Will Hawkish Fed and Strong Payrolls Blow Out Gold Rally?

Commodities / Gold and Silver 2018 Feb 06, 2018 - 03:42 PM GMTBy: Arkadiusz_Sieron

At the end of last week, gold encountered a couple of headwinds. Will they topple the yellow metal?

At the end of last week, gold encountered a couple of headwinds. Will they topple the yellow metal?

First Gust of Wind: Fed

As we predicted, the last FOMC meeting turned out to be more hawkish than expected. On January 30, we wrote:

(…) the Fed has its own meeting this week. We could see a hawkish strike, especially that it will be the last Yellen’s meeting and she has nothing to lose. The changing composition of the policy committee could also point to a more aggressive pace of rate hikes in 2018. If that happens, the U.S. dollar may catch its breath, which would exert downward pressure on gold prices.

Indeed, the Fed was hawkish last week. It pointed out that the gains in employment, household spending, and business fixed investment haven been solid, while the unemployment rate remained low. The U.S. central bank also noted that the market-based measures of inflation compensation have increased in recent months.

However, the most important change in the Fed’s language was the upward revision of the inflation outlook. In December we could read that “inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee’s 2 percent objective over the medium term.” But the recent statement is more optimistic:

Inflation on a 12 month basis is expected to move up this year and to stabilize around the Committee's 2 percent objective over the medium term.

The message is clear. The next interest rate hike is coming. Traders understood the signal. The market odds of a March hike increased from 67.6 percent one month ago to 77.5 percent. The flutter of the hawks’ wings may blow out the golden flame. In 2017, the yellow metal used to weaken ahead of an interest rate decision.

Second Blast: U.S. Labor Market

On Friday, the Bureau of Labor Statistics revealed the latest report on the employment situation. The U.S. economy added 200,000 jobs in January. It was a positive surprise, as analysts expected 175,000 job gains. Moreover, the average hourly earnings rose 9 cents to $26.74, which means that they jumped 2.9 percent over the last twelve months. It was the best result in the current recovery. The weak point of the report was the downward revision of past numbers: employment gains in November and December combined were 24,000 lower than previously reported. However, the labor market remained solid, with 192,000 job gains over the last 3 months. The strong payrolls and the uptick in wages may push the Fed to adopt a more aggressive stance. It could also strengthen the U.S. dollar, rattling the gold market.

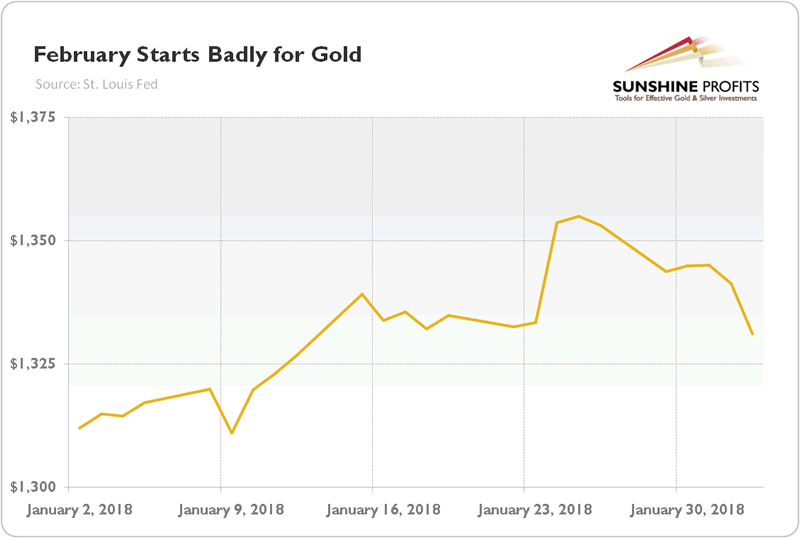

Indeed, the greenback rose against the euro after the report, while gold prices declined, as one can see in the chart below.

Chart 1: Gold prices (London P.M. Fix, in $) in 2018.

Conclusions

Although the Fed leaved the federal funds rate unchanged at 1.25-1.50 percent, the January monetary statement was more aggressive than expected, setting up the March hike. Gold should weaken in response. And indeed the price of the precious metal dropped – but the major hit came only after strong nonfarm payrolls. It signals that gold’s rally may continue, in spite of a more hawkish Fed. If the U.S. dollar generally stays in a bearish mood after the recent rebound, gold will survive the gale of higher interest rates.

On Thursday, we will analyze the impact of the current sell-off in stocks on the gold market from the fundamental point of view. It might not be what many gold investors would expect. Stay tuned!

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.