Map Shows 16 Countries Will Be Hit Hard By The Global Exporters’ Crisis

Economics / Global Economy Apr 12, 2017 - 03:12 PM GMTBy: John_Mauldin

The world is currently in the midst of an exporters' crisis. The stagnation in global consumption levels and decline of commodity prices have led to increased instability and insecurity in countries heavily dependent on exports.

The origins of the exporters’ crisis lie in the economic recessions that the United States and Europe experienced due to the 2008 financial crash. These countries were major consumers of Chinese goods, notably low-cost manufactured products.

Lost revenue slowed China's economy, leading to lower Chinese demand for commodities and goods. This caused commodity prices to fall and global exports to decline.

The Most Vulnerable Countries

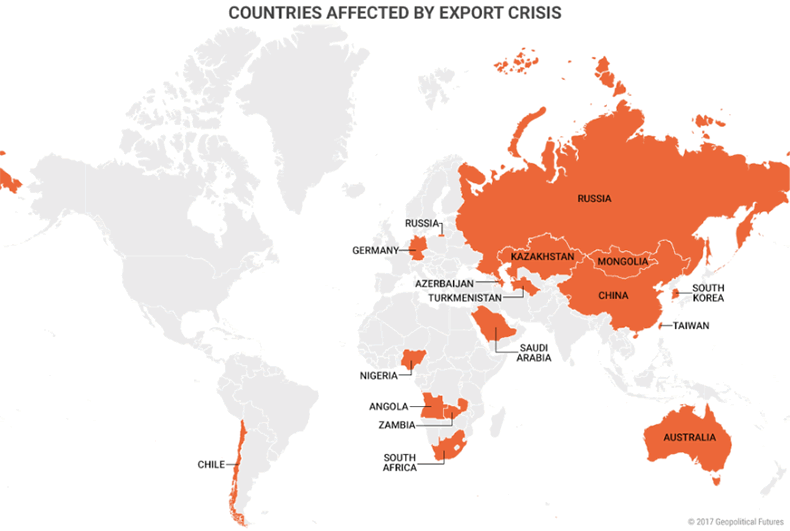

The map below shows the 16 most vulnerable countries.

They can be divided into four categories: heavyweights, critical periphery, Pacific countries, and African countries. The four heavyweight countries—China, Russia, Saudi Arabia, and Germany—are regional powers and have large enough economies to create ripple effects in other nations’ economies.

The critical periphery includes Azerbaijan, Kazakhstan, Turkmenistan, Mongolia, and Nigeria. The fates of these countries matter due to their relationships with major powers. In each case, instability and economic collapse could trigger a new crisis or worsen existing ones for nearby regional powers.

A group of countries around the Pacific—Chile, Taiwan, Australia, and South Korea—has been highly exposed to the exporters’ crisis but has yet to see the full impact. In the African countries that are most exposed—South Africa, Zambia, and Angola—the crisis could serve as a catalyst for regime change after decades of consistent rule.

They Can’t Do Anything but Hope

Exporters depend on importers to help them out of economic hardship. Prospects for recovery remain bleak because importers are not buying enough goods to offset the effects of the crisis.

Another solution is that exporters could increase domestic demand. However, doing this is very difficult. Thus, export-dependent countries will stay in crisis for as long as the global economy remains lethargic.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.