US Dollar Soaring, Stocks Collapsing ECB Rates on Hold, So wheres Inflation?

Currencies / US Dollar Sep 04, 2008 - 07:26 PM GMTBy: Mike_Shedlock

Today Trichet went to a 'neutral bias' as noted in ECB holds key rate steady at 4.25%

Today Trichet went to a 'neutral bias' as noted in ECB holds key rate steady at 4.25%

The European Central Bank left its key lending rate unchanged at 4.25% in a widely anticipated decision Thursday, and ECB President Jean-Claude Trichet signaled it likely won't make a change any time soon.

Trichet, in his monthly news conference, acknowledged the euro-zone was suffering from a period of "weak activity." But he came nowhere near signaling the all-clear on the inflation front, instead underlining worries that inflation will remain well above the central bank's medium target of near but below 2% annually.

Inflation is "likely to remain well above levels consistent with price stability for a protracted period of time and that upside risks to price stability over the medium term prevail," he said.

But he emphasized that he had previously warned of a mid-year trough and said the weak spell would likely be followed by a "gradual recovery," aided by a fall in oil prices from their July peak.

Also, world growth is expected to remain "relatively resilient" amid sustained growth in emerging economies that should support demand for euro-zone goods and services, he said.

Uncertainty Principle Revisited

Trichet may (or may not) have done the right thing by holding rates, but the ECB is on a pure guess. The ECB is affected by the same factors, pressures, and feedback loops that I noted in the Fed Uncertainty Principle .

The Falling Oil Prices Myth

As for a "gradual recovery aided by a fall in oil prices" Trichet could not possibly be more off base. Falling oil prices are a result of a slowing world economy. Trichet's statement can roughly be translated to "the economy will pick up because the economy is slowing".

As for world growth being "relatively resilient" I disagree once again. World growth was on a tear for one reason only: Credit was rapidly expanding everywhere. Today something very unusual happened: National City Pays Customers To Cancel Credit Lines .

More importantly The Future Is Frugality and the future is also here. Businesses and consumers are both attempting to be frugal. Frugality is showing up in housing, in commercial real estate, home equity loans, and autos. For a look at the auto sector, please see GM, Ford, Chrysler Sales Collapse .

China Contraction

In a surprise to those who mistakenly think China is the dog and not the tail, China's Manufacturing Contracts for Second Month .

In a slowing world economy, China cannot possibly hold the economic fort by itself. Some think the China contraction is related to the Olympics.

If that was the case, China would not have needed to announce a stimulus package. Please see Is China's Growth Story Coming Unglued? for more on that line of thinking.

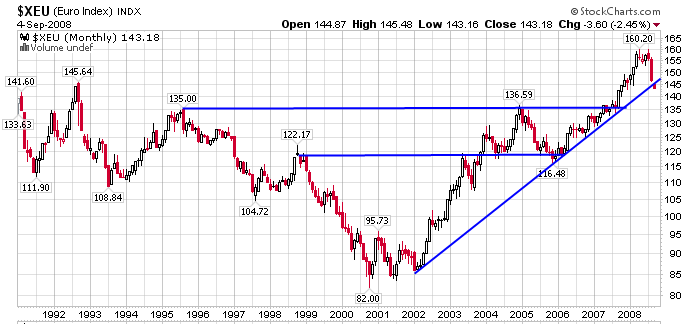

Euro vs. Dollar Monthly Chart

As I expected the Euro did not hold the monthly uptrend line. This is in the face of a tough stance on inflation by Trichet and the ECB. The market does not seem to believe Trichet and neither do I. Alternatively, the market might be acting as if the ECB is going to wreck Eurozone economy by continuing this inflation fighting stance when it should be clear that inflation is simply not a credible threat.

The first line of support on the monthly chart is 135. Should that break the next line of support is the 118 area.

British Pound vs. Dollar Monthly Chart

The pound is acting anemic and there is a very good fundamental reason for it. British public sector spending is in shambles as noted in Deflationary Hurricanes to Hit U.S. and U.K. and Chancellor Darling's Panic Move To Rescue Housing .

Technical support for the pound is soon coming up at 173. If that fails to hold a test of the 155 area could be in order.

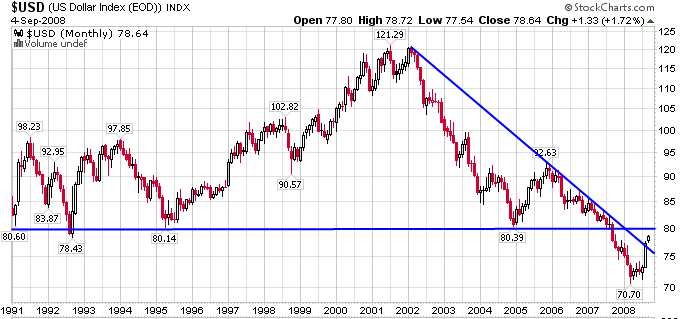

U.S. Dollar Monthly Chart

The US dollar has broken the monthly downtrend line. Odds are this is the real deal, regardless of what anyone thinks about the fundamentals. As for me, I think the US dollar is reacting in a positive fashion for good reason. That reason is not that the dollar is any good (it most assuredly isn't), but on relative basis the Euro, pound and other currencies were simply priced for perfection and perfection cannot be found anywhere.

The horizontal line at 80, depicts the former decades long support line that now acts as resistance. If that is taken out a move to 85 or even 90 is likely in the cards.

The US dollar is rallying, treasuries are rallying, the 30 year long bond is near an all time low in yields, the stock market has resumed its collapse and commodities continue to get crushed. Inflation is nowhere in sight.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.