Is a Year End Rally in Risk Markets Coming ?

Stock-Markets / Financial Markets 2017 Nov 01, 2017 - 12:41 PM GMTBy: Submissions

The Bank of Japan left its massive monetary stimulus program unchanged even as it trimmed its inflation forecasts, signaling further divergence ahead from its global peers.

The Bank of Japan left its massive monetary stimulus program unchanged even as it trimmed its inflation forecasts, signaling further divergence ahead from its global peers.

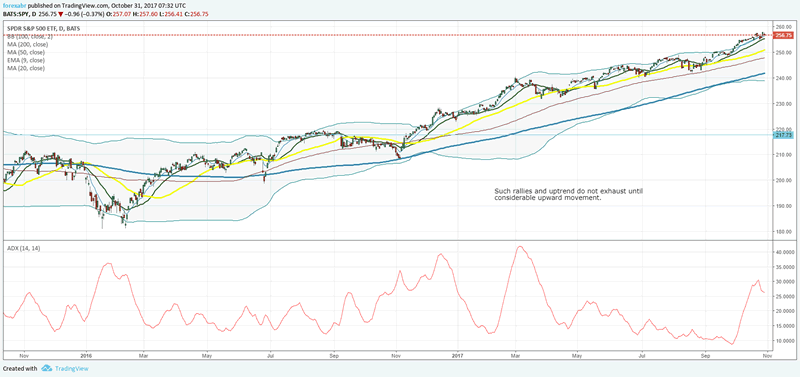

S&P

The large cap index has been on sustained uptrend this year. There are no signs of any weakness despite news flow contrary to that. Neither North Korea nor Trump falling ratings have dented the uptrend. Earnings have gen erally supported the rally. We expect the trend to continue into the year end unless news or other factors come into play at which point we will update. We are suggesting clients to be 60% invested into the rally.

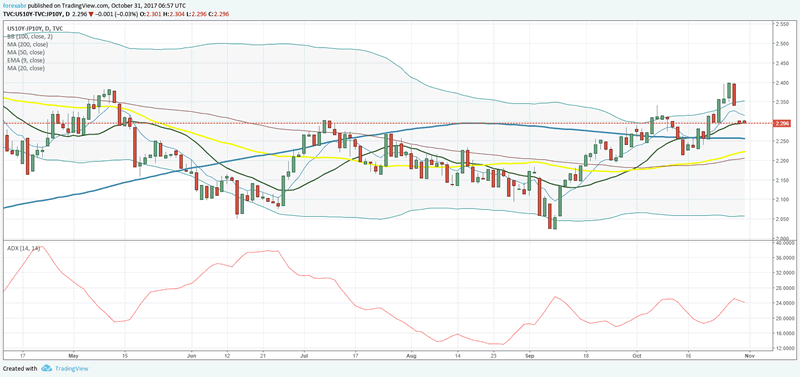

Bond market

The 10 year yield differential between US and japanese 10 year bonds seem to be narrowing which explains the tepid movement in USDJPY. However the differential is stil near its 3 month highs and hence dollar index is expected to move higher.

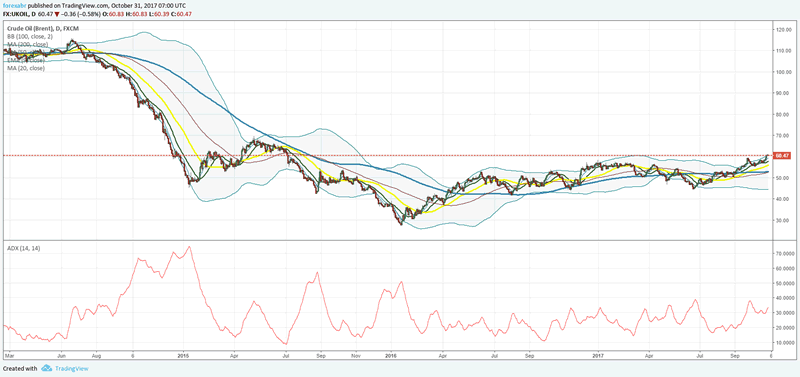

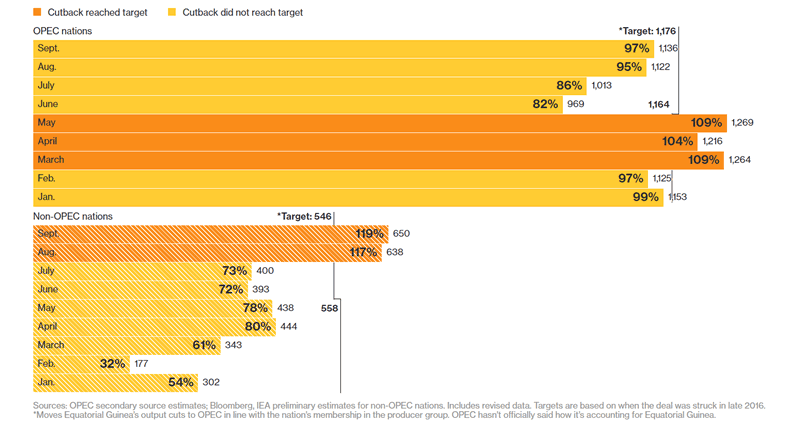

Oil

Oil prices have bucked the long term trend of downtrend. Prices above 60 will have an impact on shorts and thus give way to covering rallies. The higher Oil prices can be explained by cutting oil supplies. For the second consecutive month, a group of non-OPEC oil producers led by Russia and Mexico in September bested OPEC itself in efforts to end a global crude glut. The secret to their success: field maintenance. With at least six more months of output cuts left in their agreement, OPEC and its allies face the question of what to do when the work ends.

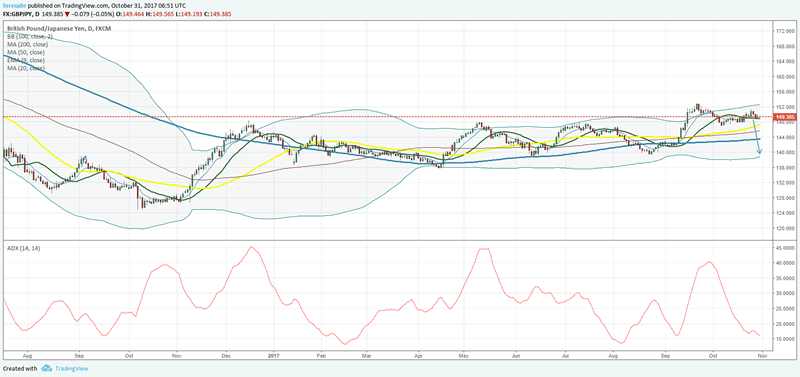

GBPJPY

The pair has made a high in September which has not been surpassed in October. The pair is in a long term downtrend and hence the price action in October can be veiwed as corrective and offering a chance to go short.

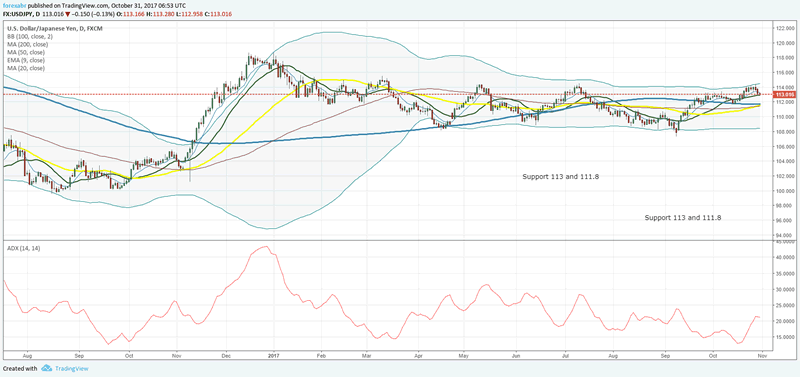

USDJPY

usdjpy is at an important support zone at 113. The pair uptrend line is at 113. Sustained break below could see it fall to 111.8/111.5 which is where important support in form of 200 DMA can be seen.

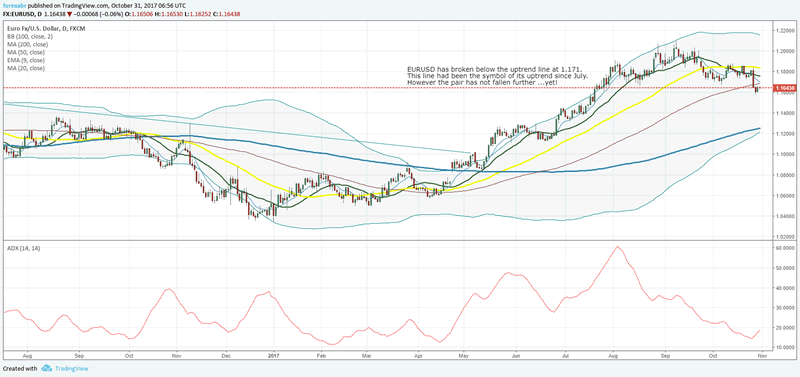

EURUSD

EURUSD has broken below the uptrend line at 1.171. This line had been the symbol of its uptrend since July. However the pair has not fallen further ...yet! If the pair finds itself back above 1.1710, we expect the uptrend to resume else it could slowly move to 1.14.

Trade Copier

The Forexabr trade copier has done very well for the 6th month running. The total returns are at 120.5% on the model account.

Those interested can get in touch with us here: TradeCopier account

By Forexabr

Forexabr is a leading analysis site specializing in fundamental and technical analysis. We also operate a high quality trade copier for forex clients to copy our trades directly to their accounts.

© 2017 Forexabr - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.