The Equity Markets perceives Trumponomic Policy SUCCESS ahead and are aggressively pricing it in!

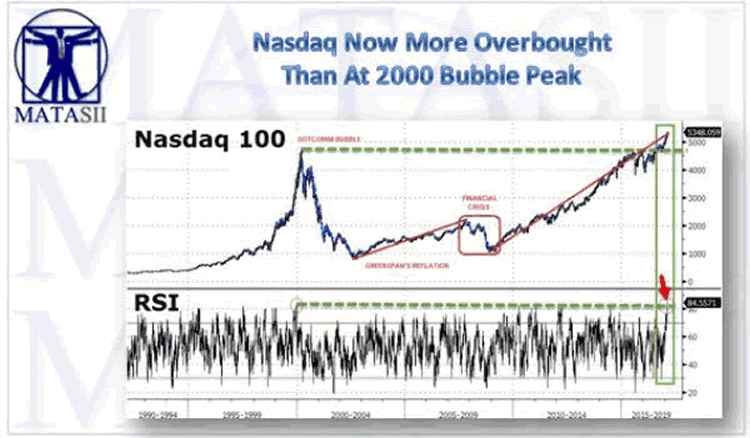

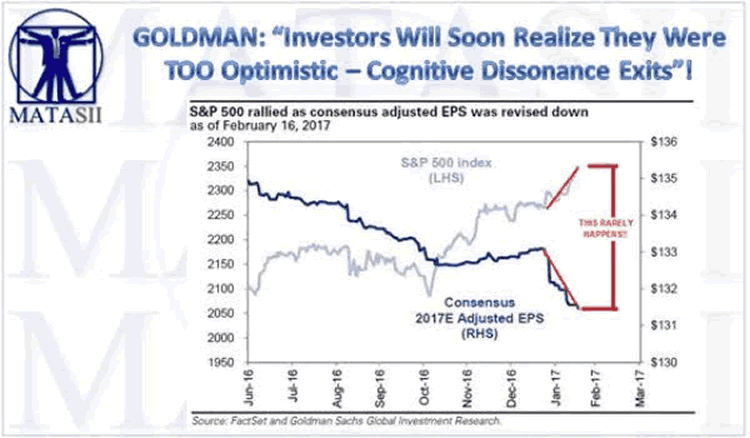

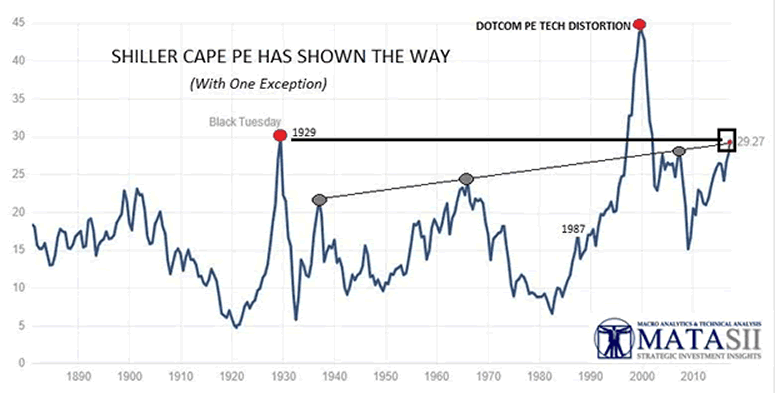

- The level of excitement has now reached the levels that it can safely be categorized as EUPHORIC.

Bond Market

- The perception of the Bond market is the REALITY of whether Trumponomic Policy will actually be implemented and within expected time frames investors mistakenly believe will happen.

- The level of concern can be safely categorized as CAUTIOUS.

Core Questions on the Table

Maybe the real underlying questions that need to be answered by thoughtful investors are the following:

- WHAT exactly are the details of the Trumponomic Policies? We have a lot of populist rhetoric, but as of yet we have little tangible detailed substance. The devil always lies in the details!

- IF in fact these policies can actually be implemented based on a clearly hostile democratic party within congress as well as significant conflict within the GOP from staunch fiscal conservative members and the Tea Party advocates.

- WHEN these policies can be implemented is a the major unknown? There is a congressional sequence that must be followed so that an encompassing congressional budget bill can be passed. The reinstatement on March 15th of the Fiscal Debt Ceiling is not a small hurdle to be overcome nor the creative ways the Democratic Party will do everything its power to derail and slow any implementation!

- RESULTS are also a major unknown. The Fiscal Stimulus, Tax Cuts and Regulatory Reduction all play well as populist policy and did work during the Reagan Administration, but will they actually work today? Many including Reagan's OMB Director, David Stockman vehemently say they won't.

Let me categorically state that in no way am I trying to be critical of the Trump Administration. I am simply, in an unbiased fashion, trying here to understand the competing views.

I would suggest that people's political bias is presently clouding their investment thinking!

To assess who is likely right we might additionally segment who we are talking about with these views.

Equity Market

We must not forget that there are two sides to the Equity Market:

THE SELL SIDE

- Wall Street Brokerage Houses selling securities and transaction volumes,

- Fund Managers wanting to attract more Assets Under Management (AUM),

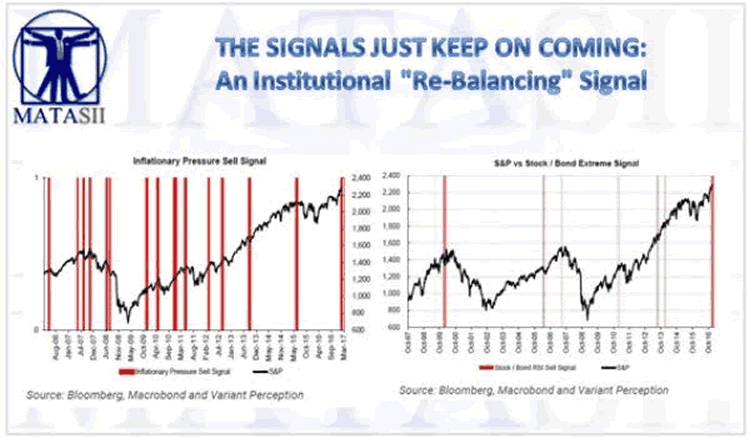

THE BUY SIDE

- Institutions who do their own research and are not in the habit of disclosing their investment strategies,

- Private Funds and High Net worth Individuals who study closely metrics such as "flows", "volumes", "divergences", "macros", "Sentiment" etc. etc.

The public has visibility to the Sell Side primarily because it dominates the media in an attempt to sell its products. The Buy Side on the other hand seldom wants to disclose its investment thinking and is not typically found talking on CNBC.

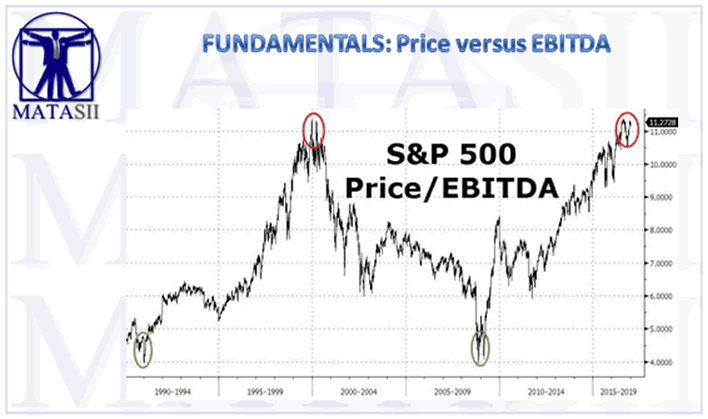

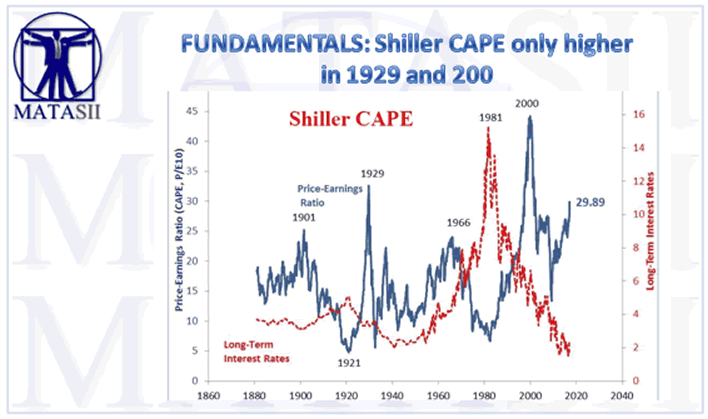

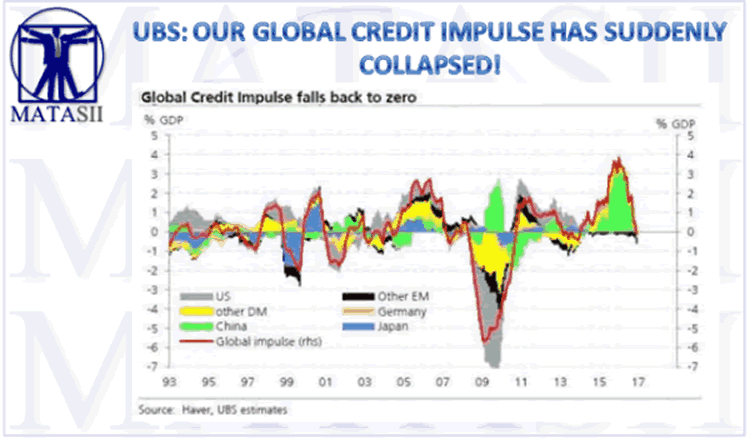

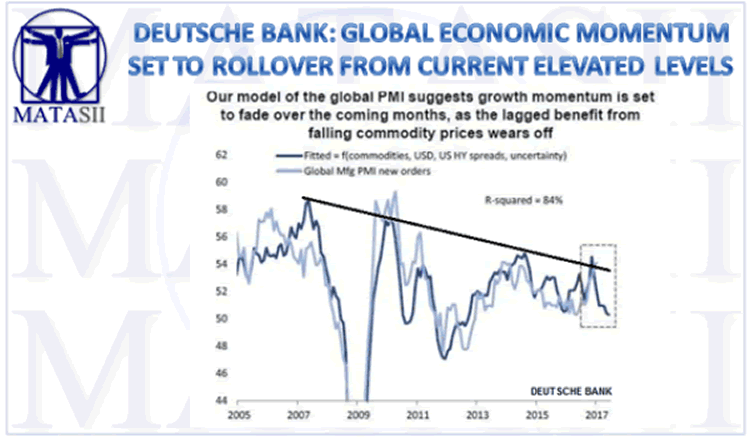

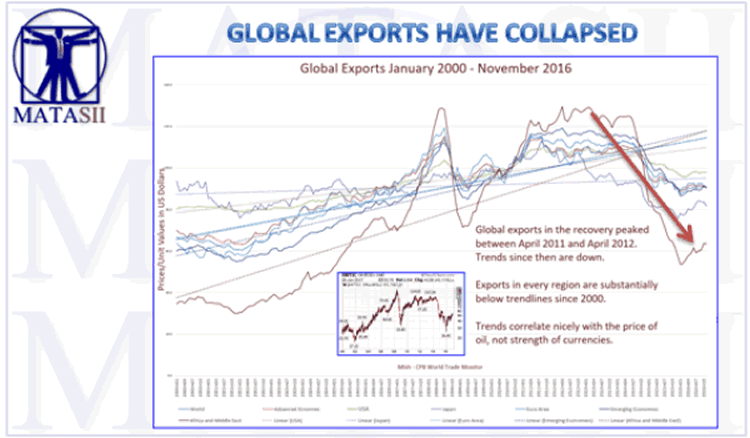

My discussions with the Buy Side suggests that with respect to the equity markets, they are presently in the Bond Market camp! They point out the concerns with the global landscape that few are paying any attention to:

Conclusion

Do we really need to know more to assess who is likely right?

Is it those who have unemotionally studied the situation, or those who have "faith", "believe" and are "afraid to miss out"?

A proven strategy has always been in situations like this:

"Be fearful when most aren't - be bold when most are fearful"

We presently have BOTH between the Equity and Bond markets. Who you favor may make all the difference to your financial health!

I KNOW WHO'S SIDE I AM ON!

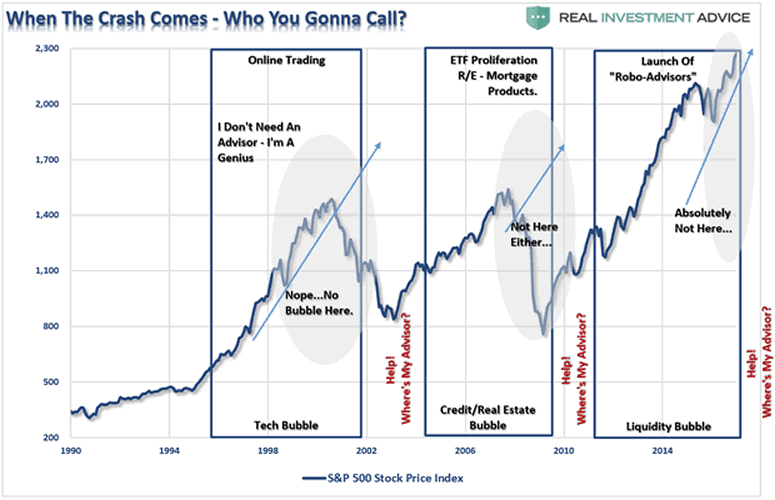

I have seen this rodeo once too many times!

For more articles signup for GordonTLong.com releases of MATASII Research

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2017 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.