SPX is Weaker, But No Signal

Stock-Markets / Stock Market 2017 May 11, 2017 - 02:28 PM GMT SPX futures are down, but not enough to give a signal, yet. The SPX may go either way, so be warned of some chaotic moments today.

SPX futures are down, but not enough to give a signal, yet. The SPX may go either way, so be warned of some chaotic moments today.

ZeroHedge reports, “Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes after today's open.”

VIX futures are moving higher this morning. The decline may be counted as complete. The first sign of a change in trend occurs above the 4th Wave high at 11.24. The 50-day Moving Average is the next level of confidence at 12.07. The daily mid-Cycle resistance is at a low 12.95, where a sell signal may be confirmed. Most traders will be looking for twice that number to take any action on the VIX.

ZeroHedge comments, “Having kept a relatively low profile for the past month, suddenly anywhere you look, there's Jeff Gundlach - between his presentation at Ira Sohn, his recent appearance on Twitter, and his latest DoubleLine webcast, the bond king has something to say. Today, as his preferred medium, he picked Reuters, where he told Jennifer Ablan what he said previously, namely that European and emerging markets equities are more attractive than U.S. equities, he also opined on volatility, saying that the VIX is "insanely low."

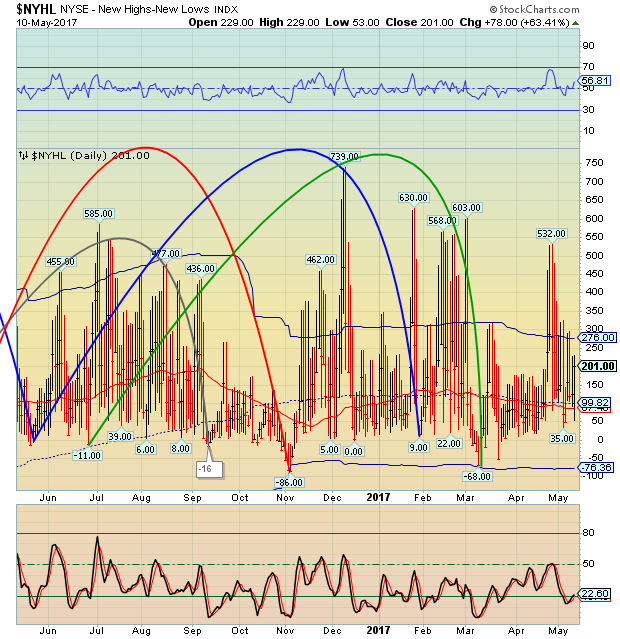

The NYSE Hi-Lo Index will be watched closely today, as an intraday decline beneath its prior low at 35 and a close beneath the 50-day at 97.40 may give us a sell signal.

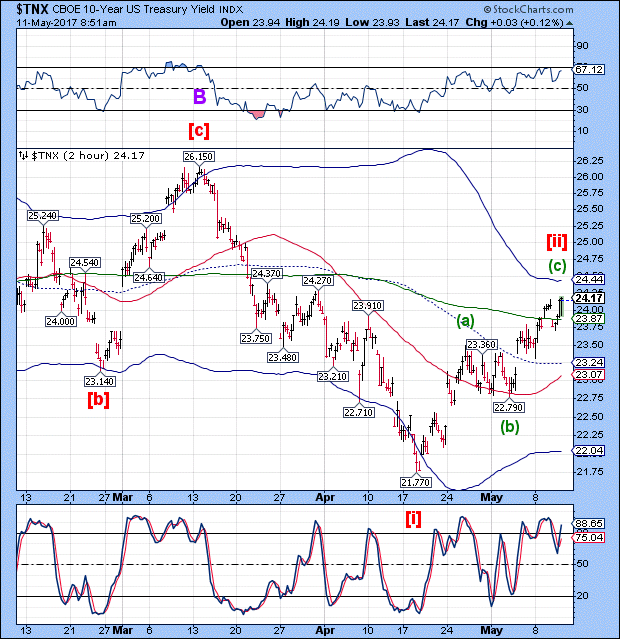

TNX appears to be completing Wave (c) of [ii]. It may have yet another probe to the 2-hour Cycle Top at 24.43.

Reuters reports, “May 10 U.S. Treasury yields on Wednesday pared their earlier fall to turn flat, following weak results at a $23 billion auction of 10-year government notes that was the second leg of this week's $62 billion supply from the May quarterly refunding.”

Reuters further reports, “The Treasury Department will complete May's $62 billion

refunding with a $15 billion sale of 30-year bonds on Thursday following a cool reception to the three-year and 10-year auctions.

"The 30-year is a different kind of animal. There should be good demand but some people may stay cautious because of its duration," said Justin Lederer, Treasury strategist at Cantor

Fitzgerald in New York.”

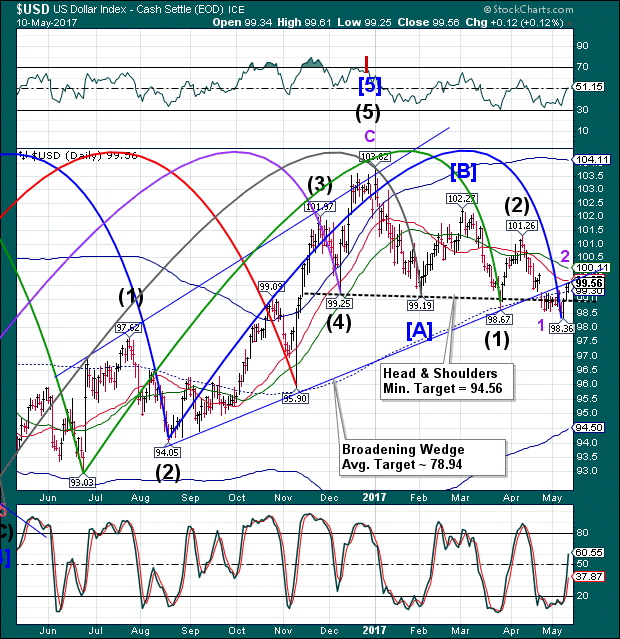

USD futures may be completing their retracement this morning by challenging Short-term resistance and the Broadening Wedge trendline at 99.67.

MarketRealist reports, “After regaining strength and gaining for three consecutive trading days, the US dollar is slightly weaker in the early hours on May 11. Increased risk appetite helped the US dollar rally this week.”

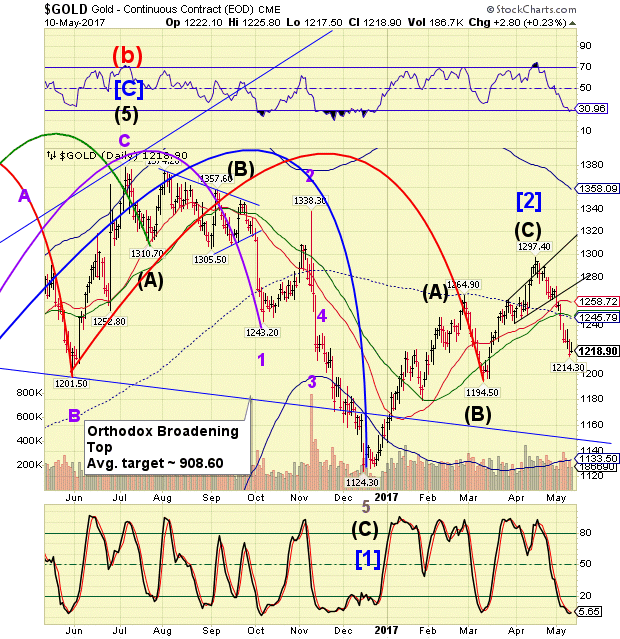

Gold futures appear to be setting up for a short-term bounce this morning. This appears to be a Trading Cycle bounce that may be an attempt to shake out the weak hands as it still has more decline ahead.

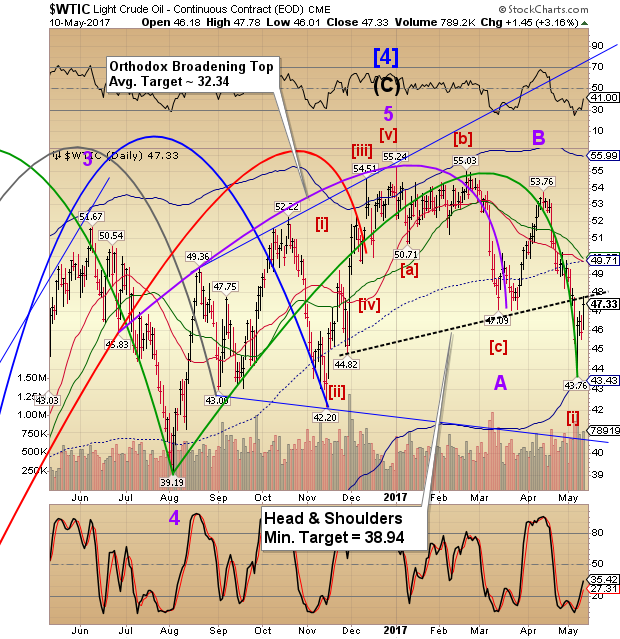

Crude Oil futures appear to be making the final challenge of its Head & Shoulders neckline prior to a reversal to lower prices. The reversal may happen by the weekend.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.