Gold Rises As Global Stocks Plunge and Bitcoin Crashes 70%

Commodities / Gold and Silver 2018 Feb 06, 2018 - 03:39 PM GMTBy: GoldCore

– Gold gains 0.6% in USD and surges 1.7% in euros and pounds

– Gold gains 0.6% in USD and surges 1.7% in euros and pounds

– European stocks fall more than 3% at the open after sharp falls in Asia

– DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7%

– Gold rises from $1,330 to $1,342, £942 to £960 and €1,067 to €1,085 /oz

– Bitcoin crashes another 10% and has now plummeted by 70% to below $6,000

– Increased risk aversion will drive safe haven demand for gold as its hedging properties are appreciated again

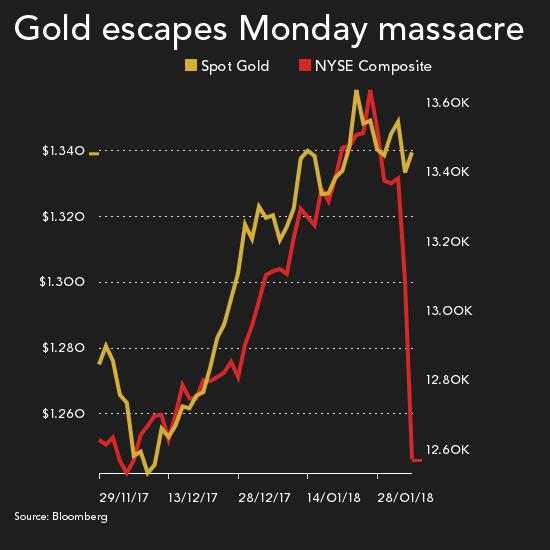

Source: Bloomberg via Mining.com

Gold prices rose today in all major currencies as a rout in global equities prompted investors to seek shelter in safe haven gold.

Spot gold prices were up 0.4 percent to $1,345.00 per ounce this morning in early European trading following Monday’s 0.6 percent gain in dollar terms. Gold saw larger gains in euros, sterling and other currencies as the dollar bounced back after a recent pronounced weakness.

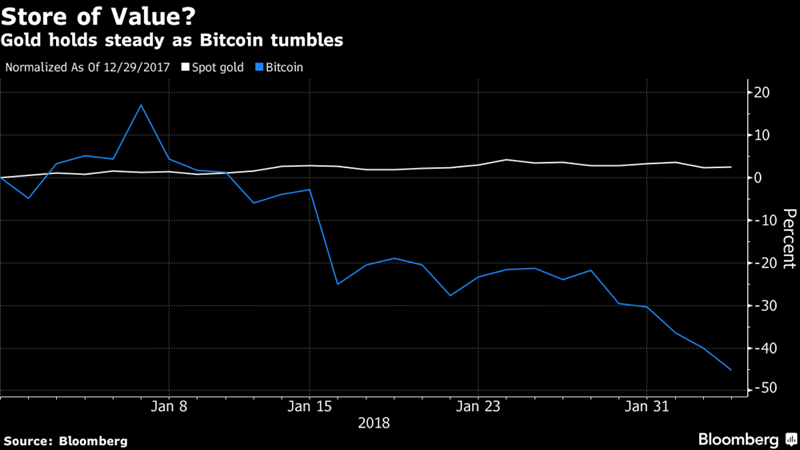

Bitcoin plummeted for a fifth day, dropping below $6,000 and leading other digital tokens lower. A backlash by banks and government regulators against cryptocurrencies is impacting already fragile sentiment due to recent sharp falls.

Yesterday, bitcoin tumbled as much as 22 percent to $6,579. It has lost 70 percent of its value from a record high $19,511 in December. Other crypto currencies also fell sharply on Monday, with Ripple losing as much as 21 percent and Ethereum and Litecoin also weaker – down 16% and 13% respectively.

We believe gold prices may rise further as the global rout in stock markets should lead to a period of risk aversion and a new found appreciation for gold’s hedging and safe haven attributes.

However, as was seen during the ‘Lehman moment’ in 2008, gold could see short term weakness if stock markets continue to crash as speculators see margin calls and some liquidate all futures positions.

The fact that gold made good gains in all currencies yesterday, including the dollar, bodes well for gold and shows there is robust demand and the fundamentals of the gold market are sound. This is more than can be said than the fundamentals of the US economy and indeed of global stock and bond markets.

Gold Prices (LBMA AM)

05 Feb: USD 1,337.10, GBP 947.20 & EUR 1,072.49 per ounce

02 Feb: USD 1,345.00, GBP 946.48 & EUR 1,077.61 per ounce

01 Feb: USD 1,341.10, GBP 941.99 & EUR 1,077.98 per ounce

31 Jan: USD 1,343.35, GBP 950.29 & EUR 1,078.98 per ounce

30 Jan: USD 1,345.70, GBP 954.37 & EUR 1,083.56 per ounce

29 Jan: USD 1,348.40, GBP 955.07 & EUR 1,085.46 per ounce

Silver Prices (LBMA)

05 Feb: USD 16.88, GBP 12.01 & EUR 13.56 per ounce

02 Feb: USD 17.14, GBP 12.05 & EUR 13.72 per ounce

01 Feb: USD 17.19, GBP 12.09 & EUR 13.82 per ounce

31 Jan: USD 17.23, GBP 12.17 & EUR 13.84 per ounce

30 Jan: USD 17.30, GBP 12.24 & EUR 13.91 per ounce

29 Jan: USD 17.34, GBP 12.33 & EUR 13.99 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.