Learning from Money Supply of the 1980s: The Power and Irony of “MDuh”

Economics / Money Supply Nov 20, 2017 - 02:08 PM GMTBy: F_F_Wiley

Forget about big hair, Ray-Bans, and Donkey Kong. Don’t even think about Live-Aid, Thriller, and E.T. Above all else, the 1980s were the gravy days of the money supply aggregates.

Forget about big hair, Ray-Bans, and Donkey Kong. Don’t even think about Live-Aid, Thriller, and E.T. Above all else, the 1980s were the gravy days of the money supply aggregates.

Beginning in late 1979, the Fed built its policy approach around the aggregates—primarily M1 but occasionally M2, and policy makers also monitored M3 while experimenting with M1B and, later, MZM. But those were just the “official” figures. Economists and pundits debated the Fed’s preferred measures while concocting their own home-brewed variations.

Notably, the Fed allowed interest rates to fluctuate as much as necessary to achieve its money growth targets. Fluctuate they did—rates soared and dipped wildly as a direct result of the Fed’s policy. The world, meanwhile, watched the action as attentively as a Yorkie watches breakfast, studying every wiggle in every M. Missing one wiggle could have meant the difference between exploiting the volatility that the Fed unleashed or being sunk by that same volatility.

And to make sense of it all, the world looked to the most famous economist of his day, Milton Friedman. By converting a large swath of his profession to his strict brand of Monetarism, Friedman more than anyone else had triggered the monetary frenzy.

But then, almost as quickly as the frenzy blew in, it blew right back out. With none of the Ms living up to their billings as economic indicators, the Monetarists drifted from view. Not in five minutes but in five years, give or take a couple, their period of fame was over. Friedman’s reputation as an economics savant fell particularly hard—his highly publicized forecasts proved inaccurate in each year from 1983 to 1986. And the Fed once again redesigned its approach, first deemphasizing and eventually dropping its money growth targets.

But maybe the Monetarists came closer to explaining the economy than their critics allowed?

Maybe the best indicator—I’ll call it “MDuh”—was somehow hidden in plain sight?

Those are the arguments I’ll make in this article, and I’ll back each one with up-to-date data. I’ll propose a way of thinking that’s considered common sense in some circles even as it’s blasphemous within the mainstream core of the economics profession. And I’ll explain why MDuh was the true lesson of Friedman’s research.

Before we get to MDuh, though, there are two things you should know about Friedman and his co-researcher Anna Schwartz (if you didn’t already know them). First, they relied on data, not theory, when they shaped their version of Monetarism. They found a strong historical correlation between money growth and economic activity, and they also found that money growth predicts activity. They published those results in a groundbreaking 1963 book, A Monetary History of the United States, 1867–1960.

Second, to their credit they never claimed to understand the monetary “transmission mechanism,” meaning the reasons the historical correlations were as strong as they were. But they offered their best guess, which lined up with prevailing Monetarist thinking. They believed that “there is a fairly definite real quantity of money that people wish to hold” and that our continual efforts to adjust money holdings to those fairly definite levels are the business cycle’s driving force. (See here for source.)

The Glaring but Rarely Acknowledged Problem with M1 and M2

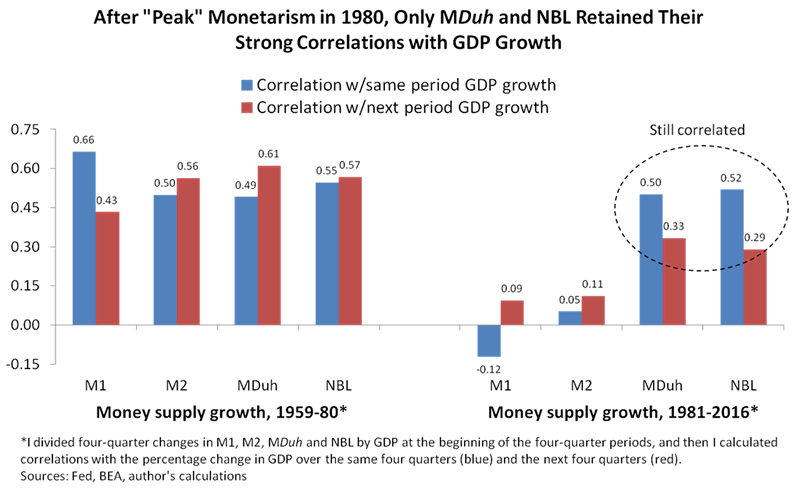

The second point above explains why Monetarists defined the aggregates as they did. They defined each aggregate according to the characteristics that might influence the “fairly definite real quantity of money that people wish to hold.” But the characteristics they believed important, such as liquidity, stability, and value as a medium of exchange, led to unreliable indicators, as shown in the chart below:

The chart compares the most popular Monetarist measures, M1 and M2, to two measures that I created, MDuh and NBL. I’ll define MDuh and NBL in just a moment. I’ll first offer an explanation for why M1 and M2 lost their pre-1980s mojo as GDP correlates. And to do that, I’ll need to review a fallacy that underpins not only Monetarism but all of mainstream macro.

Mainstream theory relies on the false premise that bank loans are no different to other loan types. It ignores the reality that bank loans are unique, because banks are the only institutions that create deposits (money) while delivering loan proceeds. Bank borrowers receive money that banks create from thin air, and that brand new money has powerful effects. It boosts spending without requiring prior saving, meaning it’s mostly additive to economic activity. That is, it doesn’t have a large “crowding out” effect on other spending—bank-created money flows directly into nominal GDP. It might affect prices, real growth, or a combination of prices and real growth, depending on how the new money is spent. But it’s important to remember that the new money connects to a bank loan. The money–GDP correlation is merely a byproduct of a lending–GDP correlation. Bank lending, not money, is the driving force.

Back to M1 and M2: Why did those highly touted measures lose their strong correlations to GDP, whereas MDuh didn’t?

I would say it’s because they lost their connections to bank lending. The economists who created them made both additions to and subtractions from bank-created money, whereas I made no such adjustments when I calculated MDuh. I didn’t bother with the differences between checking, savings, and time deposits, and I didn’t bother with money that’s not created by banks, such as money market funds. In other words, I didn’t bother with the characteristics of money that absorb the attention of mainstream economists—liquidity, stability, and value as a medium of exchange. For what it’s worth, I doubt that people maintain definite money holdings, as the Monetarists claimed.

MDuh depends on a single question: Is a potential MDuh component initiated by a private entity with the legal authority to create money, meaning either a commercial bank or a similar deposit-taking institution? If the answer is yes, I include the component in MDuh. Otherwise, I don’t. By using only that criterion, I’m estimating the amount of new money that banks pump into the economy when they make loans and buy securities. Not surprisingly, MDuh correlates almost perfectly with net bank lending—the correlation between 1959 and 2016 was 0.97. And net bank lending, as you might have guessed, is “NBL” in the chart above.

To say it again, banking realities tell us that bank lending, not money, is the business cycle’s driving force, as shown by the data in my chart.

Why Friedman and Schwartz Were Almost “on the Money”

Now for the irony.

Over the 94-year period covered in Friedman and Schwartz’s Monetary History, data only existed for a few types of money. The authors couldn’t separate different types of bank accounts as finely as statisticians do today. They couldn’t measure any non-currency, non-bank-created money that may have existed over the period of study. In other words, they couldn’t add and subtract the various components of the Ms that disconnect them from bank lending.

So MDuh is far from an original measure. It consists of currency in circulation plus bank deposits less bank reserves, which is equivalent to the measure Friedman and Schwartz used in their book for the period until the Fed’s inception in 1913 (there were no central bank–held reserves) and almost equivalent thereafter. Their monetary history could have just as accurately been called “The History of MDuh.” In effect, their study of MDuh triggered the 1980s monetary frenzy in the first place.

(The only discrepancy between MDuh and Friedman–Schwartz is my adjustment for bank reserves, which isolates private sector–supplied credit by excluding deposits that arise though the Fed’s open market operations. Without the adjustment for bank reserves, MDuh would mix apples with oranges. It would combine private sector lending, which is pro-cyclical, with the Fed’s lending, which is intended to be counter-cyclical. Private sector lending is more strongly correlated to GDP, as you would expect.)

In an ideal world, Friedman and Schwartz’s followers would have recognized that MDuh mostly demonstrates the connections between business cycles, inflation, and bank credit cycles. But that’s not what happened. They stuck to their training, which told them that bank loans are identical to other types of lending. And then they obsessed over how to define money supply, as if economic insight comes down to whether to include, say, overnight repos in your favorite M. By so doing, they moved further and further from MDuh.

Next Steps for Those Who See Things as I Do

As mentioned above, my conclusions probably sound like common sense to many of you, even as they conflict with mainstream macro. You might wonder if you can exploit that discrepancy, and I explain how in my book Economics for Independent Thinkers (website here, Amazon link here).

For now, though, I’d say the next time your favorite analyst breaks down M1 or M2, comment politely that those indicators emerged from long-standing fallacies about money and banking. Suggest that maybe people don’t fine-tune their money holdings to a “fairly definite” level as Monetarist theory requires. Or, even if they do, the desired money holdings wouldn’t propel the economy in the same way bank loans do. And then ask her to look at MDuh instead. Or, better yet, ask her to look at net bank lending and be done with it. Money, while occasionally interesting, mostly sows confusion among those who study it.

Author’s note: I plan to post a follow-up or two with more detailed statistics, including correlations with real growth, and I’ll also consider the economics profession’s response to critiques such as mine. The follow-ups are unlikely to be widely published—if interested, you may need to check back to (or subscribe to) one of my proprietary sites (nevinsresearch.com/blog or ffwiley.com). Also, for more on the realities of banking and how they differ from textbook theory, see this Bank of England report.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2017 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.