Macroeconomic Outlook for 2018 and Gold

Commodities / Gold and Silver 2018 Jan 12, 2018 - 02:39 PM GMTBy: Arkadiusz_Sieron

Luckily or not, 2017 is behind us. It was a positive year for the gold market, as the yellow market gained more than 12 percent. However, investors are forward-looking, so let’s focus on what the coming months will bring. The next year will be shaped mostly by the following broad economic trends:

Luckily or not, 2017 is behind us. It was a positive year for the gold market, as the yellow market gained more than 12 percent. However, investors are forward-looking, so let’s focus on what the coming months will bring. The next year will be shaped mostly by the following broad economic trends:

1. Global activity is improving.

2. Labor markets are strengthening further.

3. Subdued inflation is finally rising (but moderately).

4. Central banks are slowly reducing their monetary policy stimulus.

5. Interest rates are rising.

Let’s analyze them now, starting with the accelerating global growth. In 2017, the global real GDP grew by about 3.7 percent. It was higher than in 2016 and significantly above the expectations. Indeed, the world economy is outperforming most predictions for the first time since 2010. And, according to the Goldman Sachs, the world’s real economic activity may rise by even 4 percent next year. Importantly, the global growth is broad-based across countries. Gold is a safe-haven asset, which shines the brightest during periods of economic malaise, such as Great Recession. Hence, the solid economic growth likely to occur next year will be a serious headwind for the yellow metal.

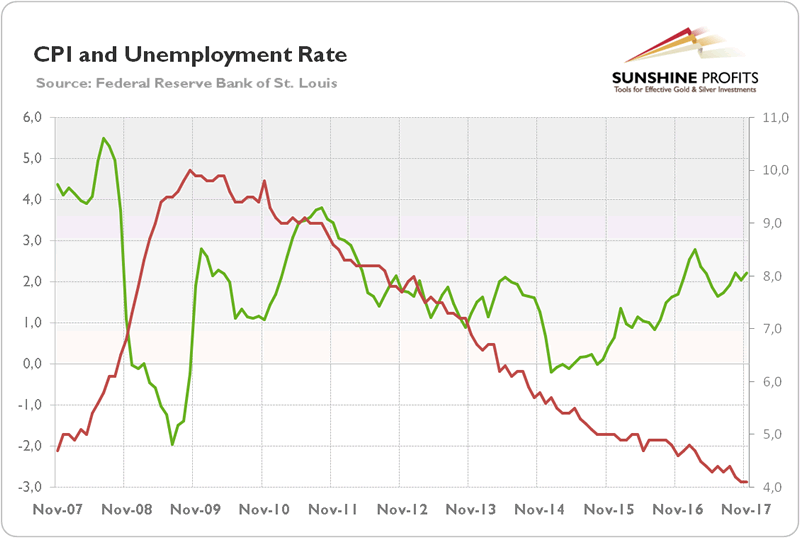

With relatively strong economic momentum, the labor markets should strengthen further. In several developed countries, including the U.S., the unemployment rate has already fallen to the pre-crisis level (see the chart below). The advanced economies are thus near full employment, with quickly closing output gaps.

Chart 1: The unemployment rate (red line, right axis) and the inflation rate (CPI, green axis, left axis) in the U.S. over the last ten years.

Hence, the flourishing economy and the tightening labor market should finally raise inflation. Actually, inflation is significantly higher than two years ago, as one can see in the chart above.

Gold is perceived to be a hedge against inflation, but a moderate increase in the CPI or the PCEPI should not boost the price of the yellow metal. Gold shines brightly during periods of high and accelerating inflation, so unless inflation gets out of control, significantly exceeding the Fed’s target, it should not rally madly. However, we cannot exclude inflation rearing its ugly head again. Actually, this is one of the biggest upside risks for the gold market in the medium-term.

Indeed, the rebound in inflation may actually encourage the central banks to adopt a more hawkish stance. This is what has been happening recently. The Fed hiked interest rates five times since the end of 2015. It also started to unwind its enormous balance sheet. And even the ECB reduced the scale of its monthly asset purchases last year. Additionally, the composition of the FOMC in 2018 will be more hawkish, so we expect a continuation of policy normalization. The tightening will be gradual, for sure, but three hikes are not unlikely next year. Or they may come earlier, as the U.S. central bank has fewer reasons than in 2017 to pause the rate hike cycle at the beginning of a new year. Tighter monetary policies and less accommodation imply higher interest rates, which is negative for gold, a zero-income asset.

Importantly, there might be also an upward pressure on the real interest rates, due to the solid economic growth and rising expectations of the fiscal policy stimulus. This is of great significance, as gold has a strong negative correlation with real interest rates.

The implications of the upcoming economic trends are not good for the gold market. We predict that the global recovery will continue, so we will have basically solid economic growth with low inflation, and balanced risks in the global economy. Thus, the macroeconomic environment is likely to exert downward pressure on the yellow metal. It does not mean that we expect a plunge in gold prices, but we simply consider a bear market to be more probable than the bull market. Surely, if the goldilocks economy remains in place, the sideways trend in the bullion market may continue. What we are saying that the downward move is more likely due to the solid economic momentum and rising interest rates.

But a lot will depend on the performance of the U.S. dollar. In 2017, the price of gold was supported by the depreciation of the greenback. We believe that a similar sell off is unlikely this year, so there is a more room for declines in gold prices, at least in the short or medium term.

Last but not least, we painted the base scenario above. But future is uncertain and a lot may happen on the way, so it does not need to materialize. If some black swans land, the price of gold may jump. We will analyze the potential upside risks for the gold market in the next part of this edition of the Market Overview.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.