USD/JPY: Bank of Japan’s Yield Curve Control Could Weigh

Currencies / Japanese Yen Jan 09, 2018 - 12:45 PM GMTBy: Submissions

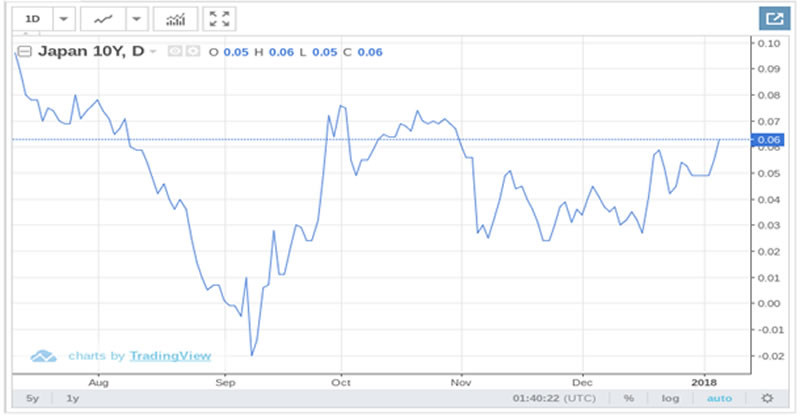

Two years ago, the Bank of Japan (BoJ) took financial engineering into a whole new level by introducing the concept of “yield curve control” in an attempt to rescue the country’s declining economy. Basically, this policy aims to keep the central bank’s 10-year government bond yield at zero. In order to do this, BoJ has opted to buy enormous amounts of Japanese government bonds at 0.110 percent.

Two years ago, the Bank of Japan (BoJ) took financial engineering into a whole new level by introducing the concept of “yield curve control” in an attempt to rescue the country’s declining economy. Basically, this policy aims to keep the central bank’s 10-year government bond yield at zero. In order to do this, BoJ has opted to buy enormous amounts of Japanese government bonds at 0.110 percent.

While it is believed that central banks cannot control interest rates, in the long run, BoJ thinks that its quantitative easing can control and make the yield curve rise. In order to do that, BoJ plans to increase the difference between long-term bonds and short-term bonds (which are negative in Japan).

Negative perceptions about BoJ’s yield curve control

BoJ’s effort to generate inflation is deemed to be an aggressive one. In fact, it is even considered to be more assertive than the U.S. Federal Reserve which has expanded its balance sheet to more than $4.5 trillion but still has failed in inflation generation. However, with the gradual stabilization of the yields from the Japanese government bonds, BoJ policymakers prompted investors that BoJ won’t make the same mistake that the latter has committed.

- Despite the assurance given by the officials of BoJ, its yield curve control policy is still subject to many drawbacks. One of the greatest challenges carried along with the yield curve control is that it will most likely increase the profitability for banks, which will depend on the wider spread in rates to take advantage of the profit difference among them.

- In general, more banking activities cause higher economic activities and higher inflation. Financial analysts, however, think that profits in Japan may only be gradual. A number of financial experts, ever since this concept was introduced, have always believed that BoJ could not make it.

What’s in store for BoJ in 2018?

As alluded to earlier, many experts think that while BoJ may still continue to stay for more years, it will no longer lead the war against deflation, unless economic growth expectations rise or is driven by a pick-up in Japanese inflation.

- According to them, it would be hard for BoJ to raise the Japanese government bond because, in the first place, the inflation is far from the 2 percent target. Market forces in areas like cfd trading will be harder to beat because the global tide of central banking is working toward normalization.

- Furthermore, experts believe that even of the BoJ boost the purchase of bonds, it may still encounter diminishing returns.

- While BoJ officials still hope that the effects of the rise of global yield on Japan would be minimal, the current market situation shows that there is no guarantee that the effects would be controlled.

- To make matters worse, the Bank of Canada, Bank of England, and many other central banks in the world are working together to pull the plug on extraordinary monetary support utilized during the financial crisis.

Copyright © 2018 New Forex Trends - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.