CABLE leads the way in a major turn for USD

Stock-Markets / Financial Markets 2017 Aug 05, 2017 - 10:31 AM GMTBy: Enda_Glynn

My Bias: short below parity in wave (5).

My Bias: short below parity in wave (5).

Wave Structure: continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

Important risk events: GBP: N/A. USD: Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate, Trade Balance.

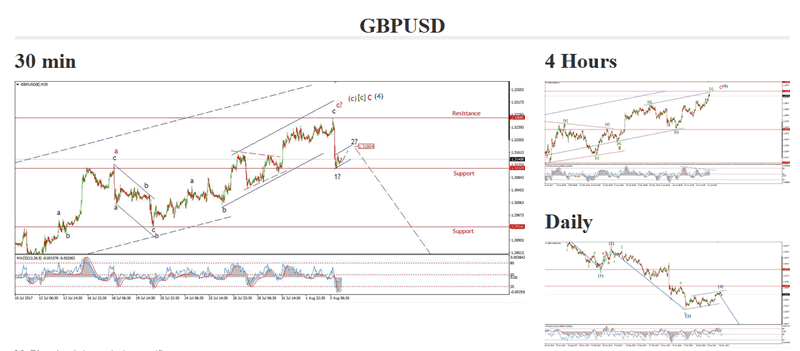

Cable took a beating today with the first bearish action in two weeks.

We got a slight new high overnight as expected,

And then a very impulsive looking decline this morning.

The wave count is looking for a top to form, and it is getting off to a good start.

I have labelled the decline as a 1,2 formation,

with another push expected into about 1.3180 to complete a three wave form.

The price must then turn down into a possible third wave decline.

The high at 1.3268 is now key resistance for the larger price structure.

The 4hr RSI gave a momentum sell signal also today,

With a downside centreline cross.

The signals are lining up for a possible large degree top formation in progress.

For tomorrow;

Watch for a three wave recovery to complete inside the trend channel.

And a further decline into support.

My Bias: LONG

Wave Structure: rally in wave [C]

Long term wave count: wave [C] is underway, upside to above 136.00

Important risk events: JPY: N/A. USD: Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate, Trade Balance.

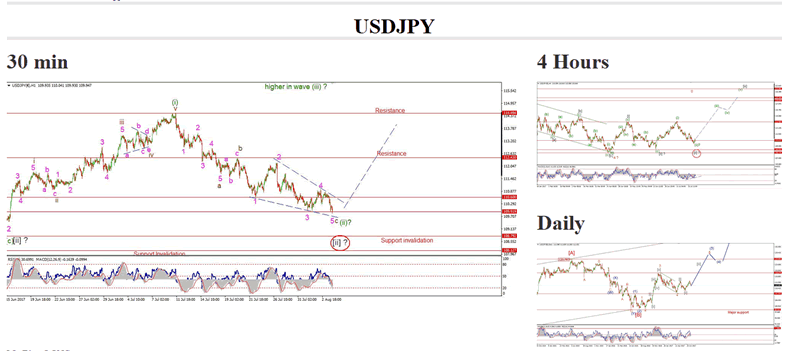

USDJPY broke short term support at 109.91 this evening.

So the early signs of a reversal are postponed for now.

No matter what way I slice the recent declines,

It still counts best as a corrective structure

rather than a new impulsive decline.

I have altered the labelling of the corrective structure.

It now shows a zigzag decline in wave (ii) green

With an ending diagonal decline in wave 'c'.

Wave '5' pink will meet the lower trendline again at 109.70.

So for tomorrow;

Watch how the price reacts off that lower trendline at 109.70

A higher low above 110.60 will signal an end to this decline.

My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Topping in wave (5)

Important risk events: USD: Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate, Trade Balance.

Have you noticed the full scale joy on display across the media for higher priced stocks?

It seems, a more expensive thing is always a better thing!

I do not agree.

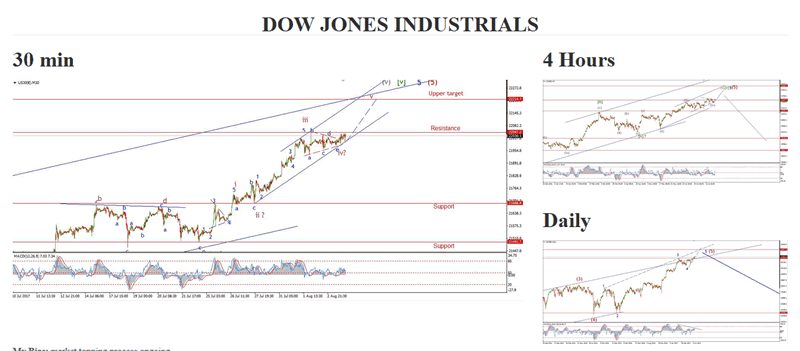

The Dow looks to have traced out a contracting triangle over the last few days.

Triangles occur in either wave B or wave 4 as a general rule.

They act as a consolidation move,

before a final wave to complete the larger structure.

Three triangles have formed at various degrees of trend over the last three weeks

This is a signal in itself, of a market running out of steam,

And a price structure which is completing at many degrees of trend.

Both are very true in this case.

Caution is advised for anyone who is still long this market.

Wave 'iv' pink may have completed at the low of the day of 21980.

If the price breaks through the all time high again,

This will signal the final run up in wave 'v' pink has begun.

The target for wave 'v' pink remains at 22200.

If you want to stay ahead of the trend,

and see the big market moves before they happen,

CHECK OUT OUR MEMBERSHIP PLANS......

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2017 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.